Publication

Legalseas

Our shipping law insights provide legal and market commentary, addressing the key questions and topics of interest to our clients operating in the shipping industry, helping them to effectively manage risk.

A new remunerative scheme to ensure the safety of energy supply in France

Global | Publication | Octobre 2015

Le marché de capacité électrique : un nouveau dispositif rémunérateur permettant de sécuriser l’approvisionnement électrique en France.

La loi n° 2010-1488 du 7 décembre 2010 portant Nouvelle Organisation du Marché de l’Electricité (NOME), codifiée aux articles L. 335-1 et suivants du code de l’énergie, met en place un dispositif d’obligation de capacité appelé marché de capacité. L’article 6 de la loi NOME prévoit en effet que le « fournisseur d’électricité contribue, en fonction des caractéristiques de consommation de ses clients, en puissance et en énergie, sur le territoire métropolitain continental, à la sécurité d’approvisionnement en électricité ».

Le décret n° 2012-1405 du 14 décembre 2012 et son arrêté d’application du 23 janvier 2015 précisent les modalités de mise en œuvre de ce nouveau mécanisme. Chaque année, les fournisseurs d’électricité se verront attribuer une obligation de capacité, en vertu de laquelle ils devront garantir qu’ils sont en mesure de répondre à la consommation effective de leurs clients pendant les périodes de pointe1, c’est-à-dire qu’ils disposent d’un certain montant de garanties de capacité. Pour ce faire, les fournisseurs devront soit détenir leurs propres installations de production ou de capacité d’effacement, soit acquérir ces garanties de capacité2 auprès d’autres détenteurs.

La détention de certificats sera la preuve que cette obligation a bien été respectée. En effet, RTE (Réseau de Transport d’Electricité)3 délivrera des certificats de capacité aux producteurs d’électricité et aux opérateurs d’effacement4 de consommation électrique, attestant de leur contribution à la réduction du risque de défaillance lors des périodes de pointe de consommation. Désormais, les producteurs pourront recevoir une prime de disponibilité de leur capacité de production et les opérateurs d’effacement pourront être rémunérés pour leur capacité à moduler la consommation.

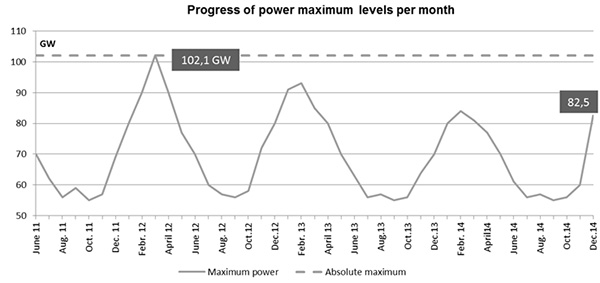

Source : RTE – the grid of power intelligence

On the other hand, the energy market offer poorly remunerates investments in capacities of energy production and in capacities of energy consumption curtailment. A report submitted in April 2010 by representatives Poignant and Sido in relation to the control of energy peak outlined the difficulties of the present energy market to attract investments in high-technology plants, even though such plants are necessary to guarantee a sufficient level of available energy during peak periods.

However, energy cannot be stored and must be constantly produced in accordance with the consumers’ demand. The consequence of these two specificities of the French energy market is the inadequate balance between the level of the available energy and the quantity of energy requested during peak periods.

According to a published RTE assessment, such inadequacy will increase in the coming years and will constitute a genuine threat for the safety of French energy supply by year 2016. Thermal production means (fuel, coal) will slowly be abandoned. As from 2013, GDF Suez (renamed Engie) mothballed5 its combined cycle power plant located in Cycofos (Bouches-du-Rhône) and cut off the electric grid of a 490 MW capacity. The very same year, the group cut back its activities, each with a 435 MW capacity, in Montoir-de-Bretagne (Spem) and in Fos-sur-Mer (Combigolfe)6. Coal plants and oil-fired plants have also been shut down since the specificities of the plants did not comply with European environmental norms that will be in force from early 2016.

The assessment also states that in case of severe winter conditions, the lack of energy could be up to 900 MW during winter 2015-2016 and up to 2,000 MW during winter 2016-2017. According to Dominique Maillard, President of RTE, the global cost of one unprovided kilowatthour was estimated to be 200 times higher than the production cost of the same kilowatthour. Two factors must be noted: a massive power curtailment involves loss for companies and individuals, and energy must be imported at high prices.

Therefore, as a strong sign of France’s commitment in the energy transition, the capacity market is bound to prevent any failure risk in the French energy system by helping to ease the transition to consumption peaks. It will be instituted by year 2016.

Many European countries have already set domestic capacity schemes to ensure the safety of energy supply (United-Kingdom, Ireland, Sweden, Finland, Belgium, Poland, Hungary, Portugal, Spain, Italy, Greece). Capacity schemes are generally divided in three instruments, the last one being the most complex:

Within the European Union, the United-Kingdom is the sole country to be already endowed with a capacity market. It is expected that each year, the British energy grid manager organizes centralized reverse auctions from which a capacity level is obtained. Such capacity level is required in order to guarantee a production level in adequacy with the energy demand. The first auctions occurred at the beginning of 2015 and set the energy capacity price that would be in force during peak periods of winter 2018-2019. A 49.3 GW capacity will be traded for an equivalent price of £19.40/KW-year.

