Market overview

UK Policy Overview

The UK remains an attractive and stable market for developers and investors in the low carbon hydrogen sector. The UK government has acknowledged the pivotal role that hydrogen can play in achieving the UK’s net zero targets and the need to stimulate supply and demand for low carbon hydrogen in tandem. Consistent with this, in recent years the UK government has demonstrated sustained support for the low carbon hydrogen production chain by implementing a number of funding and policy frameworks, most notably the Hydrogen Strategy (August 2021), the British Energy Security Strategy (2022), the Hydrogen Investor Roadmap (February 2024) and the funding support pledged for the hydrogen sector in the UK government’s 2024 Budget. An updated Hydrogen Strategy is expected by industry during autumn 2025.

The UK’s current target is for the market to deploy up to 1GW of low carbon hydrogen production capacity by the mid-2020s, ramping up to 10GW by 2030. In tandem, the Scottish government has set a goal of 5GW of hydrogen production in Scotland by 2030. The UK government has taken a ‘twin-track’ approach to achieving its current 10GW hydrogen production target as follows:

- 4GW installed capacity by 2030 of carbon capture and storage (CCS)-enabled hydrogen (i.e. ‘blue’ hydrogen), which is considered a transition technology in the path to the development and commercialisation of the green hydrogen sector and will be supported by the UK’s rapidly developing CCS projects and extensive geological stores; and

- 6GW installed capacity of electrolytic production (i.e. ‘green’ hydrogen) by 2030.

An update to these targets is expected in autumn 2025.

In recognition that the development of the UK hydrogen value chain requires government support to stimulate investment and drive production, the UK government offers supply side funding support in the form of:

- the Hydrogen Production Business Model (HPBM), which was initially announced to the market in 2020 with initial draft contracts made publicly available after a consultation process in December 2022 which were updated in August 2023 (see further details below); and

- the £240 million Net Zero Hydrogen Fund (NZHF).

The UK government also intends to drive demand for low carbon hydrogen produced in the UK by:

- introducing a cost for carbon through the UK Emissions Trading Scheme (UK ETS), which currently applies to certain aviation activities and energy intensive industries (e.g. the production of ammonia) and is expected to be expanded to certain domestic maritime transport in 2026 and waste incineration in 2028;

- providing funding through the Industrial Hydrogen Accelerator Programme for innovative projects that can demonstrate end-to-end industrial fuel switching to hydrogen, e.g. the ‘Hydrogen for the Decarbonisation of Sheffield Steel’ project which is assessing the technical and commercial feasibility for end-to-end hydrogen production, transport and end-use in the steel manufacturing industry; and

- setting policies targeting specific sectors, e.g. the Renewable Transport Fuel Obligation (RTFO) which requires fuel suppliers to ensure a certain percentage of their supply constitutes renewable fuel (currently set at 9.6% of total fuel supplied, increasing to 14.6% in 2032).

Hydrogen Production Business Model (HPBM)

The HPBM provides revenue support to successful, eligible projects and is one of the UK government’s support schemes for low carbon hydrogen production in the UK. It was introduced as part of the hydrogen provisions within the Energy Act 2023 (see our briefing: UK Energy Act 2023: Summary of the provisions relating to hydrogen for more detail). The HPBM is prepared and coordinated by the UK government’s Department for Energy Security & Net Zero (DESNZ).

Underpinned by the Low Carbon Hydrogen Agreement (LCHA) and the Low Carbon Hydrogen Standard (LCHS), the HPBM offers a financial subsidy in the form of revenue support for low carbon hydrogen projects through a ‘contract for difference’ style support package. This revenue support mechanism aims to help overcome the production cost gap between low carbon hydrogen and conventional higher carbon fuels and de-risks projects by providing investors with a greater degree of certainty on a project’s financial returns once operational.

Eligibility

The HPBM will be delivered through the LCHA, a long-term private contract between a hydrogen producer and a government appointed counterparty, the Low Carbon Contracts Company (LCCC). LCHA is comprised of two parts: (i) the Front-End Agreement (the FEA); and (ii) the Standard Terms and Conditions (the ST&Cs).

To be eligible for funding under the HPBM, producers must produce hydrogen which meets the LCHS according to the version in force at the time of entry into the LCHA and must sell those volumes to ‘Qualifying Offtakers’. The concept of Qualifying Offtakers excludes the sale of hydrogen to ‘risk taking intermediaries’ (in essence, energy traders), exporters and any market participants looking to purchase hydrogen to inject into the UK’s gas grid.

LCHS Compliance

For the hydrogen produced to be LCHS compliant, it must meet the specified maximum level for GHG emissions at the point of production. The current criteria are that each consignment of hydrogen: (i) has a GHG emissions intensity of 20gCO2e/MJLHV of hydrogen produced or less; and (ii) has been produced by a hydrogen production facility which satisfies the ‘Conditions of Standard Compliance’ (as specified in the LCHS).

