Market overview

CO2 storage potential

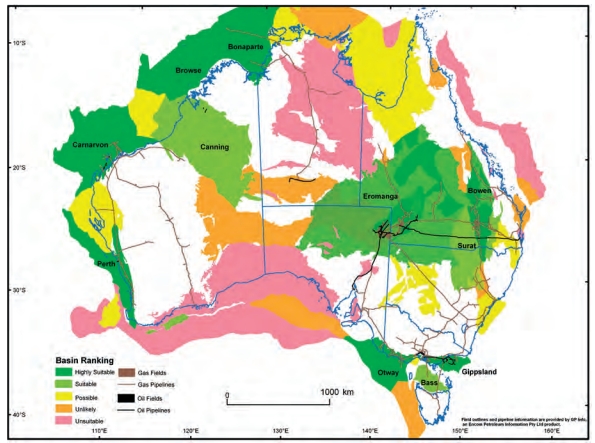

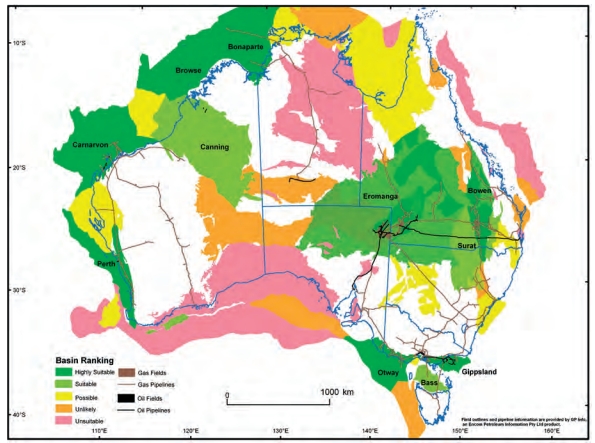

Australia has vast potential for geological storage of CO2. The CO2 Storage Resource Catalogue1, which has assessed storage resource sites across 30 countries, estimates that Australia has 31 Gt of sub-commercial and c.470 Gt of undiscovered storage resource2.

An earlier assessment, the National Carbon Mapping and Infrastructure Plan, ranked the suitability of Australia’s sedimentary basins for CCS as follows3:

Suitable locations for storage are in both onshore and offshore basins, which are principally saline aquifers and depleted oil and gas reservoirs.

Current CCS projects and pipeline of projects

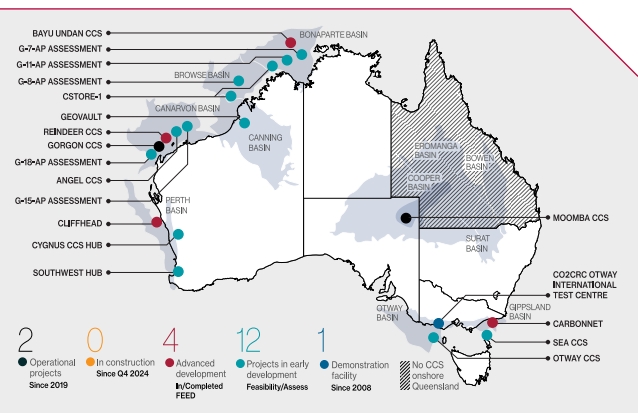

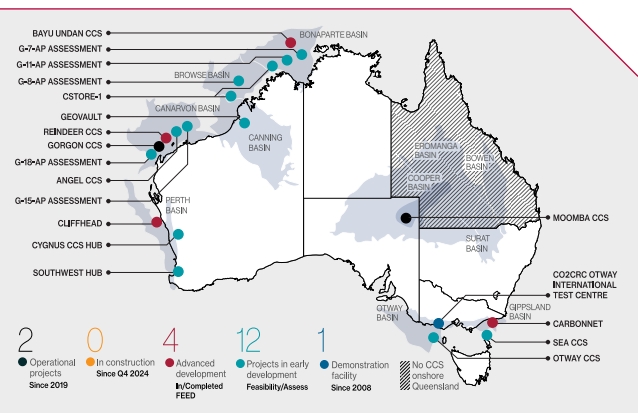

As of July 2025, there are two CCS projects in commercial operation in Australia.

