The Court Intelligence Database (CID) is a ‘big data’ cloud-based database that gives novel insights into current trends in banking litigation.

Ongoing claims reveal new trends, developing practice areas, the tactics of claimants and their law firms and the activities of other banks and financial institutions. But knowledge of these claims has traditionally been accumulated by gossip, rumour and scattergun investigation, because only the tiny proportion of claims that result in decided judgments are systematically accessible, and then only years after the claim started. The Court Intelligence Database stores this information in a structured, searchable format.

In this article we introduce one specific application of the Court Intelligence Database, the creation of an index for banking litigation activity in the English courts: the Norton Rose Fulbright Banking Litigation Index (BLX).

BLX

BLX will be produced on a monthly basis starting from January 2017. It shows the overall level of current activity in the English courts for litigation relating to banking and finance. Over time, this will show whether the English courts maintain their pre-eminence in this area – a particular focus of interest in light of Brexit.

BLX also shows which firms are active in ongoing English litigation. The breakdown of the top firms gives an overall ranking that is entirely up-to-date and based on objective data. Other rankings are based on the tiny proportion of cases that proceed to judgment or rely on self-reporting from

law firms of cases finished several years in the past. BLX gives a live, accurate snapshot of who is acting in English banking and finance litigation.

BLX can also be broken down by subject matter, barrister, the stage of the claim, the identity of the parties involved, their status in the litigation and many other factors. Some of these are explored further below. In future reports, we will investigate other areas.

BLX is calculated using a proprietary algorithm that draws on a spectrum of information for all ongoing banking and finance litigation. A firm’s activity reflects not only the number of cases in which it is involved, but also the importance of those cases and its role in them. Furthermore, the importance of a case is not just a function of the amount at stake but also the nature of the claim. This multi-factorial approach gives an accurate portrayal of litigation activity.

BLX for January 2017

The overall BLX ranking for the English courts is based at 100 for January 2017. Future reports will show the direction of travel of overall activity. Information is presented as of January 1, 2017.

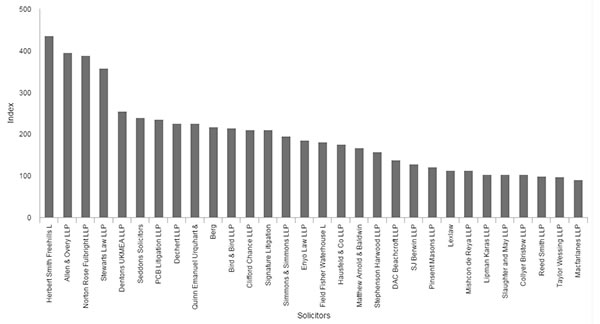

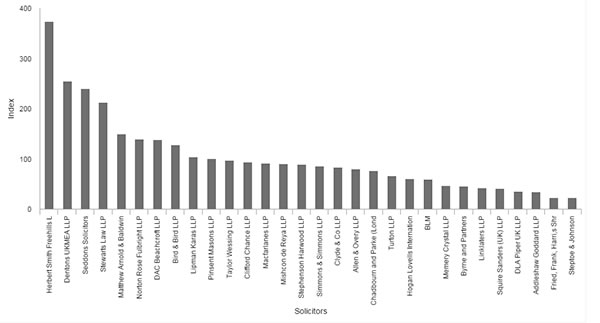

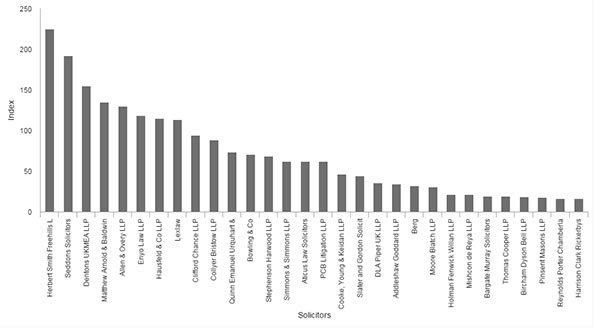

The overall ranking for law firms in January 2017 is shown below:

The Norton Rose Fulbright Banking Litigation Index

The top five for January 2017 are:

| Position |

Law Firm |

BLX score |

| 1st |

Herbert Smith Freehills LLP |

436 |

| 2nd |

Allen & Overy LLP |

396 |

| 3rd |

Norton Rose Fulbright LLP |

389 |

| 4th |

Stewarts Law LLP |

357 |

| 5th |

Dentons UKMEA LLP |

255 |

Perhaps the most striking aspect of this list is the growing importance of boutique law firms that are prepared to act against banks. These firms are active in certain sectors of the market.

