Publication

Motor Finance Redress: The Way Ahead

On August 1, 2025, the UK Supreme Court delivered its long-awaited judgment in Hopcraft v Close Brothers Limited and on 3 August the FCA announced it would consult on a redress scheme.

Global | Publication | July 2019

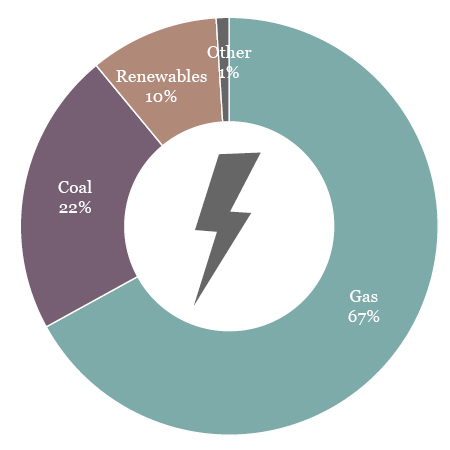

Thailand has set a target that more than 25 per cent of electricity will be generated by renewable energy sources by 2037. To meet the target, total additional capacity of approximately 18 GW will be required. More than half of the new renewable energy generating capacity is expected to come from solar and biomass.

Thailand has in excess of 10 GW of renewable power generating capacity, the majority of which comes from hydro, bioenergy and solar PV projects. More than 2,500 MW of solar PV projects and 450 MW of wind projects had entered into commercial operations by April 1, 2018.

The Electricity Generating Authority of Thailand (EGAT) is a state-owned vertically integrated electricity utility with activities in generation, transmission and distribution. Distribution activities are also carried out by the Metropolitan Electricity Authority (MEA) and the Provincial Electricity Authority (PEA).

Thailand has adopted the Enhanced Single Buyer (ESB) structure for the power industry, with EGAT, MEA and PEA acting as the sole buyers for electricity from private power projects. Under the ESB power market, EGAT as the transmission system operator, is obliged to purchase all electricity generated from renewable sources.

Consumers are allowed to own and operate power generation facilities for their own use. They may sell excess power to EGAT, MEA or PEA subject to entering into a PPA with the relevant utility. Sale of excess power to corporate consumers is possible provided all permits and licences are obtained.

Private power projects fall into three categories as follows:

Most of the renewable power projects in Thailand sell electricity generated from the project on a non-firm basis. Under a non-firm PPA, there is no contracted capacity to be delivered by the project and EGAT, PEA or MEA (as the case may be) does not provide any minimum offtake commitment. In recent years, however, there has been an effort by the Energy Regulatory Commission (ERC) to encourage development of renewable power projects which are capable of delivering energy on a firm basis, where projects will be penalised if they are unable to delivery energy up to the agreed percentage of the contracted capacity. This includes hybrid projects, combining solar PV with biomass, biogas or similar back-up facilities.

Renewable power projects have been procured under various schemes. From 2007, projects were procured under an “Adder” scheme, which provided eligible projects with a feed-in premium on top of the base tariff payment. The Adder scheme was replaced with a Feed-in Tariff (FiT) scheme in 2014. Initially, projects were procured on the basis of a first come, first served system, but that has been replaced with a competitive bidding process that is structured as a reverse auction in which the bid is submitted as a discount to the FiT.

Competitive bidding processes generally specify:

Renewable projects will generally be eligible for investment incentives under the investment promotion laws, which includes, among others: (i) exemption on the import duties for generating equipment; (ii) tax holidays for corporate income taxes; and (iii) tax exemption on dividends paid by the project company.

Projects are procured through a reverse auction system where bidders compete based on their proposed discount to the published FiT. The FiT depends on the technology and the size of the projects. All FiTs cover a 20 year period, with the exception of landfill gas projects, where the FiT applies for 10 years.

In the “SPP hybrid firm” tender conducted in 2017, the average bid received was USD 7.39 cents / kWh compared to the FiT ceiling of USD 11.09 cents / kWh.

Thailand permits rooftop solar projects under the following models:

In addition, the ERC has conducted two rounds of tenders for rooftop solar projects, one for behind-the-meter self-consumption and the other for government agencies and agricultural cooperatives. 67 projects have been awarded with a combined capacity of 281 MW. These projects will sell electricity to MEA or PEA (as the case may be) under a long term PPA.

Thailand is planning to introduce revised solar rooftop regulations in 2019 which are expected to address the issue of net metering, offsite generation for own use, corporate PPAs and private electricity trading. Future rooftop solar projects are not expected to rely on the FiT scheme.

The Ministry of Energy is reported to be planning a further tender of rooftop solar projects, some of which will be for self-consumption and some will permit sale of excess energy to the grid.

Assuming that the project company is solely engaged in the business of power generation, 100 per cent foreign ownership is permitted. However, the project company is not permitted to own land required for the project.

Nonetheless, it is typical for renewable energy projects to apply for investment incentives under the investment promotion law, which permits up to 100 per cent foreign ownership in the project company and enables the project company to own the land on which the project is located, despite the restriction that otherwise applies under the Land Code.

Generally, there is a change of control restriction whereby the number of the original shareholders of the project company (i.e. those who are the shareholders of the project company at the time of application for the PPA) cannot be less than 50 per cent of the total number of the shareholders of the project company and the number of shares in the project company which are held by the original shareholders shall not in aggregate be less than per cent of the total shares in the project company. Such restriction will end on the date falling three years from the commercial operation date of the project.

Numerous projects have been project financed, mostly by Thai banks.

Thai PPAs follow a standard form with no possibility of negotiation. Thai banks have financed projects based on these standard form PPAs on numerous occasions.

20 years or 25 years depending on the scheme and the technology.

Usually, the project company will be responsible for the costs of construction of the transmission lines connecting the project to the grid, but the construction will be undertaken by the grid owners (which are state enterprises).

The model PPA does not contain deemed commissioning provisions in favour of the project company.

Under the PPA for renewable energy projects, EGAT, PEA or MEA agrees to purchase all electricity generated by the project up to the amount agreed under the PPA. As a result, failure to purchase the electricity generated by the project could be considered as a contractual breach of the PPA.

The model PPA does not expressly contain change in law adjustment provisions.

The model PPA does not contain specified termination payments. If the PPA terminates due to breach by the offtaker, however, under Thai law, the project company would be permitted to make a claim for general damages against the offtaker.

A dispute is to be initially referred to the ERC for resolution. If the project company is not satisfied with the decision of the regulator, it can further refer the dispute to the Thai courts.

The offtaker does not provide credit support.

Publication

On August 1, 2025, the UK Supreme Court delivered its long-awaited judgment in Hopcraft v Close Brothers Limited and on 3 August the FCA announced it would consult on a redress scheme.

Publication

As with earlier editions, the 6th European Edition of High Yield Bonds: An Issuer’s Guide is primarily intended for first-time issuers, to give business owners, chief financial officers, treasurers, in-house lawyers and other key stakeholders a better understanding of the high-yield product, and to help them evaluate the pros and cons of issuing high-yield notes.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025