The Gorgon CCS project, which stores CO2 captured from the Gorgon gas project in deep saline aquifers beneath Barrow Island (off the Western Australian coast), is currently the largest operating CCS project in the world with capacity to store up to 4 Mtpa of CO2 (although it has been operating at lower injection rates since it was launched in 2019 due to sub-surface technical challenges – approximately 1.6 Mt was stored at the facility in the year to 30 June 2024).

The Moomba CCS project (which is described in section 2 below) commenced operation in late 2024. It is currently the third largest operating CCS project globally with injection capacity of up to 1.7 Mtpa.

A number of other CCS projects are under development across Australia, as depicted in the following map contained in the CO2CRC Annual Report 2023-244 (which is based on information extracted from the Global CCS Institute’s Global Status of CCS 2024 “Collaborating for a Net-Zero Future”5)

The majority of those projects are for the capture and storage of CO2 emitted from adjacent or pipeline-connected oil and gas extraction projects. Some projects are intended to establish multi-user facilities for capture and storage of emissions transported by pipeline from domestic industrial facilities (e.g. CarbonNet) or potentially by ship from industrial facilities or hubs in the wider Asia-Pacific region (e.g. Cstore1).

The following table provides further information about current CCS projects.

CO2 storage projects announced in Australia (various sources, including Carbon capture and storage | Geoscience Australia and operator websites).

| Project |

Basin |

Operators and partners |

Storage Type |

Status |

Estimated scale |

Start date |

| Otway International Test Centre |

Otway |

CO2CRC |

Saline aquifer, depleted field |

Operating |

Research

(>95 kt stored) |

2008 |

| Gorgon CCS |

Carnarvon |

Chevron, ExxonMobil, Shell, Osaka Gas, Tokyo Gas, JERA, MidOcean Energy |

Saline aquifer |

Operating |

>100 Mt

(>9 Mt stored to date) |

2019 |

Moomba CCS

|

Cooper

|

Santos, Beach Energy

|

Depleted Field

|

Operating

|

1.7 Mtpa

(up to 20 Mtpa) |

2024

|

SEA CCS

|

Gippsland

|

Esso Australia (ExxonMobil), Woodside Energy

|

Depleted Field

|

Application for environmental approval withdrawn in March 2025

|

2 Mtpa

|

2025

|

| Cliff Head CCS |

Perth

|

Pilot Energy

|

Depleted Field

|

Advanced development (resource technical assessment and pre-FEED studies completed)

|

> 1 Mtpa

(50 Mt) |

2026

|

Bayu Undan

|

Bonaparte

|

Santos, SK E&S, INPEX, ENI, JERA, Tokyo Gas

|

Depleted Field |

Advanced development (FEED over 95% completed as of January 2025, ongoing work on regulatory and fiscal frameworks, inter-governmental agreements between Timor-Leste and Australia and commercial agreements to ready for FID)

|

2.3 Mtpa

(up to 10 Mtpa) |

2028

|

CarbonNet

|

Gippsland (across two sites: Pelican (stage 1) and Kookaburra (stage 2))

|

Victorian Government, Australian Government

|

Saline aquifer

|

FEED completed, pre FID

|

Up to 6 Mtpa

(168 Mt at Pelican) |

2030

|

Bonaparte CCS / G-7-AP

|

Bonaparte

|

INPEX Browse E&P, Total Energies CCUS Australia, Woodside Energy

|

Saline aquifer

|

Early

development |

2 Mtpa

(up to 7 Mtpa) |

2030

|

| Cstore1 |

Offshore floating storage and injection hub in Northern/Western Australia

|

deepCStore, ABL Group, CSIRO, JX Nippon Oil and Gas Exploration, Kyushu Electric Power, Mitsui O.S.K Lines, Osaka Gas, Technip Energies, Toho Gas

|

Depleted field,

saline aquifer |

Early

development |

1.5 – 7.5 Mtpa

|

|

Southwest Hub

|

Perth

|

Western Australian Government, Verve Energy, Griffin Energy, Wesfarmers Premier Coal, Alcoa Australia, Perdaman Chemicals & Fertilisers

