Deals closing in Q3 and Q4 of 2025 and beyond

1. Is it an acquisition within the scope of the regime?

Acquisitions of the following are within scope:

- Acquisitions of:

- Shares;

- Assets, including legal or equitable interests in tangible or intangible assets, property, land, goodwill, intellectual property rights or partial interests in assets;

- Units in a unit trust; OR

- Interests in managed investment schemes, AND

- that are ‘connected with Australia’, meaning the target entity carries on business in Australia or the asset is located in Australia; AND

- result in the acquirer obtaining control of the target, that is, the capacity to determine the outcome of decisions about the target entity’s financial and operating policies.

2. Acquisitions that do not fall within the scope of the regime

Acquisitions of the following are outside the scope:

- Acquisitions that do not result in the acquirer obtaining control of the target, including, acquisitions of 20% or less voting power in an Australian listed company, listed scheme or a large unlisted company;

- Internal restructures and re-organisations;

- Acquisitions of assets in the ordinary course of business;

- Certain land acquisitions;

- Acquisitions by an administrator, receiver, receiver and manager or liquidator;

- Certain acquisitions of debt instruments, financial securities (e.g. dividend reinvestments, derivatives, buy-backs, custodial holdings), security interests, or through financial market infrastructure (e.g. clearing and settlement facilities).

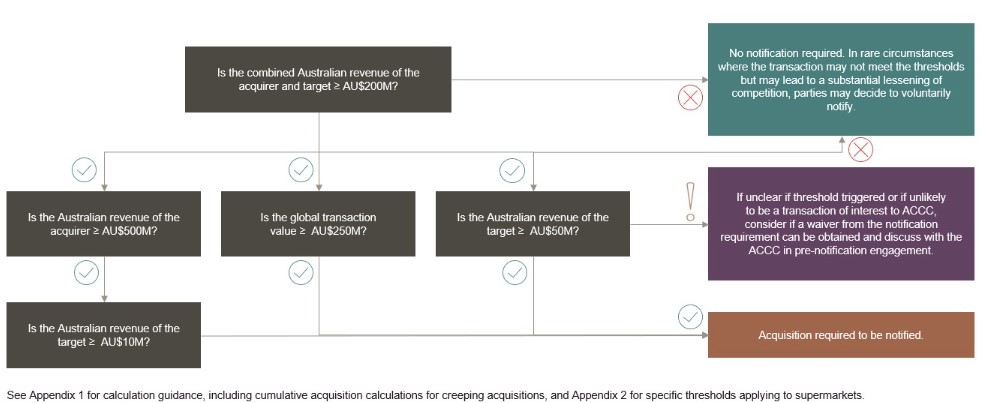

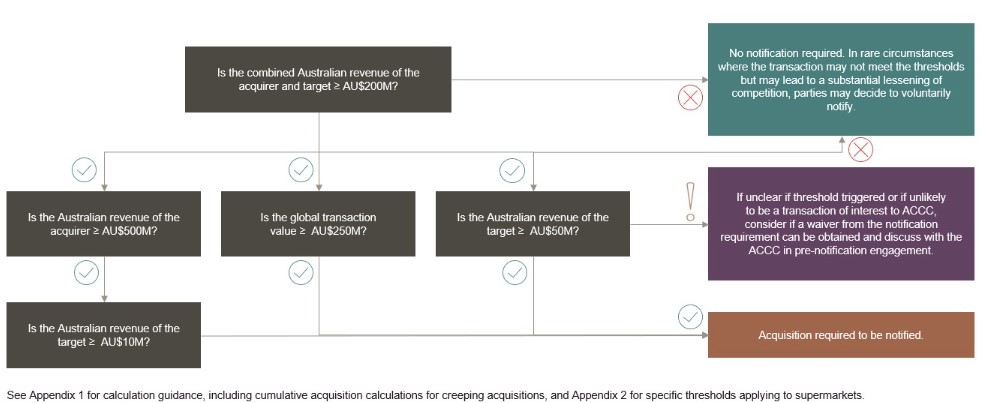

3. Does the deal trigger the notification thresholds?

4. What does the process look like?

Step 1: Pre-notification engagement with the ACCC.

