By Joy Langford in consultation with Adrian Mecz and Carey Child

Introduction

On March 11, 2020, the World Health Organization declared the novel coronavirus disease (COVID-19) outbreak a pandemic. Since the disease was first identified in Wuhan City, Hubei Province, China, in December 2019. The coronavirus has spread globally. As of April 5, more than 1,270,000 confirmed cases of COVID-19 have been reported, with nearly 70,000 reported deaths. As the death toll rises, markets around the world feel the economic impact of the unprecedented governmental measures taken to contain the spread of COVID-19. The multiple lines of insurance exposed to COVID-19 emerging risk also grows as the pandemic spreads, leaving insurers, reinsurers, regulators and rating agencies with the daunting task of quantifying that exposure and estimating how it will be allocated between the primary insurance and reinsurance markets.

Presently, there appears to be some consensus that the extent to which the reinsurance markets will bear COVID-19 losses will be driven by the insurance of major events.1 This necessarily will require insurers to identify the “event” from which its losses emanate; this question may be debated for years to come and is unlikely to present a simple or singular answer.

Can a hospital professional liability (HPL) insurer facing multiple malpractice claims from an insured hospital alleged to have negligently failed to put coronavirus safety protocols in place cede each of the individual claims to its reinsurer as a single COVID-19 related loss? To the extent that the same HPL carrier insures multiple hospitals facing similar malpractice claims, can the losses from each of the insureds be ceded to reinsurers as one systemic loss? What if one of the hospitals is part of a publicly traded healthcare system that is also facing a shareholders class action based on an alleged failure by the Board of Directors to implement adequate systems and protocols to take effect in times of pandemic? If the same insurer provides the hospital with both HPL and directors and officers' liability (D&O) coverage, can those claims be ceded to a reinsurer as a single loss arising out of COVID-19? Can a travel insurance provider cede to a reinsurer as one loss all of the claims it pays out for COVID-19 related cancelations? Will an insurer providing business interruption coverage be able to combine all of its business interruption losses from all insureds as a single reinsurance loss? If a cedent or reinsurer advocates for such a broad aggregation, what would be deemed the event from which the business interruption claims arise? Is it the onset of the pandemic dating back to December, the arrival of the virus in each individual nation, the issuance of a governmental order shutting down businesses? And if it is the latter, will that trigger an exclusion?

The permutation of such questions is boundless, and the answers will depend on the design of specific reinsurance programs and the contract wording used.

Pandemic as a Casualty Catastrophe

A “catastrophe” in insurance coverage parlance involves an event that results in multiple claims from multiple insureds, often across multiple lines of business. In property re/insurance, catastrophe risk is geographically defined. For example, Property Claim Services® (“PCS®”) defines Property catastrophes in the United States, Puerto Rico, and the US Virgin Islands as “events that cause $25 million or more in direct insured losses to property and affect a significant number of policyholders and insurers.” No equivalent approach has been developed for casualty business because casualty catastrophes are more complex. As defined by A.M. Best “casualty catastrophes can impact multiple companies, geographies and lines of business. They are events, activities or products that result in a number of lawsuits from multiple plaintiffs alleging damages that impact multiple insureds, coverages and/or time periods.”2

In 2015, CRO Forum, a group of Chief Risk Officers from large multinational insurance companies formed to focus on the development of best practices in risk management, published a white paper with the stated purpose of raising awareness regarding the need to actively manage casualty accumulation risk so as to reduce the impact of casualty catastrophes.3 The paper specifically recognized pandemic as a potential source of casualty catastrophe and warned pandemic outbreak could result in an increase in Life and Health (“L&H”) and Property and Casualty (“P&C”) “insurance claims, and could also wreak havoc on the financial markets.” The CRO Forum hypothesized that (1) business interruption and contingent business interruption policies could be affected as the spread of pandemic disrupts transport, cross-border trade, supply chains and tourism and (2) casualty exposures could arise from accident & health policies with sickness extensions or through workers' compensation, depending on the specific regulatory framework around occupational diseases.

