Publication

Listing in Australia

A comprehensive guide to Australian initial public offerings and listings on the Australian Securities Exchange.

Australia | Publication | March 2022

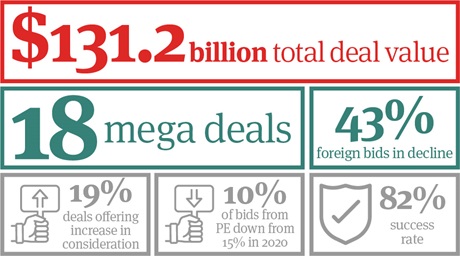

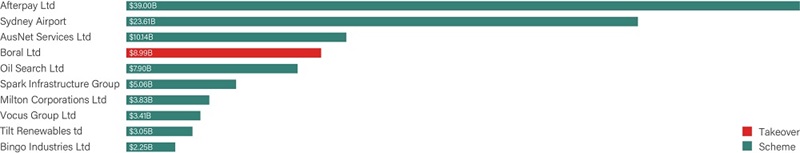

Leaving its mark as one of the richest years in M&A history, Australia’s total deal value soared well above expectations abandoning the uncertainties of 2020. Defensive strategies faded as many growth-hungry companies, pent up from a sluggish 2020, deliberately shifted from capital preservation towards capital deployment. With cheap capital behind them, many boards executed aggressive transaction strategies taking full advantage of the buyer’s market.

In our 2021 Edition of the ‘Australian public M&A deal trends report’, we examine a year filled with an uptick of record-smashing mega deals, a mammoth increase in total deal value and one where foreign investment was down yet again. With the first half of the year being slow off the mark due to ongoing border closures, supply chain issues and labour shortages, the government’s pivot towards economic recovery, high vaccination rates and low unemployment figures were several reasons behind the swift restoration in deal maker confidence.

Our report considers how the Australian public M&A market has fared during what has been a remarkable 12 months and attempts to forecast what could be another vibrant year ahead.

This report covers: |

|

|

|

Publication

A comprehensive guide to Australian initial public offerings and listings on the Australian Securities Exchange.

Publication

A guide to your duties as a director of an ASX listed company.

Publication

In our 2020 report, we look at the surprising resilience of M&A in a tumultuous year as global markets faced the COVID-19 pandemic, Brexit, the US election and other significant events.

Publication

The 2019 edition of the Takeovers in Australia guide explores the opportunities and issues affecting regulated M&A in Australia.

Press release

Global law firm Norton Rose Fulbright has advised Stanmore Resources Limited on its acquisition of all of the shares in Dampier Coal (Queensland) Pty Ltd.

Press release

Global law firm Norton Rose Fulbright has advised 5G Networks Limited (5GN) on the merger of its business with Webcentral Limited (formerly Webcentral Group Limited) by a scheme of arrangement under Part 5.1 of the Corporations Act 2001 (Cth) between 5GN and its members.

Publication

The UK remains a world leader in offshore wind, accounting for roughly 20 percent of global offshore wind capacity, with 11.3 GW operational. It is forecast that installed capacity will rise to 19.5 GW by mid 2020s.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025