Publication

What M&A trends will transform the 2024 insurance landscape?

It is widely accepted that 2023 was one of the worst years in recent memory for M&A activity.

Global | Publication | November 2016

Eagerly awaited by existing and would-be investors, the reform of the main law governing investments in Algeria published in the Journal Officiel. The Algerian authorities are already promoting this new legislation to attract investors in the various projects to be tendered this year such, for instance, a 4,000MW solar project.

Law 16-09 (the “Revised Investment Law”) is replacing most provisions (except certain institutional general rules) of the current investment legislation. The legal framework applicable to investments in Algeria now consists of the Revised Investment Law and the 2016 Finance Law. Implementing decrees are expected to be published in the coming weeks.

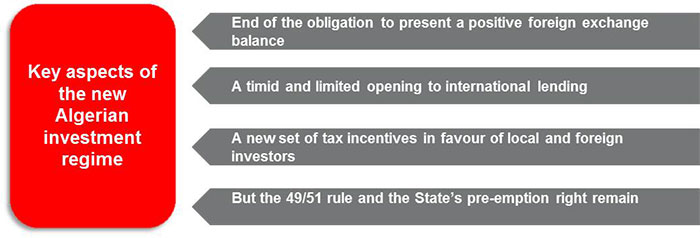

Although the Revised Investment Law introduces certain important modifications, many of the proposed changes which had been leaked to the press before its publication – and in particular the end of the 51% Algerian ownership requirement – have not been implemented.

The major changes are as follows:

Direct foreign investments were to present a foreign exchange surplus for the benefit of Algeria throughout the life of the investment. In other words, foreign investors were theoretically prohibited from transferring abroad or repatriating larger amounts than what they had brought into Algeria. Combined with the prohibition on foreign debt financing, investors were in practice drastically limited as regards the amount of dividends and proceeds of asset sales that they were entitled to transfer abroad.

The Revised Investment Law removes the obligation to present a positive foreign exchange balance and authorizes the free transfer out of Algeria of the capital invested and its proceeds - whether dividends or disposal proceeds - subject, amongst others, to certain yet undefined levels of initial equity investment. However the situation is unclear for investments which do not meet these required minimum levels and which seem to be subject to the discretion of the Algerian administration.

The prohibition on foreign financing has been slightly relaxed by the 2016 Finance Law which allows foreign financing for so called “strategic investments” which are to be approved by the Algerian Government on a case by case basis.

Whilst investors were expecting a relaxation or better yet the end of the 49/51 rule introduced in 2008 which limits foreign shareholding to 49 % of any Algerian-based company share capital, the 2016 Finance Law has maintained this restriction. In addition, the 2016 Finance Law clarified the broad scope of application of this rule as covering all foreign investment in the sectors of production of goods, services and importation.

Whilst the drafts of the investment law contemplated the removal of the State’s pre-emption right over share transfers from or to foreign investors, the Revised Investment Law has maintained this right. The procedure for obtaining a waiver by the State of its pre-emption rights is to be set out in a separate regulation which has not been enacted yet. In the meantime, Algerian authorities continue to refer to past practices as regards such waivers.

The Revised Investment Law clarifies that the obligation to notify the Government prior to any transfer of foreign companies holding shares in locally incorporated companies is limited to transfers exceeding 10 %. In such case the Government can purchase all or part of the foreign shareholder’s shares in the relevant Algerian company within the month following the notice to the Government.

The obligation of foreign shareholders to provide the Algerian authorities with details of their own shareholding - which were often not complied with - has been deleted.

A new set of incentives is provided by the Revised Investment Law.

Scope of application: Investments relating to the creation or expansion or rehabilitation of production capacities of all types of goods except those included in a negative list which is expected to be enacted by separate decree. This list is to include all goods and activities that will not benefit from such advantages. It is expected that oil and gas would not be included in this list.

Investment incentives: The Revised Investment Law contemplates 3 schemes offering a wide range of incentives which magnitude depends on the level of investment and the contemplated activities:

Publication

It is widely accepted that 2023 was one of the worst years in recent memory for M&A activity.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023