Nearly three years later Cambridge Centre for Risk Studies (“CCRS”) announced the completion of a two-year exercise documenting the full range of insurance categories that are available in the market and a classification system for all the assets that they protect. The new insurance exposure definitions and framework were created to enable companies to efficiently manage multiline accumulation and was specifically intended to address the several ways by which accumulation may occur: through having multiple insurance policies with the same insured, having different lines of insurance with clusters of insured value in the same geographical location, and by having “clash” risk from underlying events that impact several classes of insurance in an insurer’s portfolio. To demonstrate the need for the data definitions and framework, CCRS examined three catastrophe scenarios, one of which was an influenza pandemic scenario. The following is the CCRS description of how pandemic would likely cause a clash event:

Infectious disease outbreaks are examples of non-destructive threats with the potential to disrupt the economy without a great impact on property insurance lines. Pandemics are not primarily spatial events – the disease spreads through human contact and impacts are felt globally. . . . High levels of the population becoming sick puts stress on healthcare insurance while disease-related mortality stresses life insurance portfolios, and disease-related absenteeism in the workforce causes non-damage business interruption with potential for economic damage and triggering financial exposures such as trade credit and surety. Casualty liability lines are likely to suffer losses from increased levels of claims in medical malpractice and litigation that would follow business failures and economic hardship. All geographies and jurisdictions are likely to be affected, so insurers need to assess their potential exposure at a global level.4

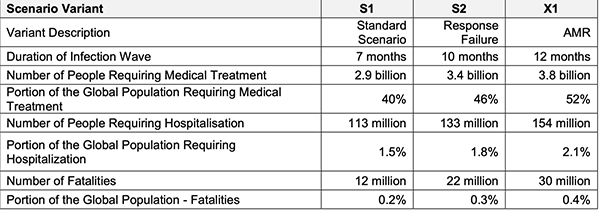

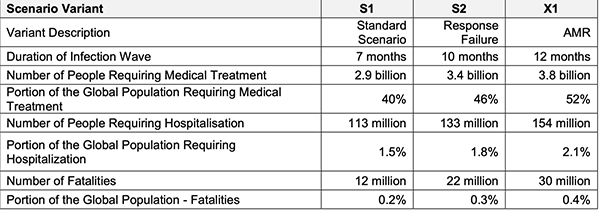

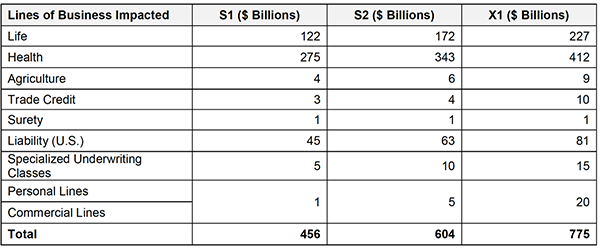

In assessing the accumulation of loss to the insurance industry, the CCRS pandemic study considered three variants: a variant with standard response by government and health organization, a variant where such response fails, and an X1 variant, which accounts for the possibility that the rise in antimicrobial resistant (AMR) strains of common bacteria prevalent in countries where antibiotic treatments are routine could render medical treatments to secondary infections from pathogens less effective, which could greatly increase the potential impact of the pandemic.

| |

|

| |

CCRS Pandemic Scenario Variants

|

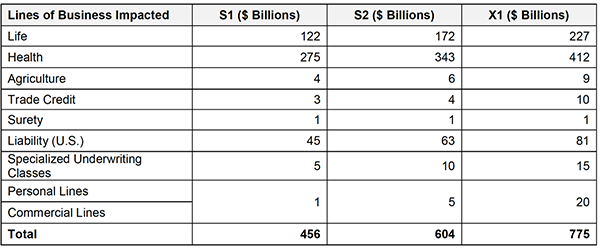

The CCRS analysis predicted a total loss to the insurance industry ranging from $456 billion to $775 billion with the greatest loss experienced by L&H classes of business as a result of the large number of people who require medical services during the pandemic and the number of fatalities that occur over a short period of time. The scenario analysis also reflects a rise in claims internationally in the Trade Credit market due to economic challenges faced by companies, which the authors of the study describe as being brought on by “high amount of employee absenteeism, lowered consumerism, dampened by fears of community social interaction and virus contagion.”5 The final significant losses accounted for in the CCSR scenario stem from liability claims related to medical negligence alleged by a proportion of patients treated in temporary medical facilities and for claims that arise from workers compensation, employer’s liability, and product liability. These liability claims produce an estimated loss range of $45 billion to $81 billion:

| |

|

| |

CCRS Total Loss Estimates: Pandemic

|

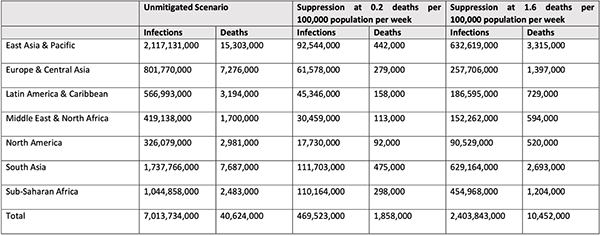

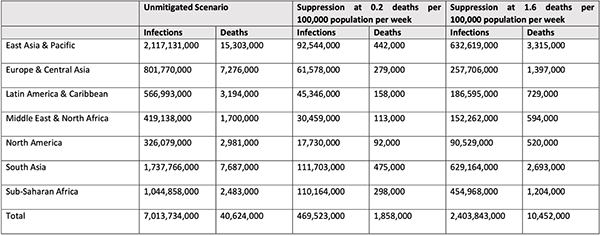

The CCRS loss estimates are of course specific to the scenario specifications stress-tested by the study’s authors.6 Whether COVID-19 will result in industry losses anywhere near those predicted in the CCRS pandemic study remains to be seen. A recent analysis of the impact of suppression strategies on the COVID-19 virus by the Imperial College COVID-19 Response Team suggests that the mortality rates associated with COVID-19 are not as significant as that assumed in the CCRS hypothetical. The Imperial College analysis published on March 26, 2020 indicates under its most optimistic variant only a fraction of the fatalities predicted in each of the CCRS study variants and only approaches the level of 30 million fatalities if a complete unmitigated approach is assumed.7

| |

|

| |

Imperial College COVID-19 Response Team

|

What can be confirmed by the events of recent months is the accuracy of CCRS’ hypothesis that a global pandemic could present the insurance industry with the type of casualty accumulation capable of rising to the level of casualty catastrophe. Daily news reports leave no doubt that numerous classes of insurance business are facing potential claims related to COVID-19, including Travel, Life, Health, Event, Business Interruption, Directors & Officers, Employer’s Liability, and Errors & Omissions. Just by way of example, recent headlines include:

Hundreds of Skiers to Sue Austrian Resort for Exposing Them to Coronavirus

Insurers Worry Virus-Linked Costs May Reach $383 Billion a Month

U.S. Commercial Insurers Face Increasing Political Pressure to Pay Pandemic Business Loss Claims

Prominent Plaintiffs Firms Preparing COVID-19 Lawsuits: Class actions by DiCello Levitt Gutzler and Bursor & Fisher were filed Friday over Membership Fees at 24-Hour Fitness and Room and Board Fees at Arizona State University

Investors Sue Norwegian Cruise Lies over Stock Fallout from Alleged Downplaying of Coronavirus

Pharma Company Hit with Securities Suit over COVID-19 Vaccine Claims

It is precisely this type of multi-line exposure that led to the following observation by Guy Carpenter in December 2014:

The “casualty catastrophe” is perhaps the most daunting threat that casualty (re)insurers face today. One root cause has the potential to trigger a chain reaction of liability through a web of tightly intertwined business relationships that in many cases can involve multiple lines of business. The proliferation of liability is replicated in casualty (re)insurance portfolios, leading to the possibility of unexpectedly high claims, a drain on capital, and, in the extreme, risk to a firm’s solvency. Multiple lines of business insureds and even multiple accident years can be swept up in a casualty catastrophe, and the carriers involved may have to pay claims that may at first seem unrelated to the event’s initial trigger.8

