The proposals for the amendment of Council Directive 2011/16/EU on administrative cooperation in the field of taxation (commonly referred to as “DAC 6”) originally announced by the European Commission in June 2017, are now in force. The legislation aims to combat aggressive tax planning and improve tax transparency in the EU.

Although not yet implemented at the national level, the disclosure obligations need to be treated as “live” since they provide for implementation with retrospective effect from June 25, 2018.

DAC 6: disclosure requirements for taxpayers and intermediaries

DAC 6 imposes mandatory reporting of “reportable cross-border arrangements” affecting at least one EU Member State to their home tax authority. The home tax authority will then automatically exchange the reported information with tax authorities in other Member States.

Although its stated objectives are to target aggressive tax planning and to improve visibility for tax authorities on such activities, the deliberately wide drafting of the Directive means that it can potentially apply to certain standard transactions which may not have any particular tax motive. Ordinary transactions, including certain types of insurance and reinsurance structures, may be considered reportable cross-border arrangements. This is because the transaction is with a party in a “low-tax jurisdiction”. There is no safe harbor for arrangements having a legitimate underlying commercial purpose.

The reporting obligations fall on “intermediaries”, or in certain circumstances, the taxpayer itself. The reportable cross-border arrangements must fall within one of a number of “hallmarks”: broad categories setting out particular characteristics identified as potentially indicative of aggressive tax planning.

The scope of the Directive is very wide and the detail is left to local implementing law and guidance.

Although the first notification will be due in August 2020, the Directive provides that notifications should be made in respect of arrangements dating back to June 25, 2018. Notwithstanding Brexit, it is anticipated that the UK will implement the Directive. Those potentially within scope will need to work out how they will respond before they are given any guidance or detail by the local implementing authorities. This will be particularly challenging in the context of the wide scope of the Directive.

Who is an “intermediary”?

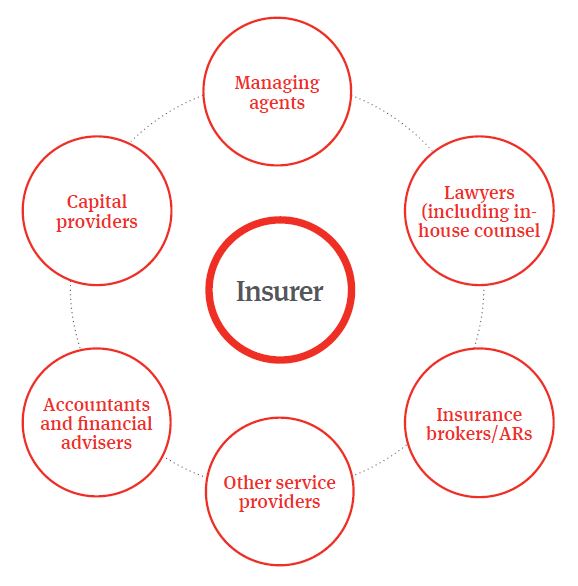

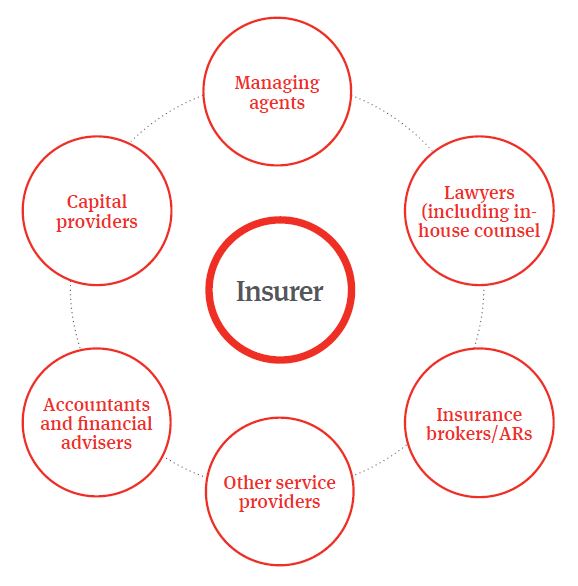

Anyone who designs, markets, organizes, or makes available or implements a reportable arrangement or anyone who helps with reportable activities and knows or could reasonably be expected to know that they are doing so would be considered an “intermediary” under the Directive.

The scope of the definition is broad, and could include consultants, accountants, financial advisers, lawyers (including in-house counsel), holding companies and insurance intermediaries.

A single transaction will involve multiple intermediaries. Take for example a reinsurance transaction. The potential intermediaries involved would include lawyers (including in-house counsel), underwriters, capital providers, insurance brokers, accountants and financial advisers. There is no carve-out for non-tax people, and there is no exclusion from the reporting obligations for in-house advisers.

An example of a common structures that are potentially reportable

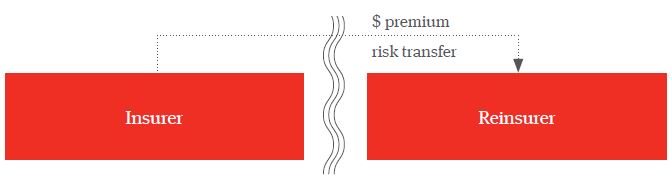

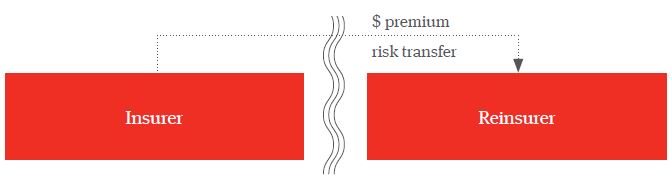

Reinsurance transactions with low tax jurisdictions

Arrangements involving cross-border payments and transfers (including to third party reinsurers) may require disclosure under Category C hallmarks.

