Latest trends in English banking litigation

Our latest analysis of trends in banking litigation shows a continued increase in disputes involving fraud, driven by new capital markets and cross-border structures rather than retail mis-selling.

Big picture

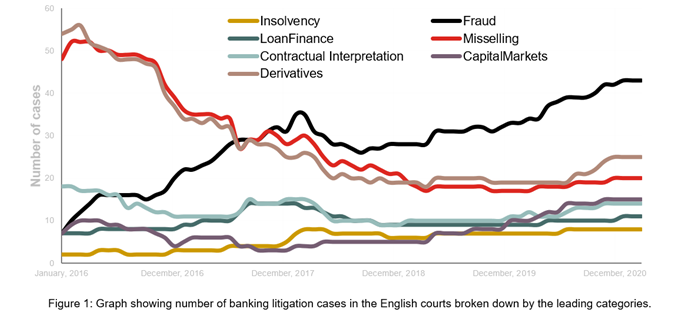

Overall, banking litigation in the English courts is back to levels not seen since 2016. The decline appears to have bottomed out in around 2018, with steady and continuous growth since then. As can be seen from the graph, fraud is the single biggest category. There have also been increases in cases involving capital markets and derivatives. Interestingly, mis-selling and derivatives are starting to decouple from each other. For the first time, mis-selling cases are declining. Many of the new cases involving derivatives are disputes between large financial entities or involve cross-border structures rather than retail mis-selling.

New trends

New disputes reveal new vulnerabilities. When transactions involving complex cross-border structures go wrong, participants look for solvent and regulated parties who may be liable to compensate for their losses. Recent transactions have included parties such as fintech startups or smaller companies structuring deals while based in low-tax jurisdictions. In those transactions, financial institutions are a more attractive target, even if they were less directly involved. This leads to the use of legal arguments that can tie in more remote parties, such as:

- Fiduciary liability, such as knowing assistance and knowing receipt, particularly where a financial institution has operated as an intermediary in a transaction;

- Bribery and similar arguments based on fraud can lead to rescission of transactions with financial institutions, or liability for the actions of an intermediary;

- Tracing of assets can lead to a bank – new techniques are being developed for tracing of cryptocurrency and cryptoassets;

- Regulatory liability – large financial institutions will also be subject to regulation. This can lead to liability for breach of statutory duty or investigations by regulators may reveal vulnerabilities to litigation.

Mitigating risk

Financial institutions can take steps to mitigate the risks from these areas of growth in litigation – increasing controls on participation in complex structures with layers of intermediaries, enforcing functional separation between departments to reduce levels of knowledge that would underpin fiduciary liability. Above all, engagement with Fintech in complex cross-border structures should be monitored for litigation risk.

England as a litigation venue

The English courts continue to be a popular forum for foreign litigants, who are employing conflicts of law arguments to try to avoid liability. These include issues relating to immunity of foreign sovereigns and capacity of foreign corporate entities and public authorities. Mismatches between English and foreign law and areas of uncertainty all create risk in litigation – the status of cryptoassets as property, for instance, features in many situations and it is to be hoped that the current Law Commission consultations in this area will lead to definitive answers.

Fortunately, an expected rise in parent liability litigation has not yet been seen in the finance sector (although it is growing rapidly in energy, for instance). Nevertheless, given decisions such as Vedanta v Lungowe [2019] UKSC 20 and Begum v Maran (UK) Ltd [2021] EWCA Civ 326, financial institutions remain exposed to these risks and should closely monitor their group-wide policies and responsibilities.

Takeaways

Our latest research reveals that ‘complexity risk’ and ‘deep pockets risk’ are two areas that banks should be focussing on. Pre-emptively increasing internal controls and ensuring functional separation will help financial institutions and particularly their regulated entities minimise these risks. In this quickly changing market, careful analysis of ongoing litigation helps to identify new and growing risks as they arise.

This analysis is based on our proprietary Court Intelligence Database, a ‘big data’ cloud-based database that mines information about ongoing banking and finance litigation in the UK.