Step 2: Parties complete and submit a long or short notification form. The long form is required where:

- For acquisitions of a competitor: Estimated market share post-acquisition is:

- ≥ 40 per cent and the increment resulting from the acquisition is ≥ 2 per cent OR

- ≥ 20 per cent – 39 per cent and the increment resulting from the acquisition is ≥ 5 per cent

- For acquisitions within supply chains, the party:

- In the upstream market has a market share ≥ 30 per cent and the other party has a downstream market share of ≥ 5 per cent

- In the downstream market has a market share ≥ 30 per cent and the other party has an upstream market share ≥ 5 per cent

- For acquisitions by conglomerate: The parties supply adjacent products or services and one of the parties to the acquisition has a market share ≥ 30 per cent.

- For acquisitions that are otherwise sensitive: Including where the target is a vigorous and effective competitor, is developing a significant product, or where the acquisition is of a business that supplies or controls a key input.

Step 3: The ACCC will confirm the effective notification date (after the filing fee is paid) and the review timeline will begin.

The filing fee to be paid to the ACCC with the notification is predetermined for each stage.

| Stage |

Transaction value (if applicable) |

Fee |

| Notification waiver |

n/a |

AU$8,300 |

| Phase 1 |

n/a |

AU$56,800 |

| Phase 2 - depending on transaction value |

AU $50 million or less |

AU$855,000 |

|

More than AU $50 million but not more than AU $1 billion |

AU$475,000 |

|

More than AU$1 billion |

AU$1,595,000 |

| Public benefits application |

n/a |

AU$401,000 |

|

|

|

Acquirers that are small businesses, i.e. have less than AU$10 million revenue in the previous financial year, are exempted from paying the fee.