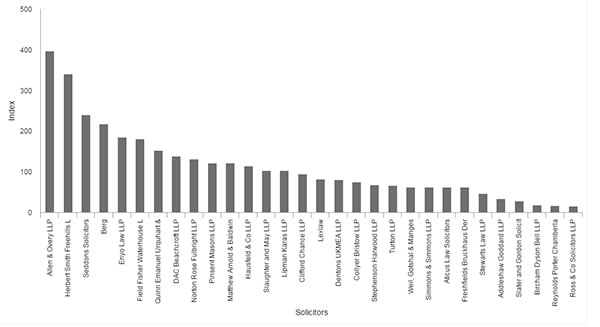

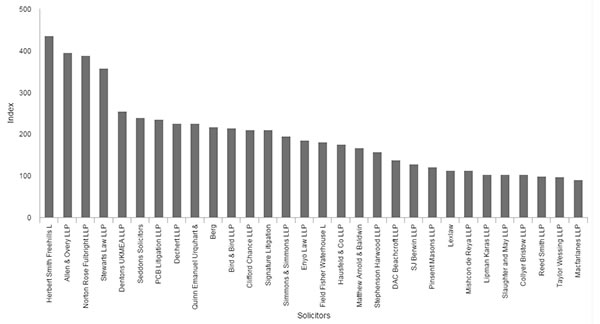

So, for instance, below is the ranking restricted to cases involving derivatives:

The Norton Rose Fulbright Banking Litigation Index by category

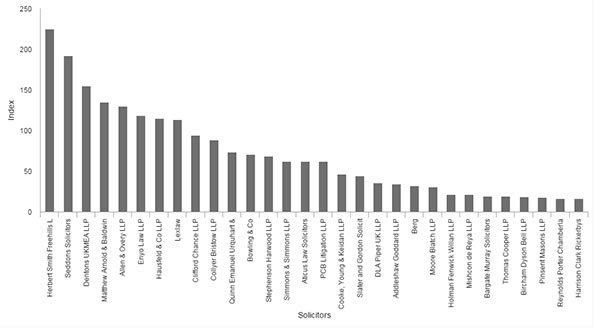

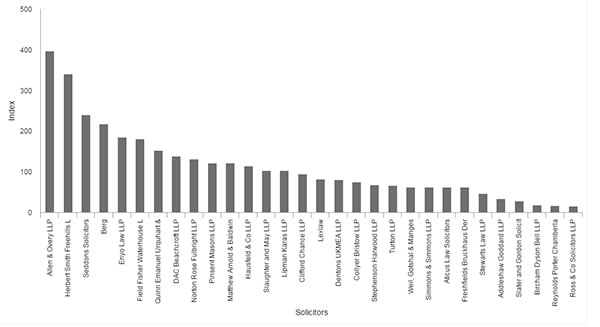

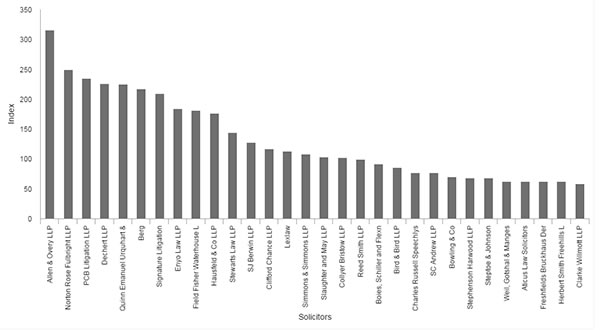

And this is the ranking for mis-selling cases:

The Norton Rose Fulbright Banking Litigation Index by category

Boutique law firms figure heavily in both of these lists, although some of the traditional heavyweights are also present.

