Publication

Regulation Around the World: Open Finance

In this issue of Regulation Around the World we look at how regulators are developing their proposals for Open Finance.

Global | Publication | February 2016

The main corporate, finance (including obligations arising from the exchange IFRS) and industrial property obligations to be observed in 2016 by the majority of Colombian corporations and/or branches of foreign corporations operating in the country are as set forth below.

If the Colombian corporation and/or branch of a foreign corporation is subject to inspection, control or monitoring by an entity other than the Superintendency of Corporations and/or the regulation of a specific governmental entity (Aerocivil, Regulation Commissions, National Hydrocarbons Agency, National Mining Agency, etc.) it will be necessary to verify the obligations that have to be met by the corresponding entity.

| Exchange matters | |||

|---|---|---|---|

| Obligation to be met or type of process | Party responsible | Receiving entity | Date or deadline |

| Updated Foreign Investment Registration - Form No. 15 "Equity Conciliation of Companies and Branches". | General regime foreign investment receiving corporations, including branches of foreign corporations that have foreign investments registered through December 31 of the preceding year and are not obliged to report their financial statements to the Superintendency of Corporations. | Foreign Exchange Department of the Bank of the Republic. | June 30, electronically. |

| Form 13: "Registry of Supplementary Investment to the Assigned Capital and Update of Financial Statements - branches of the special regime". | Branches of foreign corporations subject to the special regime (hydrocarbons and mining) that have foreign investment registered through December 31 of the preceding year. | Foreign Exchange Department of the Bank of the Republic. | June 30, electronically. |

| Equity conciliation report of corporations with shares listed on a stock exchange. | Corporations whose shares are listed through the link provided at: http://www.banrep.gov.co/ in the option equity conciliation report of corporations whose shares are listed on a stock exchange, using the same authentication mechanisms for sending information to the SEC. | Foreign Exchange Department of the Bank of the Republic. | June 30, electronically. |

| Equity portfolio information (fixed and variable income investments). | Foreign portfolio capital investors, through the local administrator. | Foreign Exchange Department of the Bank of the Republic. | Monthly within 10 business days following the closing of the month being reported. |

| Form 10: “Description of Compensation Account Operations”. | Holders of compensation accounts. | Foreign Exchange Department of the Bank of the Republic. | Monthly, with the information of theimmediately preceding month. |

| Administrators of non-financial public entities must present the Report on financial investments and assets held abroad by non-financial public entities. | Administrators of non-financial public entities. | Foreign Exchange Department of the Bank of the Republic. | 15th of the month immediately following that in which the investment was made. |

| Intellectual property aspects | ||

|---|---|---|

| Obligation to be met or type of process | Receiving entity | Date or deadline |

| Registration of trademarks and slogans and depositing of trade names. | Superintendency of Industry and Trade. | Prior to use. |

| Renewal of trademarks and slogans registration. | Six (6) months prior to expiry. | |

| Renewal of deposit of trade names. | Six (6) months prior to expiry. | |

| Registration of change of name of the holder of a trademark, slogan or trade name. | Immediately upon change in ownership or change in the corporate name. | |

| Registration of trademark or slogan license. | Immediately the license is granted. | |

| Registration of patents, industrial designs and usage models. | Before disclosure. | |

| Application for Health Ministry registrations. | Prior to marketing. | |

| Renewal of Health Ministry registrations | Within six (6) months and up until the day prior to the expiry date. | |

Appendix 1 - IFRS Groups

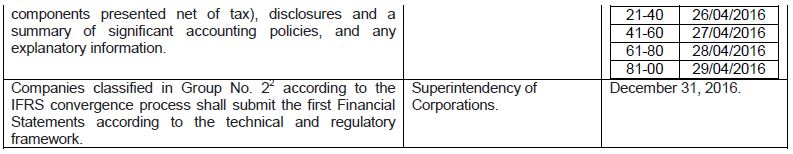

By External Circular 200-000010 of 2014, the Superintendency of Corporations established deadlines for entities classified in Groups 1 and 2 of the process for the implementation of International Financial Reporting Standards (IFRS), to report their financial statements under this new standards framework. For better understanding of same, the conditions and characteristics of each of the Groups for the purpose of compliance with the implementation of this accounting system are set forth below:

| GROUP 1 (Decrees 2784 of 2012 and 3024 of 2013) Conditions and characteristics: I. Being a subsidiary or branch of a foreign company that applies IFRS. II. Being a subordinate or parent of a national company that must apply IFRS. III. Making imports (payments abroad) and exports (income from abroad) representing over 50% of purchases (costs and expenses) of the immediately preceding the year being reported. IV. Being a parent, associate or joint venture of one or more foreign entities applying IFRS. | GROUP 2 (Decrees 3022 of 2013 and 2267 of 2014) Conditions and characteristics: Such gross income is the income for the year immediately preceding the reporting period. For the classification of those companies with combinations of payroll and total asset parameters other than those specified, the determining factor for such effect will be the total assets. | GROUP 3 (Decrees 2706 of 2012 and 3019 of 2013) Conditions and characteristics : |

1 See Appendix 1 – IFRS Groups

2 See Appendix 1 – IFRS Groups

Publication

In this issue of Regulation Around the World we look at how regulators are developing their proposals for Open Finance.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025