|

Saline aquifer

|

Early

development |

0.8 Mtpa

|

|

Cygnus CCS

|

Mid West WA

|

Wesfarmers Chemicals, Energy and Fertilisers, Mitsui E&P Australia

|

Depleted field

|

Early development

|

0.5 – 1 Mtpa

|

|

Reindeer CCS / G-11-AP

|

Carnarvon

|

Santos, Chevron Australia

|

Depleted field,

saline aquifer |

Feasibility

|

5 Mtpa

|

2028 |

Bonaparte CCS

|

Bonaparte

|

Santos, Chevron Australia, SK E&S

|

Saline aquifer

|

Feasibility

|

|

|

Browse CCS / G-8-AP

|

Browse

|

Woodside Energy, Shell, BP, MIMI, PetroChina

|

Depleted field,

saline aquifer |

Feasibility

|

4 Mtpa

|

|

Geovault CCS

|

Canning

|

GeoVault (Buru Energy subsidiary)

|

tbc

|

Feasibility

|

|

|

Carnarvon Basin CCS

|

Carnarvon

|

Energy Resources

|

Saline aquifer

|

Feasibility

|

|

|

Angel CCS

|

Carnarvon

|

Woodside Energy, BP, MIMI, Shell, Chevron

|

Depleted field |

Feasibility

|

Up to 5 Mtpa

|

|

G-15-AP

|

Carnarvon

|

InCapture, SKearthon, Carbon CQ

|

tbc |

Feasibility

|

3-6 Mtpa

|

|

Onslow CCS / G-18-AP

|

Carnarvon

|

Chevron Australia New Ventures, Woodside Energy

|

Saline aquifer

|

Feasibility

|

|

|

Utilisation

Australian science and industry is at the forefront of developing carbon capture and utilisation (CCU) technologies to assist decarbonisation of “hard to abate” sectors such as cement and steel production.

The Commonwealth Scientific and Industrial Research Organisation (CSIRO), Australia’s national science agency, released a CO2 Utilisation Roadmap in 20216 which identifies how these technologies could support growth opportunities in the food and beverages industry, creation of building products and materials and low emissions chemicals and fuels production.

Through the Carbon Capture Technologies Program7, the Australian government is investing A$65 million in 7 CCU projects based on technologies such as mineral carbonisation and direct air capture.

The Australian Government’s Net Zero Plan includes the development of 6 sectoral emissions reduction plans across the Australian economy covering electricity and energy, transport, industry, agriculture and land, resources (including oil and gas extraction) and the built environment. Those plans will consider key enabling technologies including CCUS and atmospheric carbon removal and provide a detailed policy framework to guide investment in the energy transition.

Policy overview and targets

The Australian government has acknowledged that CCS needs to grow in Australia to support a least-cost energy transition. The Net Zero Australia Mobilisation report: How to make net zero happen (July 2023)8, which analyses potential methods and strategies for Australia to achieve its net zero emissions targets by modelling six scenarios and is cited in the Australian Government’s Future Gas Strategy (May 2024)9, suggests that in most of those scenarios, Australia will need to achieve sequestration of 150 Mtpa of CO2 equivalent emissions by 2040, requiring rapid acceleration of CCUS deployment.

Governmental support to date at the Commonwealth level has mostly been through regulatory reforms and other policy initiatives to facilitate development of the CCS industry in Australia (see "Commonwealth" for further details). Financial support measures for CCS have been relatively modest compared to support available for other aspects of energy transition (such as production tax incentives available for renewable hydrogen production and critical minerals processing) and have been largely withdrawn or curtailed (see "Challenges" below for further details). The Australian Government expects its 2023 reforms to the Safeguard Mechanism (which is briefly described in "Regulatory framework – Commonwealth" below) to catalyse development of the CCS industry in Australia by imposing legislative obligations on the country’s largest emitters to reduce their emissions and requiring net zero emissions from new gas field developments supplying LNG facilities. Commonwealth funding support has instead been re-directed towards research and development for capture and use of CO2 in hard-to-abate sectors such as cement manufacturing and direct air capture (DAC) technology.

Australia’s role in supporting the Asia-Pacific region’s transition to net zero is recognised in the Future Gas Strategy. In that regard, the Australian government has legislated to facilitate transboundary CCS (see "Cross-border CCS" below) and has announced that it will establish a new initiative on regional cooperation on transboundary CCS.

There are currently no legislated targets for CCS per se, either nationally or at the state/territory level.