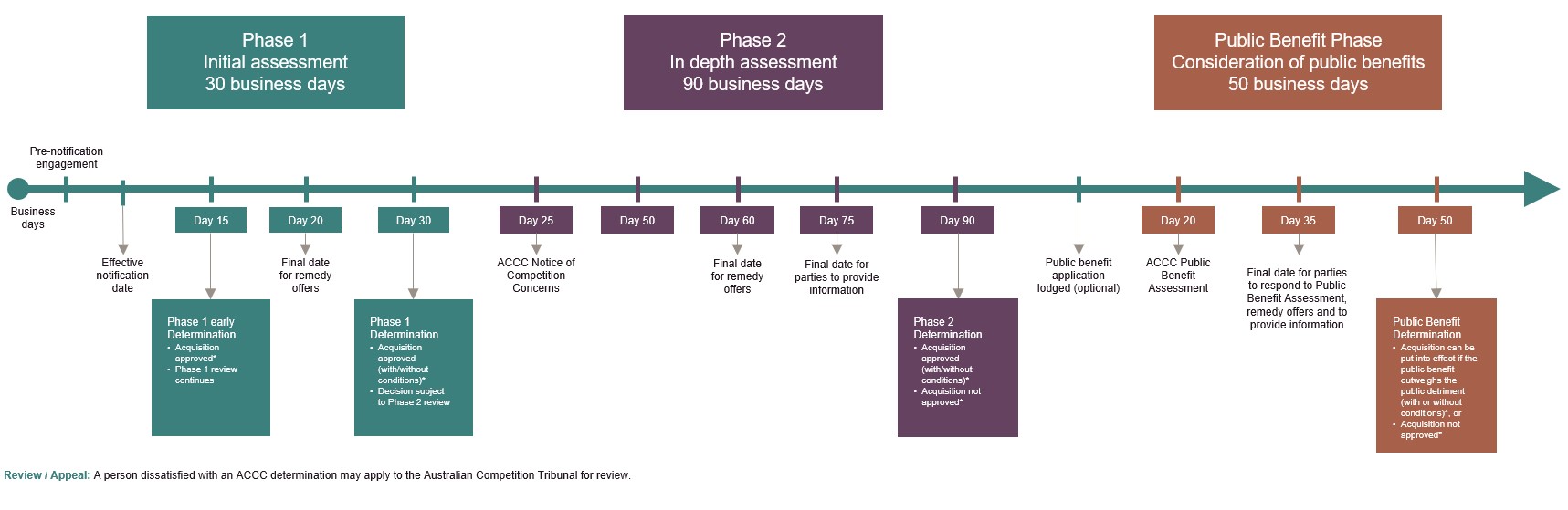

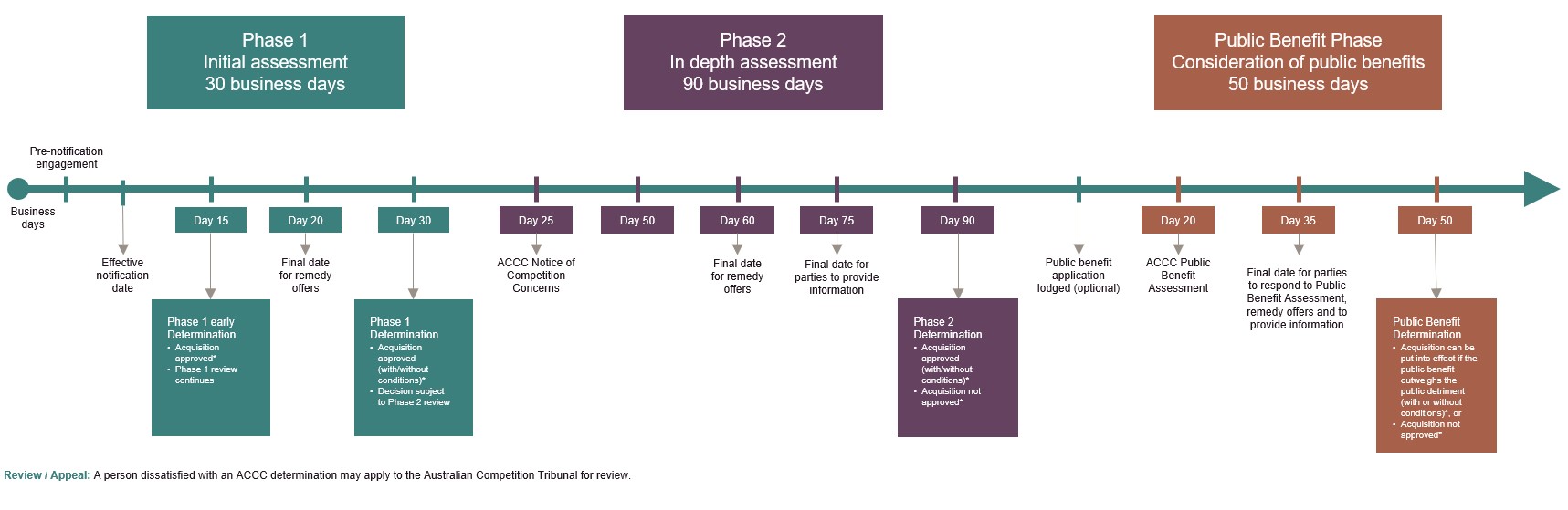

5. How long will the ACCC review take?

| Phase |

Timing |

|

Pre-notification discussions

|

The ACCC will engage ‘promptly and meaningfully’ with businesses once a request is received. The ACCC recommends that parties initiate pre-notification engagement at least two weeks before formal notification and earlier for acquisitions which may raise competition concerns.

|

|

Phase 1

(15-30 business days)

|

There will be an initial ‘Phase 1’ review process of 30 business days, from a complete application being lodged. Most deals are expected to clear in this timeframe. There will also be scope for a fast-track determination by the ACCC after 15 business days if no competition issues arise.

|

|

Phase 2

(+90 business days)

|

A ‘Phase 2’ review will be more in-depth and will take up to a further 90 business days. At the end of Phase 2, the merger can

be put into effect with or without conditions or disallowed by the ACCC entirely. The ACCC cannot block a merger unless a

Phase 2 review has occurred.

|

|

Public benefit assessment (+50 further business days)

|

From 2026, approval on the basis that there are substantial public benefits that outweigh anti-competitive downsides, is only

able to be sought by merger parties if the ACCC blocks the deal in Phase 2. The prescribed period for this review is an

additional 50 business days.

|

|

Regime promotes timing discipline but the clock can be stopped

|

If an ACCC determination is not made within the statutory timeframe for Phase 1 or Phase 2, the acquisition will be

deemed approved. This is a significant shift from the current flexible timeframes for reviews in the informal regime that can be varied unilaterally by the ACCC. However, in practice we would expect the ACCC to utilise ‘stop the clock’ mechanisms to extend the statutory timelines thereby providing some flexibility.

|

| |

|

6. Other important aspects

- Implications of not notifying: Putting a notifiable transaction into effect (including certain pre-completion coordination with the target/purchaser) without receiving clearance of a notifiable transaction is a breach of the Act and significant penalties may apply. It will also render the transaction void.