The LCHS is subject to change over time for future allocation rounds. The LCHA will confirm which version of the LCHS is applicable to the project in establishing whether the hydrogen produced constitutes a ‘Qualifying Volume’.

Net Zero Hydrogen Fund (NZHF)

The aim of the NZHF is to lower investment risks in hydrogen production and reduce lifetime costs by providing CAPEX and DEVEX funding.

The first application round was launched in April 2022 and the second application round opened in April 2023. Each application round comprised of two strands:

- strand 1 - which provided DEVEX for FEED and post-FEED activities with the aim of building the pipeline of hydrogen production project and to support their deployment; and

- strand 2 - which provided CAPEX support for hydrogen projects that do not seek support under the HPBM.

A total of 15 successful applicants from Round 1 of the NZHF were announced in April 2022, whilst a further 7 successful applicants were announced in respect of Round 2 in April 2023. Awards in excess of £59m have been allocated, subject to contracts being signed. The second application round is now closed and any future application round is to be confirmed.

Hydrogen Allocation Rounds (HARs)

The HAR process allocates revenue support under the HPBM to selected hydrogen production facilities across the UK.

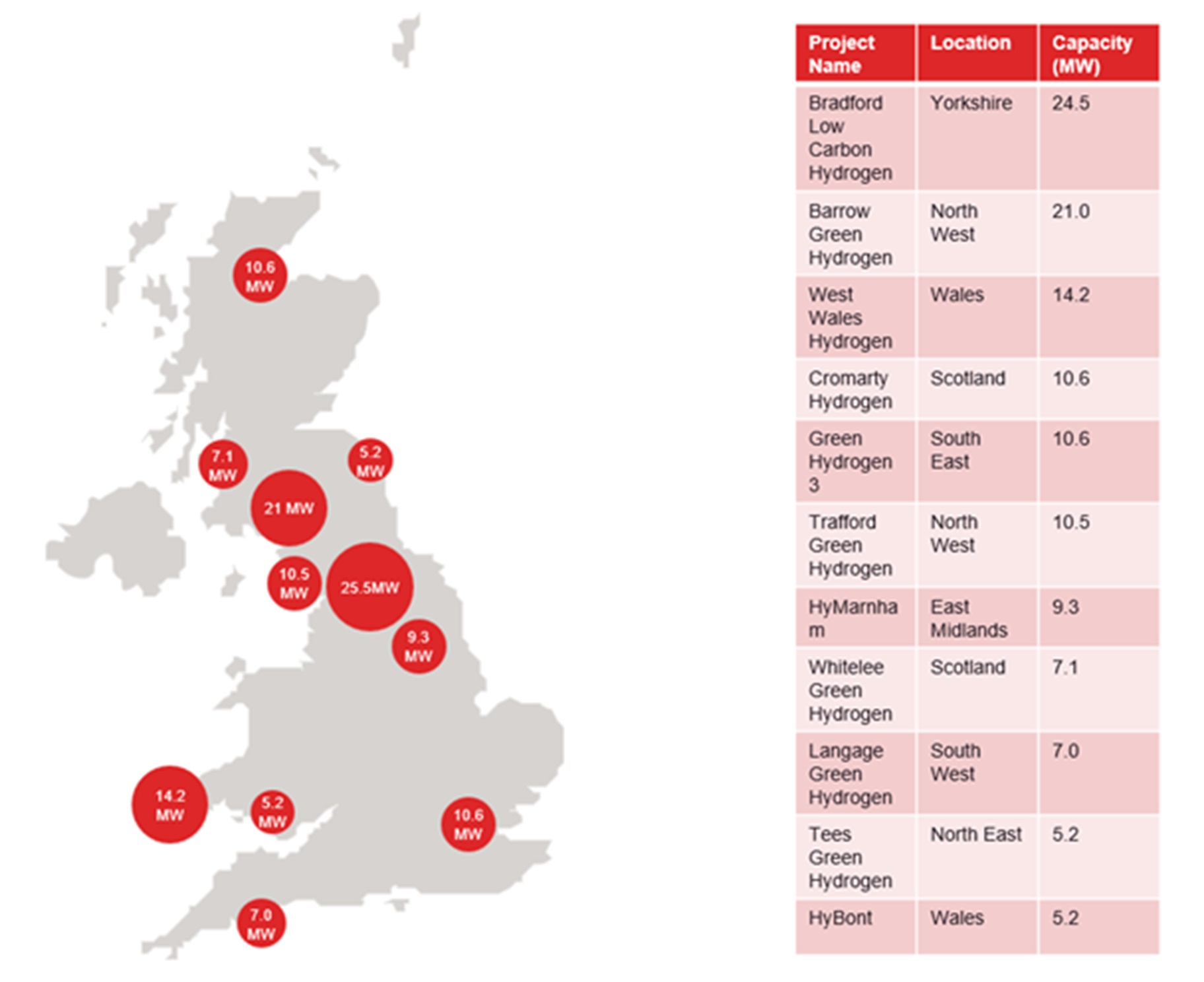

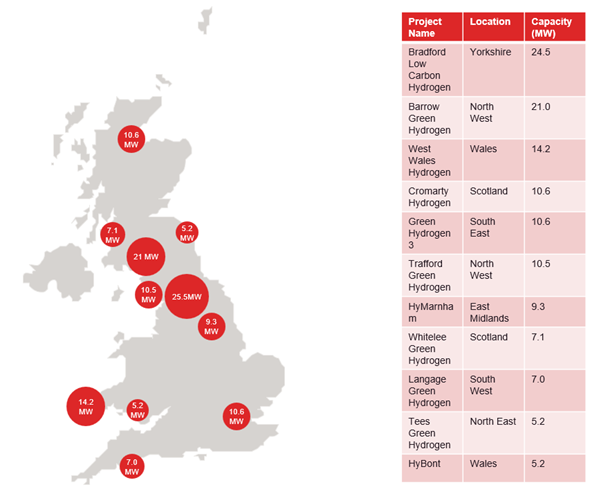

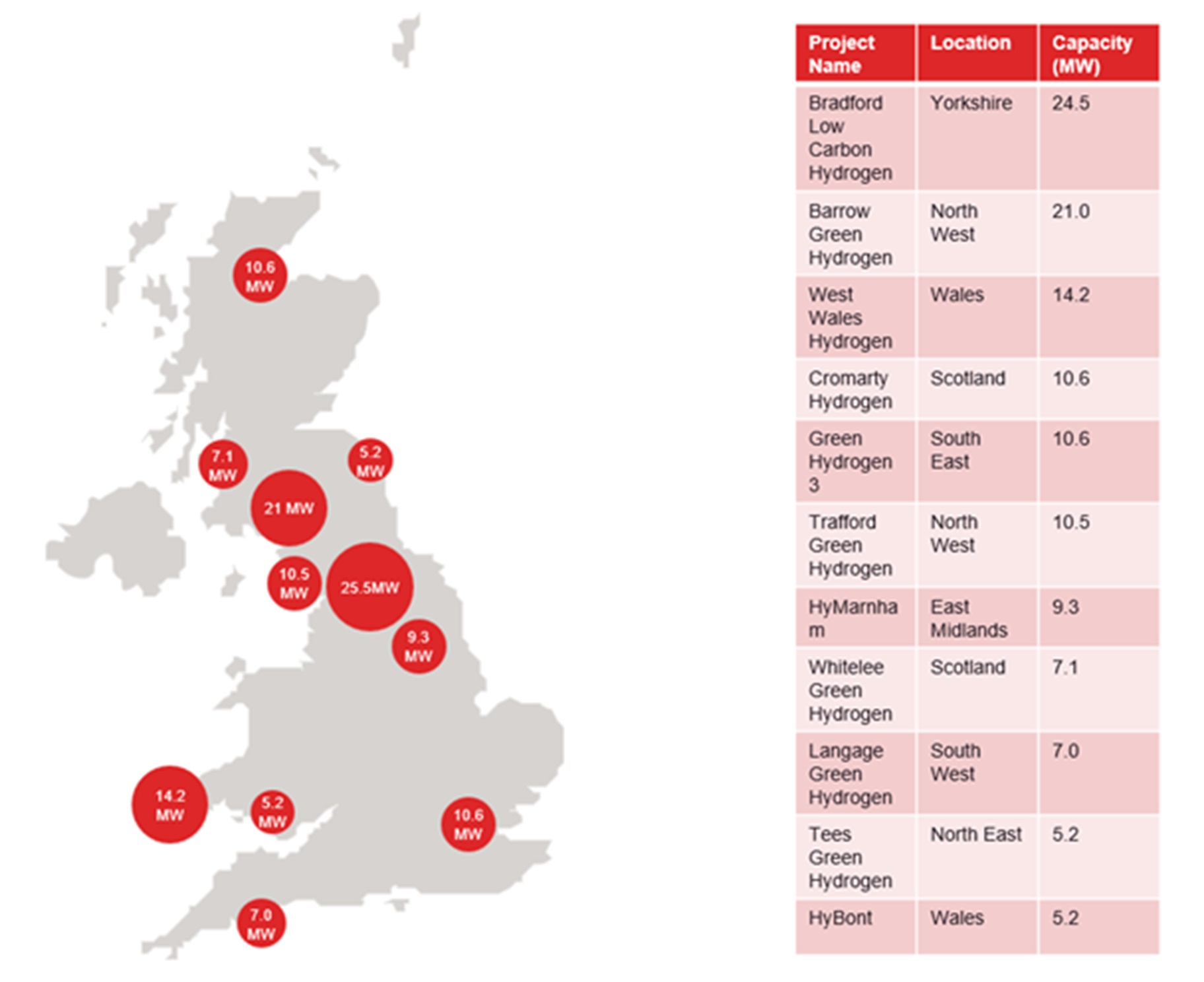

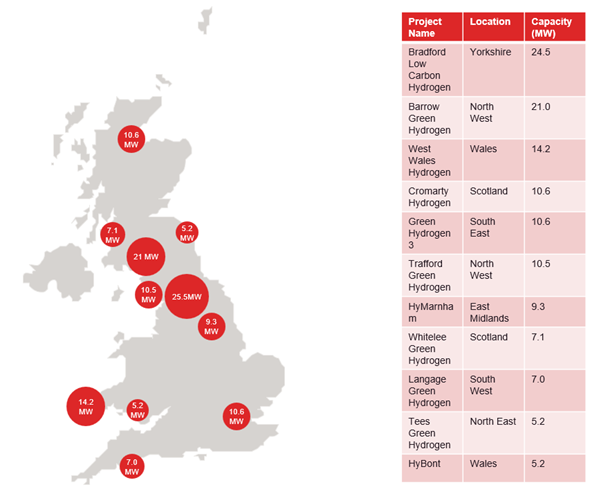

The first HAR (HAR1) was launched in July 2022, representing the largest number of commercial scale green hydrogen production projects announced together in Europe. HAR1 jointly offered HPBM revenue and CAPEX support through the NZHF. Initially, the UK government aimed to deliver 250MW of capacity but proceeded to shortlist 20 projects, totalling 408MW of capacity, for further negotiations. 