Publication

Low carbon projects

Low carbon projects, especially those involving hydrogen and Carbon Capture and Storage (CCS), play a crucial role in the journey towards global decarbonisation.

Information correct as of June 2025

The United Arab Emirates (UAE), and Abu Dhabi in particular, has long been a major player in the energy industry. Its position in the oil and gas market is well known, however it has also been a champion, and leader, of developing new technologies that have contributed to global decarbonisation efforts. Abu Dhabi Future Energy Company PJSC (Masdar), Abu Dhabi National Oil Company (ADNOC), Abu Dhabi National Energy Company PJSC (TAQA), Emirates Water and Electricity Company (EWEC), Mubadala Investment Company PJSC (Mubadala) and other Abu Dhabi entities have been pioneers in the energy industry over many years.

The next phase of the push to develop new technologies is focusing on carbon capture and low carbon hydrogen. The UAE has various attributes which will allow it to not only champion but lead in these developing sectors, just as it did with the offshore wind sector many years ago.

The UAE's National Hydrogen Strategy outlines plans to establish the country as a major producer and exporter of hydrogen while maintaining the focus on achieving Net Zero by 2050. The strategy sets out ambitions to capture a significant share of the global hydrogen market and integrate hydrogen into domestic industries such as steel, cement and transportation.

CCS is also a critical component of the UAE’s net-zero strategy. The UAE Net Zero by 2050 initiative includes major investments in carbon capture technologies, with ADNOC playing a central role in scaling up CCS capacity. The UAE is the first country in the Middle East and North Africa (MENA) region with this target.1 The strategy aligns with broader regional efforts, particularly in Saudi Arabia, to develop CCS infrastructure and create a regional hub for carbon dioxide (CO2) storage and utilization as well as UAE’s commitment to the Paris Agreement goals.

The UAE has a competitive advantage in a number of different areas which place it in a unique position to be an industry leader in the hydrogen and CCS sectors. It can leverage existing infrastructure (in particular, oil and gas infrastructure) which can be repurposed for large-scale hydrogen and CCS projects. Existing CO2 pipelines and enhanced oil recovery systems provide a foundation for engineering expertise and offtake connections. The UAE is also home to the world’s largest solar farms, which can power green hydrogen production. It also has established export networks to key markets such as Europe, Japan and South Korea. Following the implementation of carbon regulation around the world (and specifically in the European Union (EU)), major UAE industries, including steel, aluminium and cement are adopting hydrogen-based processes to produce low-carbon products and explore CCS integration to reduce emissions and maintain EU market access.

The UAE’s hydrogen and CCS projects benefit from a combination of public and private investment, with the Government and state-owned energy companies playing central roles.

Recent developments include the creation of XRG, a USD 80 billion energy investment platform within ADNOC, highlighting the UAE's commitment to diversifying its energy portfolio and investing in low-carbon technologies. XRG’s Low Carbon Energies platform will invest in the solutions needed to meet increasing demand for low carbon energies and decarbonisation technologies to drive economic growth through the energy transition. The market for low carbon ammonia alone is expected to grow by between 70-90 million tonnes per annum by 2040.2

Figure 1 – UAE’s 2031 production potential for categories of hydrogen (UAE National Hydrogen Strategy, July 2023)

CCS Projects

The UAE’s policy on hydrogen is set out in the UAE Energy Strategy 2050, the UAE National Hydrogen Strategy and the Low-Carbon Hydrogen Regulatory Framework. These policies support the development of hydrogen projects and the integration of CCS technologies to reduce industrial emissions. Development of a clear regulatory framework for hydrogen is a key component of the action plan outlined in the UAE National Hydrogen Strategy.

The UAE National Hydrogen Strategy contemplates a suite of business models and support mechanisms intended to underpin the development of a robust hydrogen economy. These include contracts for difference (CfD), regulated asset base (RAB), hydrogen purchase agreements and auction-based mechanisms such as the H2Global model. Each of these models is designed to address specific challenges in the hydrogen value chain, from bridging the cost gap with conventional fuels to de-risking investment and securing long-term offtake.

