On January 9, 2017, the President of the Republic passed Decree Nº 2,660 through which the national minimum salary was increased by 50% for all workers in the public and private sectors (Decree for the Increase of the Minimum Salary). The decree was published in the Official Gazette N° 41,070 dated January 9, 2017. Hereinafter we point out the most significant aspects of the decree.

Minimum salary

National Minimum Salary

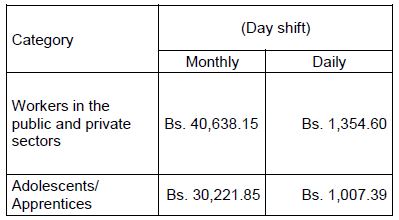

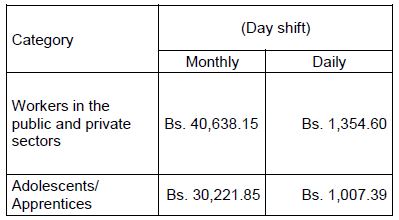

The decree increased the national minimum salary for workers by 50%, with retroactive effects from January 1, 2017, on, notwithstanding the number of workers who work for a certain employer:

According to the provisions of article 172 of the Organic Labour Law for the Workers (OLL) and Article 6 of the Decree for the Increase of the Minimum Salary, the minimum salary of workers hired part time may be paid prorated to the agreed shift.

Retirees and Pensioners

The decree adjusted the pensions of retirees and pensioners in the National Public Sector to the same amount fixed as minimum salary, that is Bs. 40,638.15 per month from January 1, 2017, on.

Therefore, the decree sets the minimum amount for pensions granted by the Venezuelan Institute of Social Security (VISS) at Bs. 40,638.15 per month from January 1, 2017, on.

Method of Payment

According to the Decree for the Increase of the Minimum Salary, the minimum salary must be paid in cash and no salary in kind shall make up such minimum salary.

Penalty

Article 7 of the Decree for the Increase of the Minimum Salary establishes that if the employer pays a salary lower than the one set as the minimum national salary, the employer shall be penalized in accordance with article 533 of the OLL, with a fine not lower than 120 tax units1 (TU), and not higher than 360 TU.

Effect of Salary Increase on Labour Laws

Many labour benefits and obligations are based on the minimum salary. Below we show how the increase in the minimum salary affects the most important labour benefits and obligations set forth under Venezuelan labour law:

Comprehensive Care for Workers’ Children

According to articles 343 and 344 of the OLL and to articles 101 and 102 of the Regulations of the abrogated Organic Labour Law2 (ROLL) still in force, any employer who employs more than 20 workers must offer a childcare or initial education service during the working shift for workers with children from three months to six years of age and whose salary is lower than five minimum salaries, which from January 1, 2017, is Bs. 203,190.75. If the employer elects to comply with this obligation by paying a monthly amount to an institution duly authorized by the Ministry of People’s Power for the Family, such monthly payment must be equal to 40% of the minimum salary, which from January 1, 2017, on shall be Bs. 16,255.26 for registration fees and monthly fees.

Para-fiscal Contributions

Social Security (Health and Pensions):3

- Employer’s Rate: 9 to 11%.

- Employee’s Rate: 4%.

- Maximum Amount of Minimum Salaries: Bs. 203,190.75 from January 1, 2017.

- Calculation Basis of Minimum Salaries: Five minimum salaries.

- Base Salary: Normal Salary.

Employment Benefits Regime:

- Employer’s Rate: 2%

- Employee’s Rate: 0.5%

- Maximum Amount of Minimum Salaries: Bs. 406,381.50 from January 1, 2017.

- Calculation Basis of Minimum Salaries: Ten minimum salaries.

- Base Salary: Normal Salary.

Effective Date

The Decree for the Increase of the Minimum Salary will apply retroactively from January 1, 2017, according to the text of the Decree.

Footnotes

1 A tax unit is currently equal to Bs. 177, Administrative Provision No. SNAT/2016/0006, Official Gazette Nº 40,846 dated February 11, 2016.

2 Regulations of the Organic Labour Law, Official Gazette N° 38,426 dated April 28, 2006.

3 Law on Employment Benefits Regime, Official Gazette N° 38,281, dated September 27, 2005.