17 of the original 20 projects entered final negotiations, and 15 projects proceeded to submit best and final offers. 11 successful projects totalling 125MW capacity were finally announced in December 2023 (see Figure 1 below). In December 2024, three projects signed LCHAs with the LCCC. The updated LCHA standard terms and conditions and front-end agreements applicable to several HAR1 projects were published on 12 February 2025.

Figure 1 – HAR1 successful projects

The second HAR (HAR2) is underway and aims to support up to 875MW to reach the government’s target of 1GW of hydrogen production capacity by the mid-2020s.

Beyond HAR2, the UK government’s intention is to hold annual allocation rounds for electrolytic and alternative technologies from 2025 until 2030, with the goal of allocating up to 1.5GW of production capacity in HAR3 and HAR4. These allocation rounds will be subject to the core principles set out in the UK government’s Hydrogen Strategy, including long term value for money for taxpayers and consumers.

CCS-enabled hydrogen – CCS Cluster Sequencing

CCS-enabled hydrogen projects are eligible to receive support under the HPBM in parallel with the CCS cluster sequencing program and the UK CCUS business models.

Track 1-Phase 1 of the CCS cluster sequencing program saw the Northern Endurance Partnership (NEP) and HyNet North West CCS projects selected for support in November 2021.

In March 2023, Track 1-Phase 2 of the CCS cluster sequencing program saw a further two CCS-enabled hydrogen projects (bpH2Teeside and HyNet Hydrogen Production Plant 1 (HPP1)) proceed to negotiate the terms of a LCHA.

Finally, in February 2024 the government commenced ‘final negotiations’ with EET Hydrogen in respect of the HPP1 low-carbon hydrogen plant at Ellesmere (which is intended to form part of the HyNet North West cluster) (see further details below).