These business models are at the stage of assessment, design, and policy development. The strategy specifically states that a commercial model assessment is to be completed and procurement policy defined as part of the 2023–2025 action plan, with the intention to introduce and operationalise them in the coming years as the market matures and as part of the phased action plan leading up to 2031. The appropriate commercial mechanisms are to be identified and implemented to foster investor confidence, stimulate domestic demand, and position the UAE as a leading global producer and exporter of low carbon hydrogen. The establishment of a hydrogen entity to oversee the development and implementation of these models at the national scale is also planned.

Whilst no specific hydrogen or CCS-related legislation has yet been adopted, the UAE has implemented multiple policy levers with respect to decarbonisation which serve as incentives for introducing low-carbon alternatives in production processes (such as using low carbon hydrogen in production processes).

Figure 2: Production pathways under UAE Hydrogen Strategy to meet for UAE’s forecast production capacity of 1.4 mtpa by 2031. (UAE National Hydrogen Strategy, 2023)

As set out in the NDC, the UAE’s industrial sector emissions are from captive power production by major industrial entities (such as off-grid electricity generation by oil, gas, and aluminium producers for their own use). By 2035, emissions from the industrial sector are projected to decrease by 27 percent to 68.0 metric tonnes of carbon dioxide equivalent compared to the 2019 baseline level. This will be achieved through a combination of initiatives across various sectors. In the iron, steel and cement sectors, strategies will include the use of hydrogen, low-carbon electricity, CCS, and efficiency improvements, as well as an increased reliance on scrap metal. In the aluminium sector, the NDC indicates that efforts will focus on increasing production efficiency and optimizing energy consumption through the adoption of alternative heat sources and improved process efficiency. The transition will also leverage low-carbon electricity to reduce emissions and expand the use of secondary metal capacity and scrap aluminium.

The oil and gas sector will look to incorporate CCS technology to mitigate emissions, integrating substantial amounts of CO2 capture into their operations. ADNOC has allocated USD 23 billion (AED 84.4 billion) to accelerate investments to scale up practical and commercially viable initiatives decarbonization and low-carbon solutions. The company has set an ambition to achieve net zero by 2045 and reduce their carbon intensity by 25 percent by 2030, through greater energy efficiency, zero routine flaring, reductions in methane emissions, the electrification of our onshore and offshore operations using nuclear and solar energy sources and applying carbon capture and storage technologies. 19

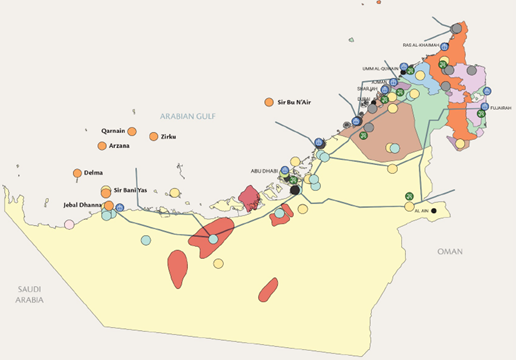

Figure 3 – UAE map of potential low carbon hydrogen oases and clean energy precincts (UAE National Hydrogen Strategy, 2023)

Outside the UAE, the introduction of EU Carbon Border Adjustment Mechanism (CBAM) and other sustainability regulations in the EU is expected to impact UAE exports, particularly for those industries which are energy intensive.