The Commonwealth has a comprehensive regulatory framework for offshore CCS, and most state/territory jurisdictions have regulatory frameworks in place to enable onshore CCS.

Western Australia, South Australia and the Northern Territory are particularly supportive of CCS:

- In November 2023, the CSIRO and the Global CCUS Institute released a report commissioned by the Western Australian LNG Jobs Taskforce which found that WA has significant opportunities to develop CCUS hubs centred around major emissions clusters (such as the Pilbara and Kwinana regions) by leveraging its existing infrastructure, highly skilled workforce and suitable geological formations. The Government of Western Australia published its CCUS Action Plan in November 2024 and has various grant funding mechanisms and other initiatives to support CCUS (which are described further in "Resourcing Australia's Prosperity Initiative" below).

- The Government of South Australia (where the Moomba CCS Project is located) is also encouraging CCS development to decarbonise emissions intensive industries and increase their global competitiveness and to enable new industries / technologies such as blue hydrogen/ammonia production and direct air capture (DAC).

- The Northern Territory Government is working with the LNG industry to develop a CCS common user hub.

Political support for CCS development does not exist across all jurisdictions, however. In June 2024, the state of Queensland, in which coal seam gas is produced for the domestic and LNG export markets and in which a number of “safeguard facilities” required to reduce or manage emissions under the Safeguard Mechanism are located, legislated to permanently ban greenhouse gas storage and injection activities in its Great Artesian Basin areas (which cover most of the state’s landmass). In New South Wales and Victoria, support is guarded at best.

Regulatory framework – Commonwealth

Overview

The legal framework for regulation of CCS in Australia largely sits within legislation and regulations having broader application to activities beyond CCS.

Under Australia’s federal system, permitting and regulatory oversight of offshore CCS projects in Commonwealth waters (which constitute the offshore area between 3 and 200 nautical miles from the Australian coastline) is established under Commonwealth legislation. Onshore CCS projects are primarily regulated under legislation of the relevant state or territory, although various Commonwealth laws of broader application may apply to onshore as well as offshore CCS activities.

The table below outlines key features of some of the main Commonwealth legislation and regulations affecting (or potentially affecting) CCS projects in Australia.

| Offshore Petroleum and Greenhouse Gas Storage Act 2006 (OPGGSA) and Regulations |

Establishes a framework for licensing, regulatory supervision and environmental management in relation to offshore petroleum and greenhouse gas (GHG) storage in Commonwealth waters (as described above). |

| Key regulatory bodies and their responsibilities: |

| National Offshore Petroleum Titles Administrator (NOPTA) |

Grant of titles, key operations approvals, data management. |

| National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) |

Health and safety, structural and well integrity, environmental management including acceptance/approval of plans. |

| Main types of titles issued under the OPGGSA relevant to CCS: |

| GHG assessment permit |

Typically granted through a competitive tender process for a 6 year term.

Titleholder may explore in permit area for potential GHG storage formation and GHG injection sites.

|

| Declaration of GHG storage formation |

Titleholder may apply if it finds a suitable site for permanent GHG storage in its title area.

Required in order to obtain one of the titles mentioned below.

|

| GHG holding lease |

Issued where titleholder is not in a position to apply for an injection licence, but is likely to be within 15 years.

Titleholder may undertake exploration activity (as per GHG assessment permit above) and injection/storage in a declared GHG storage formation on an appraisal basis.

Typically granted for a 5 year term (which can be extended).

|

| GHG injection licence |

Titleholder may inject and permanently store GHGs in a declared GHG storage formation.

Operations must be carried on in accordance with an approved site plan.

May be cancelled if no injection operations carried out within 5 years from grant.

|

| A holder of a petroleum retention lease or petroleum production licence under the OPGGSA is entitled to apply for a GHG holding lease or GHG injection licence within the relevant lease/licence area. |

| How long term CO2 leakage risk is addressed: |

|

Obtaining a site closing certificate

When injection and storage operations cease permanently in an injection licence area, a licensee must apply to the Minister for a site closing certificate. The application must be accompanied by a report on the behaviour/expected migration of injected GHG and the suggested approach to monitoring. A decision must be made by the Minister within 5 years.