The CO2 emitted from bpH2Teeside will be sequestered into the NEP Track 1-Phase 1 project and the CO2 emitted from HPP1 will be sequestered into the HyNet North West Track 1-Phase 1 project.

The Viking CCS and Acorn CCS transportation and storage (T&S) projects were awarded track 2 status (the Track 2 Projects) in July 2023. Emitter projects (including CCS-enabled hydrogen projects) will be selected for the Track 2 Projects in due course.

Payment support under the Hydrogen Production Business Model

The LCHA aims to mitigate price and volume risks. It uses a revenue support mechanism similar to the UK's CfD regime to stabilise returns for producers by reducing their exposure to hydrogen price volatility and improving financing conditions in the UK's green hydrogen market.

The support is set at an agreed 'Strike Price' for hydrogen, covering production costs plus an allowed return. This price and its components will be negotiated per project and may vary across different production technologies. Hydrogen is not physically transferred under the LCHA, and the LCCC does not act as a single buyer. Instead, producers must sell their hydrogen to a Qualifying Offtaker through a separate, bankable hydrogen purchase agreement.

Figure 2 – Low Carbon Hydrogen Production diagram

Payments Streams

The LCHA provides three key payment streams for producers: (i) the Difference Amount; (ii) the Price Discovery Incentive; and (iii) the Sliding Scale Top Up Amount.

Difference Amount

The Difference Amount is based on the CfD regime and is calculated by comparing the Strike Price (the agreed subsidy price) with the Reference Price. Since there is no liquid market for hydrogen, the Reference Price is the higher of the Achieved Sales Price (the actual price under the offtake agreement) and the Floor Price (the lower of the natural gas price or the Strike Price).