And it may be thought that this bifurcation might be reflected in firms that act for claimants and firms that act for defendants.

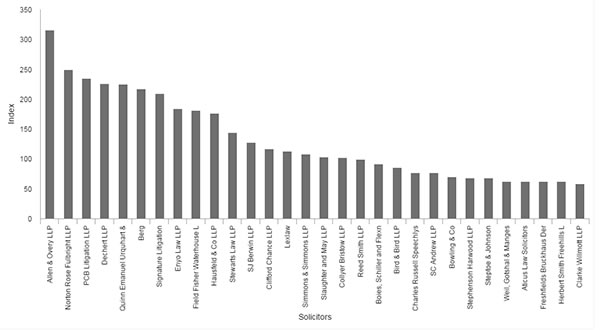

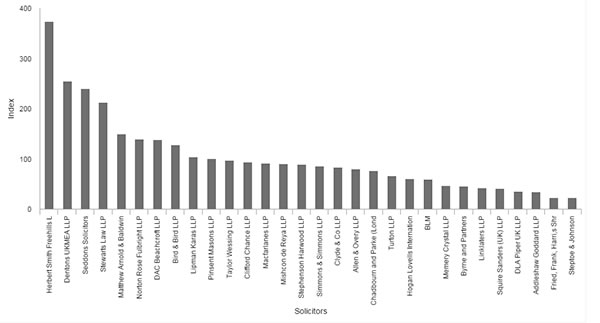

This is the BLX for defendants:

BLX for claimants only is shown below:

The Norton Rose Fulbright Banking Litigation Index

Interestingly, the split is less marked than expected. This suggests that litigation relating to mis-selling, for instance, is not only instigated by the investor, so that the financial institution may appear as claimant or defendant.

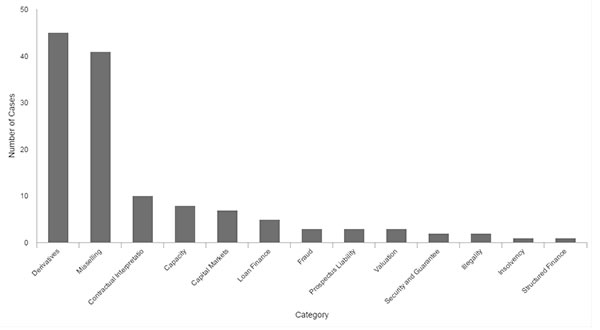

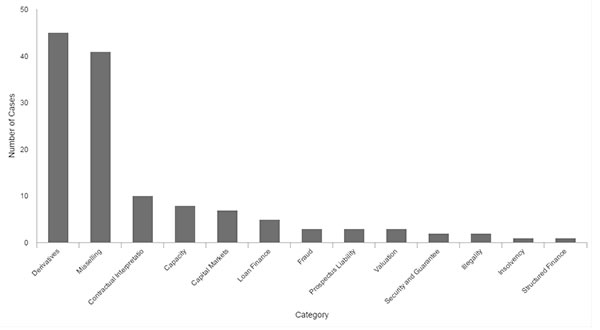

Finally, we use BLX to break down activity in the English courts by subject-matter:

Number of cases by category

This graph, unlike the others, shows just the raw number of cases in each category. Derivatives and mis-selling claims (many of which overlap) dominate the rankings. There are many smaller, similar claims within these categories. Cases involving structured finance or prospectus liability are far fewer in number, but tend to be far more important.

Nevertheless, the English courts appear to be fairly reliant on derivatives and mis-selling claims to maintain the flow of finance litigation.

BLX will measure whether the vote for Brexit has any impact on use of the English courts for banking and finance litigation. The ranking of law firms by BLX shows that the traditional banking litigation heavyweights have been joined by boutique law firms acting on large numbers of mis-selling and derivatives claims. For the latest updates on these issues and to see who achieves high rankings on BLX, see forthcoming editions of the Banking and finance disputes review.

For further information about the Court Intelligence Database, including exclusive access to online trials, contact Adam Sanitt.