As an interim step, the Minister will issue a pre-certificate notice specifying:

- the monitoring program to be carried out by the Commonwealth

- the security to be lodged by the applicant in relation to costs/expenses of the monitoring program before a site closing certificate is issued.

There are various statutory grounds on which the Minister may/must refuse to issue a pre-certificate notice (e.g. if there is significant risk of significant adverse impacts or injected gas is not behaving as predicted in site plan, failure to comply with OPGGSA / Regulations or conditions of a GHG injection licence).

Closure assurance period

No less than 15 years after a site closing certificate has been issued, the Minister may declare the period since the site closing certificate was issued to be the closure assurance period if satisfied that the injected gas is behaving as predicted in the site plan and there is no significant risk of significant adverse impacts on geotechnical integrity / environment / safety.

Once the closure assurance period has been declared, the Commonwealth indemnifies the GHG injection licence holder against liabilities for acts/omissions in carrying out operations authorised by the GHG injection licence which are incurred or accrued after the end of the closure assurance period or (if the titleholder has ceased to exist) assumes those liabilities.

Note that there is no certainty as to whether / when the Minister will declare the closure assurance period. In the meantime:

- the titleholder remains liable for CO2 leakage, and

- the Minister may require additional security to be provided by the titleholder to support performance of its obligations.

|

| Trailing liability regime: |

| Since early 2022, the OPGGSA has included a trailing liability regime allowing NOPSEMA (or the responsible Minister) to hold current and former title holders (and their related bodies corporate) liable for decommissioning and remediation obligations. |

| Environment Protection (Sea Dumping) Act 1981 |

Gives effect to Australia’s obligations under the London Protocol on prevention of marine pollution by dumping of wastes/other matter (1996) to which it is a Contracting Party (the London Protocol).

Requires a sea dumping permit to be obtained for offshore CO2 storage.

Administered through the Department of Climate Change, Energy, the Environment and Water’s Environmental Permitting and Compliance Division.

|

| National Greenhouse and Energy Reporting Act 2007 |

Establishes the NGER Scheme, a single national framework for requiring companies meeting certain thresholds to register and report information about GHG emissions, energy production and energy consumption annually.

Establishes the Safeguard Mechanism which:

- applies to industrial facilities releasing more than 100,000 tonnes of CO2 equivalent Scope 1 (direct) emissions per year – “safeguard facilities”;10

- requires those facilities to reduce their emissions in line with national emissions reduction targets (43 percent below 2005 levels by 2030 and net zero emissions by 2050) by setting annual emissions baselines which generally decline over time (but are zero tonnes of CO2 equivalent per tonne of reservoir CO2 for new gas field production supplying LNG facilities).

If a safeguard facility:

- exceeds its baseline emissions, then it must manage its excess emissions, including by surrendering ACCUs or Safeguard Mechanism credit units (SMCs) (see below) or taking certain other actions;

- operates below its baseline emissions, it may earn SMCs which can be sold to other safeguard facilities or surrendered in future years to stay within its baseline.

|

| Carbon Credits (Carbon Farming Initiative) Act 2011 and Carbon Credits (Carbon Farming Initiative) Rule 2015 |

Establishes the Australian Carbon Credit Unit (ACCU) Scheme under which registered eligible offsets projects earn one ACCU per tonne of CO2 that would otherwise have been released into the atmosphere.

ACCUs can be sold:

- in the secondary market (including to safeguard facilities for subsequent surrender); or

- to the Australian Government through carbon abatement contracts.

ACCUs can be generated from new (pre-FID) CCS projects, including for capture and storage of CO2 from existing gas fields, subject to meeting eligibility criteria. However, see "Challenges" below regarding restrictions on generating ACCUs from new CCS projects at safeguard facilities.

|

Regulatory framework – States and Territories

Western Australia11, South Australia12 and Victoria13 have specific legislation governing CCS projects. The permitting regimes are broadly similar to those under the OPGGSA described above, but aspects differ across those jurisdictions. For example, the South Australian and Victorian legislation do not provide for indemnity of title holders by the state for post-closure assurance period leakage, whereas this is provided for under the OPGGSA (as outlined in "Regulatory framework – Commonwealth" above) and the Western Australian legislation.

In addition, environmental legislation in each of those jurisdictions requires comprehensive environmental impact assessments to be undertaken and environmental management plans to be developed for CCS projects.