The LCCC compensates producers if the Strike Price is higher than the Reference Price, and producers pay the LCCC if the Achieved Sales Price is higher than the Strike Price.

Figure 3 – LCHA Price Curve

The diagram in Figure 3 illustrates the pricing mechanism. In essence, the LCCC tops up the producer’s revenues for the difference between the Strike Price and the Reference Price and the Producer is required to pay amounts to the LCCC where the Achieved Sales Price exceeds the Strike Price. This is designed to mitigate price risk.

Price Discovery Incentive

The LCHA includes an upside-sharing incentive to encourage producers to achieve sales prices above the price of natural gas. Producers receive a portion of the difference between: (i) the lower of the Reference Price and the Strike Price; and (ii) the Floor Price.

The Price Discovery Incentive Ratio is set at 10%, which means producers get only 10% of this additional sales value, which is considered a low threshold for incentivising higher pricing strategies.

Sliding Scale Top Up Amount

To mitigate volume risk, if the total volume of hydrogen sold in a billing period falls below 50% of the forecast reference volume, the producer will receive a top-up amount for each qualifying unit of hydrogen sold. The producer will not be able to rely on this volume support if the reduction in sales is caused by an event which is not demand-related (for example, a facility outage). Volume support is only available where some hydrogen is produced. If actual sales falls to zero, no volume support will be available. Industry participants flagged this as a major concern during the consultation on the HPBM, but the Government indicated that the principle of value for money was crucial for the HPBM.

Sales Cap

There are two notable sales caps which apply to the producer under the LCHA:

- a cap on the overall volumes which will be supported over the life of the LCHA (LCHA Sales Cap); and

- a cap on the volumes which can be invoiced in any fiscal year (Permitted Annual Sales Cap).

The LCHA Sales Cap limits the volume of hydrogen that can receive support, based on the facility's forecast total volumes over 15 years. Whilst non-qualifying volumes produced and sold by the facility do not receive support under the LCHA, they will still count towards the LCHA Sales Cap. If production exceeds the LCHA Sales Cap, the LCHA expires automatically. It is important to understand how forecast volumes produced are modelled across the term of the LCHA, to ensure that developers and financiers are comfortable that these caps will not be breached and inadvertently trigger the early expiry of the LCHA. From a bankability perspective, financiers may require the ability to monitor the levels of hydrogen produced and the inclusion of cash sweeps if such obligations were breached.

The Permitted Annual Sales Cap is 125% of the Reference Volume adjusted for the number of days in the year. Volumes above this cap will not receive support under the LCHA but will count towards the overall LCHA Sales Cap. Breaching the Permitted Annual Sales Cap more than twice grants the LCCC a termination right. Unless sales are forecast to be steady each year, the 25% buffer applied to each fiscal year may be insufficient and this should be considered when modelling the project.

For further information on the LCHA please see our briefing: The UK’s Low Carbon Hydrogen Agreement: How the revenue support works and key risks.

Focus on EET Hydrogen

The HPBM is technology agnostic and offers support to both CCS-enabled hydrogen projects and electrolytic hydrogen projects. The UK is particularly well placed to lead in the CCS-enabled hydrogen field due to its abundant geological gas stores and its rapidly developing carbon capture and storage sector.

The Vertex Hydrogen / EET Hydrogen1 (EET Hydrogen) is a planned CCS-enabled production project highlighted in UK Government’s Hydrogen Net Zero Investment Roadmap (February 2024).

EET Hydrogen, a joint venture between Essar and Progressive Energy Limited, is a key part of the HyNet North West cluster. Hydrogen production is due to begin in 2026 with the first plant (HPP1) intended to produce 350GW and the second plant (HPP2) intended to produce up to 1000MW of CCS-enabled hydrogen.

It is to be built at the Stanlow Manufacturing Complex in Ellesmere Port, Cheshire and will convert waste gases and methane into hydrogen with the resultant CO2 being transported to and stored by the HyNet North West CCS project in Liverpool Bay (see section 5 below for further information on CCS-enabled hydrogen).

Figure 4 – HyNet North West Cluster map of projects including EET Hydrogen

As EET Hydrogen is not an electrolytic production project, it is not eligible for support under the HAR process. Instead, it will receive support under the HPBM in parallel with the development of HyNet North West as a Track 1 CCS project.

Essar intends to be an initial offtaker using the hydrogen at the Stanlow Manufacturing Complex. In addition, EET Hydrogen intends to supply its hydrogen to a wide range of businesses including companies in the chemicals, ceramics, paper, glass and flexible power generation sectors. Tata Chemicals Europe, Encirc, InterGen, Solvay, Ingevity, Novelis, Glass Futures and Saica Paper are all reported to have all expressed an interest in purchasing the hydrogen from the EET Hydrogen project.

EET Hydrogen intends to increase production to around 4GW of low carbon hydrogen by 2030 (around 40% of the UK government’s aggregate hydrogen production target).