Pandemic and reinsurance coverage

Many commentators have recently remarked that, pandemic-related losses are included "silently" in almost all reinsurance coverages9 with recovery under such coverages dependent on the design of the reinsurance program. For purposes of assessing potential reinsurance exposure in connection with casualty catastrophe losses, aggregation clauses contained in the original policy(ies) and/or the reinsurance contract at issue are likely to be of significant importance.

Aggregation clauses make it possible for two or more covered losses linked by a unifying factor to be treated as a single loss for deductible/retention and limit purposes. In this regard, it is worth noting that aggregation clauses can work in favor of either the insured/reinsured or the insurer/reinsurer depending on the circumstances that give rise to the claim(s) and the amounts as compared to the coverage limit. Aggregation works to benefit the insured/reinsured for the purpose of establishing the insured/reinsured has exceeded the limit of the deductible/retention or excess required to trigger coverage. Where the act or event described in an aggregation clause is widely defined, thousands of linked insured losses that fail to breach a deductible or retention on an individual basis may be combined to trigger coverage, whereas a narrow aggregation clause would mean that every individual loss fell within the deductible or retention and the reinsurer pays nothing. Conversely, the aggregation clause can be advantageous to the insurer/reinsurer because it allows the insurer/reinsurer to rely upon the relevant limit of its liability in relation to the aggregation of the various losses to cap its exposure to a single loss limit for what might otherwise be a multitude of individual losses.

Because aggregation language varies from program to program and wording to wording, the potential to aggregate COVID-19 losses will depend upon the nature of the claims the reinsured seeks to aggregate, an analysis of how the unifying factor meant to allow for claims aggregation is defined in the particular clause under consideration, and consideration as to whether the proposed aggregation is consistent with underwriting intent and pricing.

Casualty Reinsurance Aggregation May Hinge on Interpretation of Event or Cause-Based Clauses

Generally speaking, the unifying factor found in reinsurance aggregation clauses applicable to casualty catastrophe losses will either qualify as event-based or cause-based. Cause-based language can take various forms, including “originating cause,” “common cause,” “same causative agency” or “attributable directly or indirectly to one cause.” A detailed analysis of the plethora of judicial authority interpreting the many iterations of such wordings is beyond the scope of this commentary. However, we note that as a general proposition, cause-based clauses are considered to allow for broader aggregation than event-based clauses. A UK court called upon to review an arbitration panel’s decision regarding the propriety of aggregating certain reinsurance claims related to the 9/11 World Trade Center attacks recently provided the following summary of English-law precedent relevant to event-based aggregation clauses:

- An “event” is something which happens at a particular time, at a particular place, in a particular way (AXA v Field (1996)).

- An event cannot be a state of affairs or series of different negligent acts.

- Where a policy aggregates "a series of losses and/or occurrences arising out of one event", there should be: (a) a common factor properly described as an event; (b) that event must satisfy the test of causation; and (c) the event must not be too remote for the purpose of the insurance (Caudle v Sharp (1995)).

- An event must be something out of which a loss arises or series of losses arises, not a state of mind.

- An “occurrence” (or “event”) could include a number of losses if there is the necessary degree of unity, as viewed from the point of view of an informed observer in the position of the insured, taking into account the four unities i.e. cause, locality, time and intentions of the human agents (KAC v KIC (1996)).

- Losses "arising out of one event" require: (a) something that can be called an event; (b) an event prior to the aggregated losses; (c) a causative link between the losses and event, which is looser than a proximate cause; and (d) that the event and losses are not remote (Scott v Copenhagen Re (2003)).