As noted in "Policy overview and targets" above, Queensland has introduced a legislative ban on all GHG storage and injection activities in the Great Artesian Basin areas of the state.

Find out more about hydrogen in Australia

Focus on: Moomba CCS Project

The Moomba CCS Project, operated by Santos and located in the Cooper Basin in South Australia, is one of the world’s largest operating CCS facilities. In its first phase, the project is designed to capture and store approximately 1.7 Mtpa of CO2 from the Moomba gas processing plant, which receives production from more than 100 gas fields. The captured CO2 is transported by underground pipeline and injected into depleted oil and gas reservoirs within the Cooper Basin. Future expansions of the facility may result in the project achieving storage capacity of up to 20 Mtpa.

The project was awarded A$15 million of grant funding in 2021 from the Commonwealth Government’s Carbon Capture Use and Storage Development Fund and is a registered project under the ACCU Scheme (see "Regulatory framework – Commonwealth" above) enabling it to generate ACCUs from the emissions captured and stored from the project, providing a revenue stream to offset capital and operating costs and support the project’s financial viability.

In the longer term, Santos intends to consider integrating the production of low carbon fuels such as synthetic methane or e-methane, produced by combining part of the CO2 stream captured at the Moomba facility with renewable hydrogen which can be used as a direct substitute for natural gas in existing infrastructure including pipelines, power plants, and industrial facilities. Santos has entered into a memorandum of understanding with Tokyo Gas, Toho Gas and Osaka Gas Australia to explore e-methane production at the facility and the potential for export of e-methane to Japan.

The Moomba CCS Project represents a significant advance in Australia's CCS capabilities. Through strategic partnerships with Japanese utilities and the potential integration of low carbon fuels production, the project demonstrates the potential for CCS to contribute to the development of broader carbon recycling and clean energy solutions.

Development and support regime

Commonwealth

Key initiatives include:

1. Cross-border CCS: The Environment Protection (Sea Dumping) Amendment (Using New Technologies to Fight Climate Change) Act 2023 (Cth) has enacted amendments to the Environment Protection (Sea Dumping) Act 1981 (Cth) (see "Regulatory framework - Commonwealth" above) which allow the Minister for the Environment to issue permits for the export of CO2 from carbon capture processes for sequestration into sub-seabed geological formations. This legislation gives effect to the 2009 amendment to the London Protocol, which overcame the prohibition under Article 6 of the London Protocol on the export of wastes or other matter to other countries for dumping or incineration at sea by allowing the export of CO2 streams for sub-seabed sequestration. It entered into force on 7 November 2024, when Australia deposited a declaration of provisional application of the 2009 amendment to the London Protocol with the International Maritime Organization.

As a result of these legislative and governmental actions, Australia is now poised to enter bilateral agreements or arrangements with other countries which will provide a legal foundation under the London Protocol to enable cross-border CCS to be implemented with those countries.

In the 2024-25 Federal Budget, the Commonwealth Government allocated A$32.6 million over four years for regional cooperation on carbon sequestration, including to establish regulatory frameworks and bilateral agreements to support heavy industry to reduce emissions, both in Australia and overseas. The Future Gas Strategy states that a new initiative on regional cooperation on transboundary CCS program will be established which will provide options for energy security and carbon management solutions for Australia’s regional partners.

2. Resourcing Australia's Prosperity Initiative: This initiative is a national, long-term program led by Geoscience Australia, Australia’s pre-eminent public sector geoscience organisation, spanning 35 years from 2024 to 2059, with an investment of A$3.4 billion which aims to comprehensively map Australia's resource potential.14 A key component of the initiative is the assessment of suitable onshore and offshore sites for CO2 storage. The initiative plans to release a national CO2 storage resource atlas in 2028.

3. Carbon Capture Technologies Program15: This program allocated c.A$65 million in funding in 2024 to support seven projects developing CO2 capture and utilisation technologies such as direct air capture and mineral carbonation.

4. Review of environmental management regime: The 2023-24 Federal Budget allocated A$12 million over three years from 2023-24 for a review of the environmental management regime for offshore petroleum and greenhouse gas storage activities to ensure it is fit for purpose for a decarbonising economy. This will include consultation requirements for offshore projects, including with First Nations peoples. The review will examine opportunities to provide regulatory and administrative certainty for offshore CCS projects to enable Australian industry to meet net zero targets whilst delivering domestic energy security and regional energy security.