By supporting CCS-enabled hydrogen, the HPBM also supports demand for the UK’s CCS sector and demonstrates the symbiotic nature of these two swiftly developing sectors.

Hot Topics

CCS-enabled or ‘blue’ hydrogen

CCS-enabled hydrogen (often referred to blue or low carbon hydrogen), is hydrogen produced from natural gas, most commonly through:

- steam methane reforming (SMR), which involves heating fossil fuels to high temperatures in the presence of a catalyst to form a syngas of hydrogen, carbon dioxide and carbon monoxide (which is further converted to produce more hydrogen and carbon dioxide); and

- autothermal reformation (ATR) in which partial oxidation and steam reforming are used to produce a syngas of carbon monoxide and hydrogen. The syngas is then purified to create hydrogen and carbon dioxide.

To reduce GHG emissions from these processes, CCS technology is used to capture the CO2 to be compressed and then transported for permanent storage underground in geological formations such as saline aquifers or depleted oil fields.

CCS-enabled hydrogen is seen by industry as one of the primary paths to the decarbonisation of hard-to-abate sectors such as oil refining, steel, cement and transport. With the ability to significantly decrease CO2 emissions, CCS-enabled hydrogen can serve as a more cost-effective method of producing hydrogen to supplement the UK’s electrolytic hydrogen production, which is currently faced with significant cost challenges. While green hydrogen is the ultimate goal as part of the energy transition to net zero the higher cost of producing green hydrogen is a challenge, most notably due to the cost of electrolyser technology and renewable power required for electrolytic hydrogen production.

Globally, the production capacity of blue hydrogen is expected to grow significantly over the next decade. To produce large-scale blue hydrogen, a substantial capacity of CCS technology is required. These technologies can be retrofitted onto existing hydrogen processes or integrated into new hydrogen plants by design.

Given the UK’s significant geological stores and readily developing CCS, it is well placed in the global hydrogen market for the development of CCS-enabled hydrogen. Two major carbon capture clusters are already being developed in the North of England that will include blue hydrogen. Government funding of £21.7 billion will be split between the HyNet hub in Merseyside and the East Coast Cluster hubs in Teesside over the course of 25 years. These clusters are in favourable geographical locations that already have existing infrastructure in place, including import technologies and gas pipelines. The development and retrofitting of these clusters would not only bring environmental benefits but also create new jobs, local education, and skills development, potentially leading to a highly skilled UK-based supply chain and making the UK an exporter to other countries.

The UK government is actively supporting CCS-enabled hydrogen projects through substantial funding and strategic initiatives. In particular, the HPBM and LCHS are technology agnostic and offer support to both CCS-enabled hydrogen and electrolytic hydrogen (i.e. green hydrogen) projects. Investors and developers of CCS-enabled hydrogen projects can benefit from the price risk and volume risk support under the HPBM to aid the commercial viability of their projects. Similarly, projects can benefit from the NZHF to support the upfront costs of developing and building low carbon hydrogen. NZHF is structured into four strands of funding, dependent on its maturity and required support, and can also be used in conjunction with HPBM for capital support.

CCS-enabled hydrogen has an important role to play in the development of the hydrogen sector in the UK and warrant consideration by investors and other participants in the hydrogen space alongside green hydrogen.

Low Carbon Hydrogen Certification Scheme (LCHCS)

Hydrogen certification schemes, used to evidence that hydrogen produced is compliant with relevant standards and demonstrate eligibility for applicable subsidy schemes, are being developed in various jurisdictions to promote transparency, credibility and confidence in the low carbon hydrogen and green hydrogen sectors.

Without credible certification schemes, there is a risk that non-compliant hydrogen could enter the market, damaging consumer and investor confidence.

The LCHCS was first mooted in the 2022 British Energy Security Strategy and has undergone detailed development and consultation over the past few years. In October 2023, the UK government committed to the launch of the LCHCS in 2025. It is expected that the LCCC will act as delivery body for the LCHCS. Certificates will be issued in MWh (HHV), in alignment with the HPBM.

Initially, the scheme will focus on hydrogen produced and sold in the UK and will be implemented on a voluntary basis. As previously mentioned, to receive certification the hydrogen will need to comply with the LCHS showing the emissions credentials up to the point of production (i.e. well-to-gate).

Other jurisdictions have also developed or are developing hydrogen certification regimes, such as the voluntary CertifHy regime in the EU. The mutual recognition and interoperability of different certification schemes is therefore key to supporting international trade in low carbon hydrogen. Accordingly, the UK government intends to keep both the LCHS and the LCHCS aligned with other international schemes where appropriate.

For UK hydrogen certificates to be accepted in the EU (and vice versa), the EU and the UK will need to conclude an agreement for the mutual recognition of the relevant certificates. The development of a robust certification scheme will be a crucial step in ensuring confidence in the low carbon hydrogen markets. Reciprocity and mutual acceptance of different certification regimes will be required for free-flowing international trade in hydrogen.