- Although the link is looser than that of proximate cause, the courts will look for a significant rather than weak causative link (Scott).10

Other English precedent indicates that “cause” has been interpreted as “altogether less constricted” than “event” and may include a “continuing state of affairs” as well as “the absence of something happening.” When “cause” is modified by the word “originating” the contracting parties may be deemed to have “consciously chosen” the word “originating” to open up the widest possible unifying factor in the history of the losses which it sought to aggregate."11

Despite this general proposition that “cause” allows for a broader aggregation than “event”, English law has also held that deference is to be given to the decision of an arbitration panel that required an exercise of finding fact or reaching mixed conclusions of law and fact. In the same matter in which the above precedent interpreting “event” was cited as guidance, the UK court upheld an arbitration panel’s determination that the following categories of losses arising out of the 9/11 World Trade Center attacks could be aggregated as arising out of “one event”:

- Workers' Compensation Claims brought against the Port Authority of New York by those who were struck by or trapped under the debris of the falling towers; and

- Claims against the Port Authority of New York by thousands of firefighters, police officers, clean-up workers and others who claimed to have suffered respiratory damage due to the alleged negligence of the Port Authority in failing to provide necessary protective equipment and/or training.12

Certain courts and arbitrators in the United States have allowed for an even broader interpretation of “event,” especially where the agreement at issue provides no specific definition of “event.”13 Conversely, there is also US precedent suggesting that the broader “cause” based language may be subject to stricter spatial and temporal limits when preceded by the phrase “series of.”14 Thus, the only thing that can be said with any degree of certainty is that a determination of what claims may be aggregated will turn on the specific wordings at issue, the facts surrounding the losses, and perhaps the jurisdiction in which the decision is being made.

Per Policy or Per Risk reinsurance

Reinsurance treaties issued on a Per Policy or Per Risk basis provide capacity for the limit of each policy issued by the reinsured and should follow the provisions of the original policy wording. Aggregation of several losses into one loss occurrence under Per Policy or Per Risk reinsurance can arise from the existence of claims or loss series clauses (i.e. the language upon which aggregation is based) in the original policy wording or in the reinsurance agreement. When the aggregation language is found only in the original policy, barring evidence of unreasonableness or bad faith by the cedent, the reinsurer may find that its ability to question the cedent’s aggregation decision is limited by the follow the fortunes doctrine and/or express follow the settlements or follow the fortunes language found in the reinsurance treaty. This deference, however, is less likely to be afforded where the aggregation is based upon language contained in the reinsurance contract. See Travelers Casualty & Surety Co. v. Certain Underwriters at Lloyd's of London, 96 N.Y.2d 583, 760 N.E.2d 319, 734 N.Y.S.2d 531 (N.Y. 2001) (where the court held that environmental injury claims arising out of pollution taking place at multiple sites throughout the country over more than a decade could not be aggregated as one loss resulting from a series of accidents, occurrences and/or causative incidents having a common origin. In so doing the court rejected the cedent’s reliance on follow the fortunes, noting that although "follow the fortunes" clauses may bind reinsurers to indemnify their reinsureds for reasonable, good faith decisions to settle claims based on the terms of the underlying policies, allocation and aggregation decisions based solely on the contractual language in the reinsurance treaties are not afforded the same deference).

Excess-of-Loss Per Event Coverage and Casualty Clash/Catastrophe Reinsurance

Clash or Catastrophe reinsurance coverage is a type of reinsurance targeted at protecting the direct insurer burdened by multiple claims arising from events resulting in a magnitude of losses beyond those contemplated by basic primary and excess-of-loss reinsurance covers. This type of reinsurance is designed to protect an insurance company from the loss of its normal reinsurance recoveries when it is faced with multiple claims from multiple insureds arising out of the same catastrophe and where its basic reinsurance program does not fully reimburse the insurer for these related losses. Again, exactly how such coverages will respond to COVID-19 losses will hinge on the specific clash or catastrophe wording contained in the relevant contract and the nature of the claims sought to be aggregated for clash purposes.