5. Offshore GHG storage acreage releases: In August 2023, the Commonwealth Government released ten areas for GHG storage assessment located in basins offshore of Western Australia, Victoria and Tasmania. This followed the earlier release of five areas offshore of the Northern Territory and Western Australia in December 2021 for which GHG assessment permits were awarded in 2022.

Under the Future Gas Strategy, the Commonwealth Government has committed to continuing to release offshore acreage for GHG storage and to ensure that future releases consider regional energy security and transition needs.

Western Australia

Key Western Australian Government CCUS-related initiatives are outlined below.

Carbon Capture, Utilisation and Storage Action Plan

The WA Government released its CCUS Action Plan16 in November 2024. The plan outlines a strategic framework for the development and implementation of CCUS technologies in the state. The key action areas identified in the plan are:

1. Implement a leading legislative and regulatory framework for CCUS. Actions include finalising and implementing regulations, procedures and guidance underpinning CCS legislation, developing guidance to support proponents to navigate State and Commonwealth legislative regimes, streamlining approval processes, and upholding high standards of operational, maintenance and health, safety, and environmental practices.

2. Work with industry to enable and facilitate CCUS projects. Actions include establishing an industry-government engagement mechanism, encouraging data sharing among proponents, supporting industry to develop business cases for CCUS hubs, exploring funding mechanisms and investigating opportunities for CCUS in the decommissioning value chain.

3. Share information and knowledge. Actions include establishing an online 'one-stop-shop' for CCUS information, providing accessible and credible information to enhance community awareness and understanding and expanding available pre-competitive geological data for prospective CCUS and mineral carbonation locations.

4. Support research, development and demonstration with clear pathways to commerciality. Actions include supporting new research aligned with the Minerals Research Institute of Western Australia’s Mineral Carbonation Roadmap (see below), working with Cooperative Research Centres to support innovation and enabling better access to venture capital across a range of industries, including in CCUS technologies.

5. Support Aboriginal and community engagement: Actions include supporting early engagement and enduring partnerships between Government, industry, Aboriginal peoples, and regional communities.

6. Attract investment and deepen strategic international partnerships. Actions include continuing to promote Western Australia in targeted markets, including through Invest and Trade WA's international office network and working with international partners to explore CCUS partnership opportunities.

Investment Attraction Fund

The Western Australian Government’s Investment Attraction Fund, established to encourage new investment that will create local jobs and contribute to a more diversified economy, has to date provided:

1. A$15 million towards Australian Gas Infrastructure Group’s development of a transmission pipeline for an offshore multi-user CCS hub in the Pilbara region;17 and

2. A$11 million towards Mitsui E&P Australia Pty Ltd and Wesfarmers Chemicals, Energy & Fertilisers’ development of the Cygnus CCS hub in the Mid West region.18

CO2 Geological Storage Atlas

The Geological Survey of Western Australia has received funding through the WA Ministerial Taskforce on Climate Action to create a new CO2 storage atlas of Western Australia which includes geological information such as seismic surveys, drilling logs and core analysis. The project commenced in July 2022 and is ongoing. The new Western Australia Carbon Dioxide Geological Storage Atlas provides government and industry with a clearer understanding of the potential for permanent sequestration of CO2 by identifying new geological storage sites and further analysis of known storage sites. All data, information and modelling produced as part of the project is being made publicly available.19

Mineral Carbonation Roadmap

Through the Minerals Research Institute of Western Australia, the Western Australian Government commissioned the development of a Mineral Carbonation Roadmap for Western Australia20 which was released in 2024 and provides a science and technology, economic assessment, social and environmental and regulatory development pathway to de-risk the prospective development of a future mineral carbonation industry in Western Australia.

Carbon Innovation Grants program

The Carbon Innovation Grants Program21, part of the Government of Western Australia’s Climate Action Fund announced in 2021, is an A$15 million program that is funding (through competitive grant rounds) feasibility studies, pilot projects and capital works that help to avoid, reduce or offset carbon emissions from heavy industry processes, with a focus on supporting innovative technologies for carbon abatement and sequestration.