As is the case for the various policy levers that have been put in place within the UAE, EU regulations serve as incentives for introducing low-carbon alternatives in production processes (such as using low carbon hydrogen in production processes).

i. EU CBAM and the impact on UAE exports20

The EU CBAM, which commenced its transitional phase in October 2023, seeks to address the issue of carbon leakage in production processes by imposing an emissions-based carbon pricing regime on imports into the EU in high-emission sectors, to ensure they face the same carbon cost as EU-produced equivalents under the EU Emissions Trading System (ETS). The EU CBAM applies to hydrogen, cement, electricity, fertilisers, iron, steel and aluminium, as well as processed products from those goods. From 2026 onwards, UAE exporters of these materials will need to pay a carbon price equivalent to the ETS rates. Rather than absorbing the costs of purchasing EU CBAM certificates, UAE exporters are seeking ways to ensure compliance by decarbonising production through initiatives such as green steel production, low-carbon aluminium production and other projects designed to ensure compliance with EU environmental regulations.

ii. Hydrogen export to the EU

The UAE’s national strategies and progress in the hydrogen space places the country in a unique position to export hydrogen to the EU. However, to benefit from the EU’s support regimes for green and low carbon hydrogen - specifically, Renewable Fuels of Non- Biological Origin (RFNBO) - which would support the commercial viability of such exports, the product must comply with stringent EU requirements set out under the EU’s Renewable Energy Directive (RED II and RED III), which sets strict sustainability, carbon intensity and traceability standards for green and low carbon hydrogen. To qualify as renewable hydrogen, hydrogen exported to the EU must achieve at least 70 percent greenhouse gas emissions savings, which is determined through a full life cycle assessment covering all stages from production to delivery. Further, the hydrogen must be produced using additional renewable electricity - meaning the electricity used must come from renewable energy sources built specifically for hydrogen production, not from existing sources. Furthermore, there must be temporal and geographical correlation between the renewable electricity generation and hydrogen production. For example, hydrogen electrolysers must be matched with renewable generation in the same region (such as clusters) and operate in timeframes that align with renewable output, as set out in the EU Delegated Act on a methodology for RFNBO.

The UAE is a strong proponent of integrating advanced waste management with its decarbonisation and energy transition agenda, particularly through the conversion of municipal solid waste (MSW) from landfills into low-carbon fuels such as hydrogen and sustainable aviation fuel (SAF). This approach not only addresses the environmental, land use and waste challenges, but also supports the UAE’s leading position in sustainable energy in the region.

The UAE generates significant volumes of waste (including MSW), with per capita waste generation rates among the highest globally. Much of this waste would be deposited in landfills, which would pose environmental and land use challenges. The UAE’s National SAF Roadmap (2022-2050) seeks to address those challenges by treating MSW as a resource, leveraging waste-to-energy and waste-to-fuel technologies to reach its goal of developing a domestic SAF capacity sufficient to supply 700 million litres of SAF on an annual basis by 2030. The UAE’s National SAF Roadmap includes a voluntary target, aiming to supply 1 percent of fuel to national airlines at UAE airports from locally produced SAF by 2031.

The UAE’s National SAF Roadmap contemplates SAF production via the following two main pathways:

Recent examples of such projects include the following:

The opportunities for the UAE in the hydrogen and CCS space are clear, given its existing industrial footprint and supply chains and export markets, coupled with the skill set and expertise of its current workforce and political and financial support behind the energy sector.

At the same time, UAE exporters will be considering investment decisions in circumstances in which regulatory frameworks and support regimes are still being developed, leading to uncertainty and less than perfect visibility for making long-term financial decisions. In particular, the deployment of appropriate support regimes and business models as contemplated in the UAE Hydrogen Strategy would be instrumental for the commercial viability and further development of the UAE hydrogen sector by reducing investment risks, stimulating market demand and fostering a competitive environment for hydrogen production.

As these challenges are addressed, the UAE will be well-placed as a key regional and global player to in the hydrogen and CCS space, as part of the UAE’s well-established existing low-carbon sector.

Publication

Low carbon projects, especially those involving hydrogen and Carbon Capture and Storage (CCS), play a crucial role in the journey towards global decarbonisation.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025