Hydrogen Transportation and Storage Business Models

The HPBM discussed above currently only provides support to projects producing hydrogen. It is recognised that government support will also be required to encourage the development of: (i) the infrastructure needed to transport hydrogen; and (ii) store hydrogen at scale.

Hydrogen Transportation

The UK government is planning to put in place an additional business model during the course of 2025 to support hydrogen transport infrastructure. The government has stated this will primarily focus on large-scale onshore pipeline infrastructure. This transportation business model will follow the regulated asset base (RAB) model which allows a developer to receive revenue (including a return on investment) during the construction phase as well as the operation phase. The RAB model is intended to decrease the risk for the developer and in turn lower the cost of capital and borrowing for the project thus reducing consumers’ bills.

Hydrogen Storage

A hydrogen storage infrastructure business model is also intended to be put into place during the course of 2025. Due to development lead times of up to 10 years, the UK government has stated its initial focus will be on providing support to developers of geological storage facilities with the aim of evolving the model to encompass all storage types as the hydrogen storage industry continues to grow. One of the key objectives of this support is to guard against demand risk, which the government perceives as beyond the control of the storage provider and a significant barrier to entry for potential investors. Therefore, the government plans to establish a minimum revenue floor for storage providers. This amount would cover the entire contract term and would be equal to the total capital costs of creating the storage facility, plus fixed operational costs and a return on capital investment. In respect of subsidy support for geological storage facilities, this will likely be for at least 15 years and implemented through a private law contract model.

Hydrogen to Power (H2P) Business Model

In December 2023 the UK government launched a consultation on market intervention required to boost the deployment of hydrogen to power (H2P). In December 2024 the UK government published its response to the consultation which was broadly positive on the role that H2P can play in supporting both clean power systems and security of power supply.

As part of its response, the UK government announced its commitment to deliver a Hydrogen to Power Business Model (H2PBM) based on a Dispatchable Power Agreement (DPA) for CCUS developed by the UK government to support the deployment of power generation facilities which incorporate CCUS technology. The H2PBM is expected to provide another route to market for low carbon hydrogen in the UK and thereby increase demand for low carbon hydrogen.

Low carbon hydrogen can, theoretically, be used as fuel in gas-fired power plants. However, it is suggested that CAPEX costs for hydrogen fuelled plants will be at least 10% higher compared to conventional natural gas-powered plants. The H2PBM aims to close any such cost gap and reduce investment uncertainty. This would enable hydrogen compatible power plants to participate in the capacity market and provide another route to market for low carbon hydrogen.

The UK government is committed to designing the H2PBM to be a negotiated commercial contract which will provide for an ‘availability payment’ to the facility per unit of capacity available to the grid, regardless of dispatch. The H2PBM should therefore provide a regular revenue stream to cover CAPEX costs and help build investor confidence to support investment in hydrogen fuelled power plants.

The use of low carbon hydrogen as a fuel in power plants is likely to require significant transport and geological storage infrastructure. The H2PBM would therefore work alongside the HTBM and HSBM and it is envisaged that the relevant funding allocations will be coordinated to ensure the concurrent development of hydrogen networks, hydrogen storage facilities and hydrogen fuelled power plants.

The government is expected to publish a H2PBM market engagement document in Spring 2025 outlining further details of the proposed design of the H2PBM.

UK Emission Trading Scheme (UK ETS) and Carbon Market Adjustment Mechanism (CBAM)

UK ETS

The UK ETS currently places a price on greenhouse gases emitted by certain sectors including some UK power stations, industrial plants and certain aviation activity (e.g. some domestic UK flights and flights from the UK to the EEA). The scheme commenced on 1 January 2021 and replaced the EU emissions trading scheme. The scheme is expected to expand to other sectors in the future, including the maritime sector from 2026.

The UK ETS works on a cap-and-trade principle. The amount of emissions permitted by a relevant sector is capped and the intention is to reduce such permitted emissions over time to incentivise decarbonisation. Within the cap, participants may receive free allowances or can buy emission allowances at auction or through the secondary market. This therefore creates a market price for emission allowances.

UK CBAM

The UK CBAM is scheduled to come into force on 1 January 2027. It will introduce a levy on UK importers of certain emission intensive industrial goods from countries with a lower or no carbon price and is intended to ensure fair competition between foreign producers and domestic producers who will pay for carbon emissions under the UK ETS. It therefore works in tandem with the UK ETS.

The UK CBAM will apply to industrial goods imported into the UK from the aluminium, cement, fertiliser, hydrogen, iron and steel sectors. The glass and ceramic sectors will be considered for future inclusion but will not be within the scope of the UK CBAM from 2027.

The UK CBAM will be applied to ‘direct’, ‘indirect’ and select ‘precursor’ product emissions embodied in imported CBAM goods. The UK CBAM rate for each sector of goods in scope will be set by the Government each calendar quarter.