Opportunities and challenges

Opportunities

1. Australia’s vast onshore and offshore geological storage potential. Geological data from historical oil & gas exploration and development and government led geological mapping/cataloguing initiatives provides a foundation for exploration and appraisal of potential CO2 storage sites. Development and depletion of hydrocarbon fields over future decades is likely to yield additional storage sites.

2. Australia’s sizeable LNG and domestic gas industry presents significant opportunities to establish large scale foundational CCS facilities which can provide pathways for participation by hard-to-abate sectors to support domestic decarbonisation efforts and storage of imported CO2.

3. Potential for the Safeguard Mechanism reforms, particularly the requirement for new gas field developments supplying LNG facilities to have net zero reservoir emissions, to incentivise new CCS projects.

4. Existing expertise, workforce and infrastructure from the LNG and domestic gas industry can be deployed for CCS.

5. Australia’s geographic proximity to Asian markets, which reduces transportation time/costs and enables Australia to support the decarbonisation and energy security goals of regional partners (a key pillar of Australian energy policy), supports the viability of the development of CCS as a “service” for overseas emitters.

6. Australia has strong political, investment and trading ties with Asian countries with limited CO2 storage potential, including through its LNG export industry in which Asian gas utilities and trading houses have been significant long term investors and which is a key source of energy supply to Asia. A number of collaborations have been established to develop CCS value chains involving capture of CO2 for export from Asia to CCS projects in Australia, such as those announced by JERA and INPEX (in May 2024), JX Nippon Oil & Gas Exploration Corporation and Chevron (in March 2024) and JX Nippon Oil & Gas Exploration Corporation, ENEOS and Santos (in December 2023).

7. There is strong government support in key state jurisdictions (especially Western Australia) for CCUS development.

Challenges

1. Lack of financial support from the Commonwealth Government and perceived policy incoherence due to reversals of various measures in recent years, despite the Australian Government’s stated broad support for large scale CCS development and recognition of its important role in supporting domestic and regional decarbonisation efforts. In particular:

a. Lack of financial support from the Commonwealth Government and perceived policy incoherence due to reversals of various measures in recent years, despite the Australian Government’s stated broad support for large scale CCS development and recognition of its important role in supporting domestic and regional decarbonisation efforts. In particular:

b. The Commonwealth Government’s CCUS Development Fund, which provided A$50 million of funding commitments to 6 projects in 2021, was not extended and its A$250 million CCUS Hubs and Technologies Program created in 2021 was discontinued in October 2022.

c. Under changes to the ACCU Scheme implemented together with Safeguard Mechanism reforms in May 2023, ACCUs may no longer be generated from abatement of the covered emissions of a safeguard facility. The Moomba CCS facility is the only CCS project that was registered prior to these changes to which this restriction does not apply.

d. The strategic investment priorities of the Australian Renewable Energy Agency and the Clean Energy Finance Corporation, two key Commonwealth government owned vehicles for directing Commonwealth funding to energy transition projects, no longer include CCS.

2. The reforms to the Safeguard Mechanism, and in particular their impact on price competitiveness of Australian LNG, have attracted public criticism from foreign investors, including key investors from Japan and Korea.

3. Social licence concerns around CCS in Australia. Criticisms made by CCS detractors include that it is expensive and unproven at scale (technical challenges at the Gorgon CCS Project in its early years of operation are often cited in support of such claims), prolongs use of fossil fuels, provides an excuse for sectors not to decarbonise / adopt clean energy solutions (a “licence to pollute”) and presents an environmental threat due to leakage risks. The legislative ban on CCS introduced in Queensland (see "Policy overview and targets" above) stemmed from environmental concerns around groundwater contamination and has led to the abandonment of at least two planned CCS projects in that state.

4. Slowness, duplication and lack of certainty in project permitting / approval processes (which the ongoing review of the offshore petroleum and GHG storage regulatory regime is seeking to address).

5. Regional competitor countries, particularly Malaysia (which has implemented substantial tax incentives to encourage investment) and Indonesia, are acting at speed to develop transboundary CCS projects with significant government involvement.

6. The combination of the above factors, as well as the high costs of developing CCS projects, means that potential proponents are using alternative means to meet their emissions reduction obligations which entail lower costs at present (such as purchasing ACCUs).