In 2008, the General Insurance Research Organising (GIRO) Committee of the Institute and Faculty of Actuaries formed a working group to specifically address casualty catastrophes and the way in which casualty aggregates or events might be defined. The working group devised three possible definitions designed to establish separate categories of casualty catastrophes all of which could potentially apply to one or many insureds as well as to one or many classes of insurance. The structure devised by the working group may prove helpful in developing early assessments of potential COVID-19 related reinsurance exposure, and thus, we provide the GIRO working group’s proposed definitions for review:

Single Negligent Occurrence

A single event occurs, and negligence is established e.g. Exxon Valdez oil spillage. The date of loss will usually be clear, although legal action may be required to establish coverage and liability (negligence); as a result costs may be substantial. Reinsurance coverage is usually easy to assess, these events are usually covered by standard reinsurance on a per event basis, direct claims may occur across several years of account.

Single Negligent Industry Practice

This covers multiple unrelated occurrences having the same trigger, which would normally be seen as a number of different events. The negligent act may be the same or similar across all cases. Events of this type could often involve multiple insureds, or sometimes multiple claims against the same insured. The date of loss may be harder to define (first occurrence, date of first claim). Reinsurance would most likely apply on a per event basis, with claims aggregating across events but not covering the whole gamut as one event.

There is an obvious split into two types of occurrence: gradual/latent and sudden. Most of the really large claims fall into the former categorization, as exposure builds up over time. Recent examples could include the use of asbestos and as an example of a sudden loss the various accounting scandals.

Multiple Unrelated Negligent Events with a Common Trigger

This is really a catch all to pick up other types of event where there is an overall defining trigger but no other link. Claims arise from negligence by a variety of assureds in a variety of different ways, with only a single crystalizing event e.g. Hurricane Katrina resulted in claims from relatives of those abandoned in nursing homes, pollution claims from onshore refineries, and claims from mobile rigs hitting bridges and dragging anchors across pipelines. In theory all claims would be aggregated for reinsurance purposes. . . .15

It is not difficult to imagine COVID-19 related losses falling into any one of these proposed categories. For example, hospitality companies could face lawsuits by customers alleging failure on behalf of the company to take all necessary precautions to keep them safe following the spread of the coronavirus as well as securities class actions alleging that filings with the SEC regarding the company’s handling of viruses, including COVID-19, were false and misleading. Workers Compensation (WC) claims may be another avenue of exposure presented by the same hospitality companies. When a company faces lawsuits by guests and stockholders and WC claims by employees as a result of a COVID-19 outbreak at one specific location or event, the catastrophe event may fall within the confines of the single negligent occurrence described above; the cedent arguably faces losses arising out of a single insured’s negligent practice which resulted in claims triggering three potential sources of insurance. In a scenario where a business entity has contracted with the hospitality entity to serve as host for a conference and its attendees are infected by the COVID-19 outbreak, that entity may face claims as well (e.g. allegations of negligence for failure to take necessary precautions including canceling its event upon news of the outbreak; professional liability claims resulting from shortage of staff to competently carry out professional services, etc.), further expanding the scope of the impact of the single negligent occurrence.

To the extent that multiple hospitality companies (i.e. separate insureds) face negligence claims by guests, securities class actions by stockholders, and WC claims by employees arising from COVID-19 outbreaks at separate locations or sponsored events, the catastrophe could be characterized as a single negligent industry practice, i.e. the hospitality industry’s failure to institute necessary disinfectant protocols and other protective measures to protect its patrons from communicable illnesses.

COVID-19 could likewise present a possible clash that would combine losses from multiple unrelated negligent events on the basis that they share a common trigger, namely the outbreak of the virus leading to the pandemic. In practice, such aggregation may be most likely on a class or line of business basis since disparate lines of business are often underwritten by different insurers altogether or different business areas within a single insurance company. Aggregation of all claims across all lines of business would likely only be a possibility for those cedents that have purchased high-level whole account reinsurance covers. In the aftermath of Hurricane Katrina, certain reinsurers with participations on whole account casualty catastrophe covers argued in favor of aggregating all claims caused by the storm as a single reinsurance event in an attempt to limit reinsurance recovery to a single event limit. In those situations, many cedents pushed back on the basis that the storm was too remote to be deemed the cause for certain categories of claims (e.g. the storm did not cause the riot and vandalism damage that occurred three days after the storm made landfall; the storm was not the cause of patients’ deaths at nursing homes which failed to evacuate in a timely fashion).

