Publication

Regulatory investigations and enforcement: Key developments

The past six months have seen a number of key changes in the regulatory investigations and enforcement space.

Global | Publication | May 2022

After a pandemic affected 2020, Australian and global markets bounced back strongly in 2021. M&A records were smashed as companies adapted to new ways of working and investors continued to benefit from low interest rates and easy access to capital. In Australia, the frenzied M&A market was driven by strong demand in the technology and healthcare sectors, in many cases resulting in sky-high valuations.

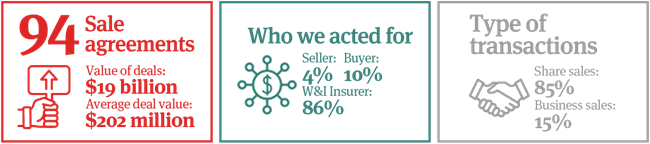

Our 2021 report closely analyses 94 completed private M&A transactions that Norton Rose Fulbright Australia has acted on during the calendar year and is intended to provide an empirical benchmark of Australian market practice for key private M&A negotiation points.

This report covers: |

|

|

Key Features

Conditionality

|

Deal Protection

M&A trends to look out for in 2022

|

Publication

The past six months have seen a number of key changes in the regulatory investigations and enforcement space.

Publication

The insurance industry is facing a rapidly changing litigation environment. Emerging risks, regulatory developments, and technological advancements are reshaping how insurers approach underwriting, claims, and risk management. Below is an overview of the most significant trends impacting the sector.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025