- The substantive test: The ACCC must be 'satisfied' that a notified acquisition would have the effect or likely effect of substantially lessening competition in order to oppose it proceeding.

- To address “creeping acquisitions” the new law:

- Makes clear that a substantial lessening of competition arising from a merger can include creating, strengthening or entrenching a substantial degree of market power.

- Enables the ACCC to look at all transactions undertaken by a party to the notified acquisition that are valued at more than $2 million and connected to Australia in the past three years in assessing the impact of the notified acquisition and in applying the thresholds.

- Uncaptured transactions:

- Acquisitions below thresholds: The ACCC will monitor acquisitions and will take appropriate investigatory and enforcement actions in respect of anti-competitive acquisitions, even if they fall below the thresholds for mandatory notification.

- Waiver: Parties to an acquisition will also be able to apply to the ACCC for a waiver, removing the obligation to notify.Waivers are intended for businesses to seek relief from the notification requirement where the acquisition is unlikely to meet monetary thresholds or will not raise competition concerns needing further investigation. The ACCC intends to provide further guidance on waivers in due course.

- Review will be public: The ACCC will publish the key details of the transaction within one business day of a notification.

- Restraints in sale documents: the ACCC will have the power to review and invalidate restraints if it considers they go further than necessary to protect goodwill.

Appendix 1: Turnover calculation methodology

The approach to calculating revenue and transaction values is similar to that which applies in many jurisdictions.

1. Calculate the Australian revenue of all parties to the transaction

| Each principal entity acquiring control |

The target |

|

Australian revenue of the previous financial year of each principal party to the acquisition and each of its connected entities ('acquirer group')

In effect, this looks at the Australian Revenue of the entire corporate group involved in the transaction.

|

- Acquisition of shares: Australian revenue of the previous financial year of the target and each of its connected entities ('target group'.

- Acquisition of assets: Australian revenue of the target group to the extent that it is attributable to the asset.

|

| |

|

- Cumulative acquisition: In calculating if the target revenue thresholds are met, Australian revenue or assets of the target group need to be considered in combination with that of past acquisitions within the previous 3 years of target businesses that are predominately active in the same or similar market. For past acquisitions Australian revenue is calculated at the time of the respective signing date. However, any acquisitions of targets that had Australian revenue below AU$2 million or were not 'connected to Australia', can be disregarded.

2. Consider the transaction value

In measuring a transaction's value, the market values of all shares and assets being acquired and the consideration received or receivable for all of the shares and assets being acquired, must be considered.

3. Notes

- The filings forms require reporting of historical Australian revenue for three years.

- 'Australian' revenue means the amount of gross revenue, determined in accordance with accounting standards, of the most recently ended financial year that is attributable to transactions or assets within Australia, or transactions into Australia.

- 'Connected entity' is broadly defined to include entities in respect of which a party has the capacity to determine the outcome of decisions about their financial and operative policies (subsidiaries, parents, certain commonly controlled entities). In case of the target group revenue considerations do not include revenue of any other entity not acquired as a result of the acquisition (for example seller revenue is not included in target group revenue).

Appendix 2: Notification mandatory for groceries

While the preceding notification thresholds apply generally across the economy, certain transactions within the supermarket sector must be notified regardless of whether they meet the general notification thresholds and regardless of whether they result in a change in control.

Major supermarkets – Coles and Woolworths (including their connected entities) – must notify the ACCC of acquisitions of shares or assets where they are acquiring:

- A supermarket business (in whole or in party, i.e. a business engaged in the retail supply of grocery products)

- Land for supermarket business, i.e. a legal or equitable interest in land (in whole or in part) that meets certain land size requirements (> 1,000m2 for a commercial building or > 2,000m2 for land)

Specific land acquisitions for supermarket business are exempted from the notification obligation:

- A lease extension or renewal for land that has currently operating commercial business;

- A subsequent acquisition in the same land that was subject to a previously notified acquisition;

- Acquisitions of land interest in the form of land development rights;

- Acquisitions related to a sale or leaseback arrangement relating to the land;

- Acquisitions of land upon which another non-supermarket business is operating or will operate.