Possible insights from April 2020 renewal

As this article was being finalized for publication, reports regarding April 2020 reinsurance renewal negotiations began to surface in industry press. Artemis observed “the [COVID-19] coronavirus pandemic escalated right as the April reinsurance renewals reached their critical point of closing resulting in some challenges in the market.”16 According to Willis Re, reinsurance rates rose by as much as 50 percent at the April 1 reinsurance renewals with the largest risk-adjusted rate increases occurring on loss-hit catastrophe reinsurance programs. Willis Re indicated that early April renewals were completed without the addition of specific exclusionary language, but later in the renewal cycle several reinsurers sought COVID-19 exclusions. In some cases, according to Willis Re, the addition of specific exclusions were achieved and in others, the reinsurance buyers provided reinsurers with “some comfort through letters of understanding explaining that the underlying original policies have no exposure to COVID-19 related losses.”17

In the week leading up to the April 1 renewal deadline, Artemis reported that “there are already some rumours spreading that a number of catastrophe programs (unclear if reinsurance or retrocession) may be subject to attempted claims or filing of early loss advice related to the outbreak.”18 Artemis opined that property catastrophe covers are intended to cover natural catastrophes and are unlikely to cover the COVID-19 related business interruption claims, but caveated that view by noting that some covers issued by the traditional markets (as opposed to the ILS markets) may have “looser” terms that will result in reinsurers being asked to honor claims. Artemis further speculated that retrocessional claims may present a stronger case for coverage as “some [retrocessional] covers are much more all-encompassing.”19

At this juncture, drawing conclusions from brief snippets, innuendo and “rumours” could be chalked up to be little more than reading the proverbial tea leaves, but it is not unreasonable to at least give a passing thought to the following in light of market industry press reporting on April 1 renewals:

- Exclusions are usually sought because an undesirable exposure is believed to exist; hence to the extent there are in force agreements that have not been renewed with an exclusion the potential for loss from the risk that compelled the markets to request an exclusion continues to exist.

- Although Artemis does not describe what is meant by “looser” terms, reliance upon the premise that property catastrophe covers are intended to only address natural catastrophes will do little to solve the question of whether coverage exists. Barring an applicable exclusion (e.g. for pandemic or for non-damage business interruption resulting from infectious disease), whether property per-risk excess-of-loss and catastrophe covers respond may hinge not only on interpretation of event or covered peril-based language but on hours and territory clauses that further define the scope of any aggregation.

- The fact that renewal negotiations completed earlier in the April 1 renewal season did not trigger exclusion discussions, but later negotiations did, indicates that as the pandemic has spread, the awareness to the potential loss triggers has grown. The longer-tail nature of casualty exposures makes it even more difficult to know where silent pandemic exposure may exist, and some market participants are acknowledging that—depending on severity—major event covers could lead to significant—but at this point predicted to be manageable—property-casualty reinsurance losses as a result of pandemic,20 an acknowledgment that indicates reinsurance coverage will in large part depend on how an event is defined.21

Conclusion

The full nature and size of COVID-19 related industry loss may not be completely known for years to come, and presently changes day to day, if not hour by hour. Nevertheless, now is the time for cedents and reinsurers to begin to assess how reinsurance may or may not respond to the multi-line exposure presented by COVID-19. A critical review of reinsurance programs will allow both cedent and reinsurer to begin to assess overall risk exposure and prepare for future COVID-19 related loss cessions. Such analysis will likely also prove necessary for purposes of (1) renewal negotiations, many of which will take place while the virus infection rates continue to rise and countries around the globe continue to enact containment measures, and (2) responding to requests by regulators and rating agencies calling for reinsurers to quantify their risk exposure.