The introduction of the PEXA e-Conveyancing platform will substantially enhance and streamline dealings in land. This e-Conveyancing platform is not just for land transfers but also for mortgages of land.

PEXA means you can avoid the hassle of printing, collating, scanning and posting documents. You no longer have to rely on couriers and settlement agents to get the job done and you’ll save time, reduce errors and have immediate reconciliation of funds. This in turn will have an impact on time, efficiency and costs to business in dealings with real property.

The key benefits of the PEXA platform:

- Fast – ability to settle multiple properties using an online property exchange

- Safe – digital integration with Land Registries to lodge instruments and exchange of funds via the Reserve Bank of Australia

- Efficient – no need to attend settlement – vendor’s proceeds disbursed electronically as cleared funds

What is PEXA?

Property Exchange Australia Limited (PEXA) is the world’s first online lodgement and financial settlement platform that facilitates the exchange and mortgaging of land through a simple online transaction.

The PEXA system provides an online secure meeting room, called a ‘workspace’ which allows each participant in a PEXA transaction (i.e. incoming proprietor, outgoing mortgagee etc) to interact. The usual documents in a conveyancing transaction, including a Transfer, Mortgage and Discharge of Mortgage, are created within the workspace, signed and lodged online.

The PEXA system is integrated with the various Land Registries that are mandated under PEXA,1 enabling documents created within the workspace to be completed with ‘validated’ land title data as a transaction is progressed. Upon completion of settlement, the PEXA integration enables a seamless updating of land title records with the relevant Land Registry, superseding the requirement for any paper lodgement.

Users of the PEXA system are ‘Representative Subscribers’ (solicitors and conveyancers acting on behalf of others) and ‘Principal Subscribers’ (being the participants who act for themselves i.e. financial institutions and governmental bodies etc).

What transactions will have to be lodged through PEXA?

EConveyancing through the PEXA platform will ultimately be the sole channel for effecting the following types of transactions in relation to dealings with real property in the active jurisdictions (VIC, NSW, SA, WA and QLD):

- standalone discharges of mortgages

- discharges of mortgages with Financial Settlement

- standalone mortgages

- mortgages with Financial Settlement

- mortgages with caveat withdrawal

- caveats with Financial Settlement

- withdrawals of caveat with Financial Settlement

- standalone caveats

- standalone withdrawals of caveat

- standalone priority notices (NSW and VIC only)

- priority notices with Financial Settlement (NSW and VIC only)

- standalone removals of priority notices (NSW and VIC only)

- extensions of priority notices with Financial Settlement (NSW only)

- settlement notices (QLD only)

- transfers with Financial Settlement

The PEXA Service Charter (clause 1.2) has a list of Land Registry or duty authority notices or supporting documentation in various jurisdictions which can also be lodged through the PEXA platform.

There are no up-front registration fees or ongoing subscription fees for joining the PEXA platform. A PEXA member only pays for each successful transaction. Charges vary based on the type of transaction. PEXA fees are separate from the statutory lodgement fees, which are set by each jurisdiction’s Land Registry. For further information on fees check with PEXA.

What are the statistics?

In October 2017, PEXA notes:

- 4,866 members are already subscribers to the PEXA platform, including lawyers, conveyancers and financial institutions (including Norton Rose Fulbright);

- 571,315 property transactions have been completed by members of the eConveyancing network; and

- $69bn worth of property value has been transacted through PEXA to date.

What are the key dates? The transitional timetable

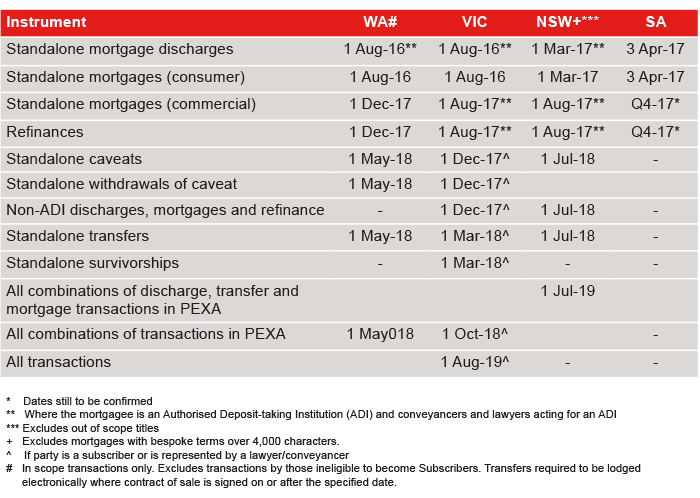

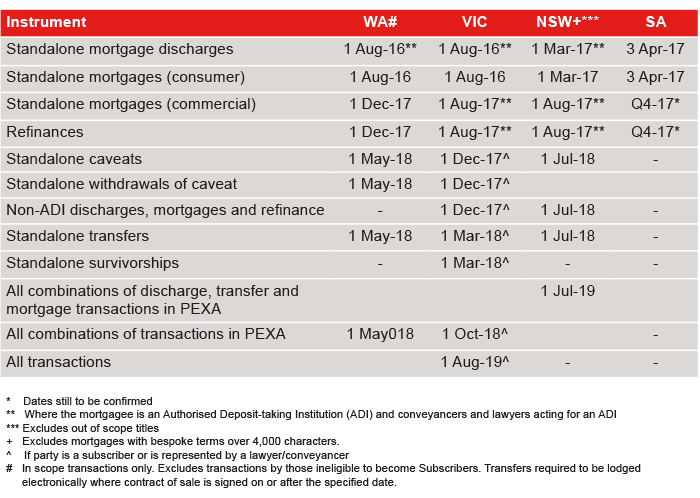

Each of the active jurisdictions has a different transitional timetable for the use of the PEXA platform for various dealings,2 however it is intended that all dealings with land (conveyancing and/or mortgage) in New South Wales must be transacted online creating a 100% digital future by no later than 1 July 2019 (with Victoria slated for total adoption by 1 August 2019).

The below table summarises the current transitional dates in the active jurisdiction for the various categories of dealings:

You will note that a number of core property dealings must already be lodged through PEXA in New South Wales, Victoria and Western Australia. Despite this, there are some exemptions and waivers that the various Land Registries will accept in relation to enabling paper lodgment for standalone mortgages and refinances that otherwise, in New South Wales and Victoria, would need to be lodged through PEXA.

How can business prepare for PEXA?

To date most of the major financial institutions, large law firms and some large institutional businesses have become members of PEXA. Many are already regularly transacting through PEXA in connection with a number of standalone dealings (such as discharges of mortgages and caveats) as well as standard property conveyances and refinances.

Having regard to the transitional timetable for the use of PEXA for various dealings, to prepare for PEXA, it is important for businesses to:

- Become a PEXA Subscriber, if not already a subscriber, or appoint your relevant Representative Subscribers (ie your law firm(s) as your representative for such dealings).

- Establish the relevant internal policies and procedures for your business transacting in PEXA, as well as set up internal controls necessary to ensure the safeguarding by your business of dealings in the system.

- Train the relevant employees who need to either use or understand the operation of PEXA.

Businesses should bear in mind that apart from the transitional timetable mandating the use of PEXA for various dealings in each of the active jurisdictions, there are good reasons for businesses taking these steps as soon as possible to ensure the prompt adoption and use of this online platform that will facilitate more efficient, streamlined and safe settlement processes for dealings with land.

For more information, contact Melanie Hunter to discuss how PEXA may impact your business and to assist in facilitating your subscription to the PEXA platform.