Impact on hydrogen demand

The UK ETS and the UK CBAM support the transition to a low-carbon economy and ensure that green and low carbon hydrogen will play a pivotal role in this shift.

The UK ETS establishes a price on carbon emissions, making carbon-intensive processes more expensive. This incentivises industries to adopt low-carbon alternatives, such as green or low carbon hydrogen. The carbon price improves the cost competitiveness of green and low carbon hydrogen relative to higher carbon alternatives, thereby encouraging the adoption of green and low carbon hydrogen across various industries. Further, revenues generated from the UK ETS can be reinvested by the UK Government in green technologies, including providing support to green and low carbon hydrogen projects, and the deployment of hydrogen infrastructure.

The UK CBAM will impose a carbon price on imported goods (including hydrogen) based on their carbon intensity, ensuring that domestic producers of green and low carbon hydrogen are not disadvantaged vis-à-vis international competitors. This will circumvent carbon leakage, where production of hydrogen might otherwise shift to countries with less stringent carbon regulations, thereby supporting the competitiveness of and demand for green and low carbon hydrogen in the UK.

Together, the UK ETS and UK CBAM create a supportive environment for the green and low carbon hydrogen sector by supporting domestic production, boosting demand and ensuring a level playing field for producers of green and low carbon hydrogen in the UK.

Opportunities and Challenges

The emergence of hydrogen as a key player in the UK's transition to a low carbon economy has prompted significant interest and investment in various hydrogen-related projects. In this section, we look at the key opportunities and challenges relevant to the UK hydrogen sector.

Opportunities

Industrial decarbonisation

Hydrogen is seen in the UK as key to decarbonising hard-to-abate sectors such as steel, concrete and heavy transport. Industrial participants (from whisky distilleries and glass and chemical manufacturers to producers of off-road machinery) are considering replacing carbon intensive fuels with hydrogen in their production processes and products to achieve significant reductions in GHG emissions.

Hydrogen to Power

Low carbon hydrogen can be stored and used to generate low carbon electricity. The UK government is developing a Hydrogen to Power business model which aims to de-risk investment and bring forward flexible capacity which is required to support the power system in extended periods of low renewable output. The current intention is for the business model to be based on the dispatchable power agreement seen in the carbon capture and storage sector.

Sustainable Aviation Fuel (SAF)

SAF is currently being considered as the main way to decarbonise the aviation sector, one of the hardest to abate sectors. Hydrogen is seen as a critical competent when producing SAF (through the Fischer Tropsch synthesized isoparaffinic kerosene (FT-SPK) pathway).

The UK’s Sustainable Aviation Mandate came into force on 1 January 2025. The Mandate should drive demand for hydrogen as it sets out that, from 2025, 2% of all jet fuel in flights taking off from the UK must come from sustainable sources, increasing to 10% by 2030 and 22% in 2040. Hydrogen used directly as aviation fuel or in the synthesis of SAF will be eligible for support under the Mandate, providing it meets the eligibility criteria. The UK government has also indicated at plans to introduce a revenue certainty mechanism for SAF producers. For further details please refer to our recent publication on the UK’s Sustainable Aviation Mandate.

Challenges

Offtaker risk

For new hydrogen projects there is a risk that the intended offtaker will fall away leaving the project without a revenue stream. Feasible early-stage projects often have a single offtaker with a strong credit risk profile located near to the hydrogen project. However, if that offtaker falls away the project is often no longer viable. Finding alternative routes to market is key to ensuring that such projects remain viable. A possible option could be injection of hydrogen into the UK’s gas grid although the commercial and technical viability of this remains to be seen (see ‘Hydrogen for heat and blending’ below).

Hydrogen for heat and blending

There has been much debate in the sector of whether hydrogen should be used for heat and be permitted to blend with methane for injection into the UK’s gas grid.

The UK government has indicated that an assessment of the latest evidence will be made (including in respect of health and safety aspects) and a consultation will be undertaken in 2025 on the role of hydrogen in home heating. Further, they intend to consult on transmission level blending in the UK in early 2025 and intend to make a decision in 2025 as to whether to support transmission-level blending or not. The UK’s Climate Change Committee has formally recommended against using hydrogen for home heating.

The lack of progress in this area has been evidenced by the cancellation of the hydrogen heating trials in Whitby and Redcar which were cancelled due to lack of support and health and safety concerns. However, a trial in Fife is currently under construction and is planned to start in 2025.

Physical infrastructure challenges

The lack of physical infrastructure generally for the distribution and storage of hydrogen is a significant barrier as:

- the UK’s existing natural gas infrastructure cannot be directly repurposed for hydrogen without significant modifications due to hydrogen's unique physical properties; and

- the development of new infrastructure for hydrogen, including pipelines, storage facilities, and refuelling stations, requires substantial investment and coordination between various stakeholders.