To fall within the disclosure rules, the intermediary must have some connection to the EU. This is established by

- Tax residence or place of incorporation.

- The presence of a permanent establishment or branch connected with the provision of the relevant services or

- Being registered with a tax, consultancy or legal professional association in the EU.

Potential intermediaries in an insurance transaction

What are cross-border arrangements?

The DAC 6 reporting requirements apply to “reportable cross-border arrangements”. An arrangement will be “cross-border” if it concerns a Member State and either another Member State or a third country. The connection with the jurisdiction is clearly established by the presence of tax resident entities or of branches but the carrying on of an activity which does not give rise to a permanent establishment is also within scope.

This does not necessarily require a cross-border transaction to take place. A domestic transaction which has tax implications for another EU Member State will fall within scope. Purely domestic arrangements which do not impact tax in another jurisdiction are not the target of this regime.

Which arrangements are reportable?

Arrangements are reportable if they fall within any of five “hallmarks”, broad categories setting out characteristics identified as potentially indicative of aggressive tax planning. These are widely drawn and there is as yet little guidance on whether many standard commercial transactions and structures will be considered reportable.

A number of the hallmarks apply only if the “main benefit” threshold is met, i.e. where one of the main benefits expected from an arrangement is a tax advantage. The UK guidance in respect of a similar test under the domestic reporting regime is relatively low, with “a main benefit” being any benefit that is “not incidental”. Accordingly, if the tax outcome is of significance in the way that an insurance or reinsurance arrangement is structured, disclosure would be the default course of action.

Category C hallmarks apply broadly by reference to features which may well be present in ordinary commercial transactions not driven by tax motives. These hallmarks pick up, for example cross-border payments or transfers between associated enterprises where the recipient is in a low, no tax or blacklisted jurisdiction or where the receipt is tax exempt. Transfers to blacklisted countries do not need to meet to the “main benefit” test but the application of the test will need to be considered on a case by case basis in all other cases.

Other hallmarks are designed to identify marketed tax avoidance schemes and technical features typically seen in tax avoidance planning and also look at arrangements which undermine tax reporting or transparency or involve features identified as high risk for transfer pricing.

There is no de minimis threshold for reportable arrangements. Although domestic implementing legislation may confine the scope of the potentially reportable arrangements, there has as yet been little indication of what this might entail and given the reciprocal nature of information exchange regimes attempts to do so may be challenged.

The “when”, “what”, “who” and “where” of reporting.

When

Once the Directive is implemented, reports need to be filed within 30 days of the earlier of

- The day on which the arrangement is made available for implementation.

- The day it is ready for implementation.

- The day the first step in implementation is made.

What

The information to be reported is listed in the Directive and includes

- The identities of all taxpayers and intermediaries involved, including tax residence; their name, date and place of birth (if an individual); tax identification number; and where appropriate, the associated persons of the relevant tax payer.

- Details of the relevant applicable hallmark(s).

- A summary of the arrangement, including a summary of relevant business activities.

- The date on which the first step in implementation was or will be made.

- Details of the relevant local law.

- The value of the reportable crossborder arrangement.

- The identities of relevant taxpayers or any other person in any Member State likely to be affected by the arrangement.

Who

Reports need to be filed by the intermediary. Where there is no intermediary or the intermediary is subject to legal professional privilege, the report must be made by the taxpayer. Where there are multiple intermediaries, showing that another intermediary has reported the arrangement can exempt an intermediary from his reporting obligations.

Where

The Directive sets out a hierarchy to determine the Member State in which disclosures should be made. This is determined, in descending order by

- Tax residence.

- The location of a permanent establishment connected with the provision of the relevant services.

- The place of incorporation and location of a tax, consultancy or legal professional association with which the intermediary registered.

Failure to report can result in penalties being imposed by the relevant Member State. In the UK, HMRC has indicated that penalties will be aligned with those under the UK’s Disclosure of Tax Avoidance Schemes (DOTAS) regime which allow for a maximum penalty of £1 million.

What practical steps need to be taken?

- Arrangements from June 25, 2018 need to be monitored. It is prudent at this stage to give a wide interpretation to the Directive when considering which arrangements may be reportable.

- Maintaining a record of potentially reportable arrangements, identifying the potentially applicable hallmark, the relevant arrangement, the transaction value and the intermediaries involved is important in order to be ready to report in 2020.

- In-house teams need to be aware that the fact that there is no discussion of tax does not mean that the transaction is out of scope. Having a list of the type of relevant transactions undertaken by an organization will assist in-house teams. Once the domestic legislation and guidance becomes available, these records can be examined to determine which reports in fact need to be made.

- Where multiple intermediaries are involved, agreement is needed between them as to who will report Putting this in place early on in a transaction will be helpful.

If you would like any further information on the challenges presented by DAC 6 or to discuss how these could be implemented in your business please contact your usual Norton Rose Fulbright advisers or one of the contacts listed below.