In addition to France, Italy and Hungary are currently instituting a capacity market.

In a press release dated 19 December 2012 in relation with the decree dated 14 December 2012, the French Minister of Environment pointed out the targets of the capacity market regarding the specificities of the French energy market:

The curtailment market development will be enhanced in a long-term perspective.

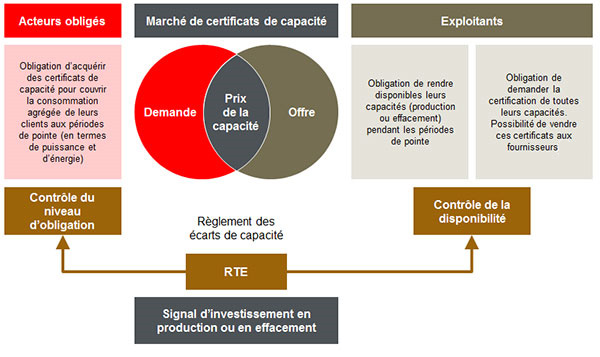

Various actors in the electricity market are called upon to contribute to the implementation of the capacity market. The below figure outlines the key actors in the capacity market and their respective missions8.

Mandatory actors refer to:

There are two kinds of capacity holders:

The State pilots the scheme but does not directly intervene on the market.

In particular, it defines the rules of capacity scheme, after the RTE submitted a report and the CRE, its recommendations.

The RTE, energy transport grid manager, has several functions in relation with the operation of the capacity mechanism:

In a manner similar to that of the energy balance manager (the RE or Responsable d’Equilibre), a decree dated 14 December 2012 introduced the notion of a manager of certification perimeter9 (the RPC or Responsable de Périmètre de Certification).

Such quality is required to be entitled to enter into an agreement with RTE.

The RPC is a legal entity, financially responsible for gaps that are assessed on his certification perimeter between the declared availability level and the real availability level. The RPC settles penalties owed by owners and as provided by article L. 335-3 of the Energy Code. Under this article, the owner must settle a penalty to the energy transport grid manager in the event the effective capacity is lower than the certified capacity.

The CRE has several control and supervising functions:

The implementation of the capacity market started on 1 April 2015 and the capacity scheme will be effective during winter 2016-2017. The following calendar was set for the first years of delivery:

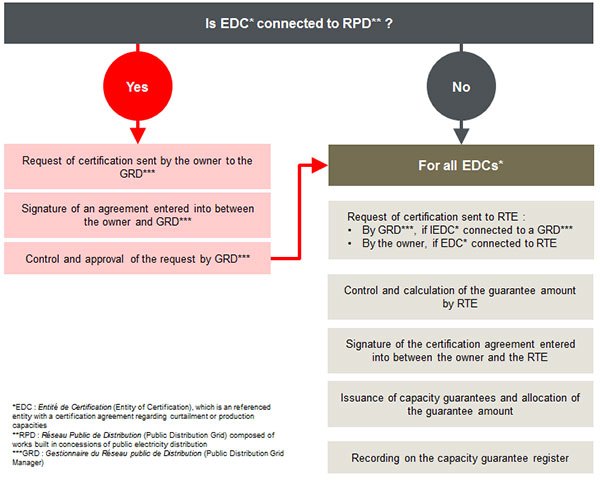

Certification attributes a volume of capacity guarantees for each capacity. Such allocation shall match the given contribution to the risk reduction of electric system failures. The following figure outlines the steps of certification:

The regulatory framework provides the following certification method:

Certification permits the holder to obtain capacity guarantees in a period that shall not exceed two months as from the reception of the certification request until the issuance of capacity guarantee to the owner.

In order to abide by their capacity obligation, capacity suppliers are allowed to purchase or sell capacity guarantee on the capacity certificate market.

The price of a traded capacity amounts to the value of curtailment and of the availability of production capacities during peak periods.

The capacity guarantees are recorded in a trade register12 held by RTE. This secured and confidential register collects issuance operations as well as trade transactions and destructions of capacity guarantees. The register is opened as from the first issuance of capacity guarantees and can be consulted on the following website: https://rega-rte.fr/.

A public register of certified capacities, held by RTE, is at the disposal of the actors. Such register contains information regarding the coming four years of delivery as well the past two years:

The ownership of a capacity guarantee is granted after RTE has registered the said guarantee on the holder’s capacity guarantee account.

A capacity guarantee is only valid for one year of delivery: a capacity guarantee issued for a specified year of delivery and recorded on the relevant year register cannot be transferred from that register account to another of a different year of delivery.

Change in the ownership of a capacity guarantee results from a sale of guarantee entered into between two legal entities, each holding an account in the trade register of capacity guarantees.

There are two ways to sell a capacity guarantee:

Trade of capacity guarantees shall be made accordingly to the following conditions:

Short period (day or season) during which failure risk is at its highest. Energy consumption are at their highest and it is necessary to operate additional energy production means and/or to operate a consumption curtailment.

Peak Period PP1 is the period during which suppliers must demonstrate they dispose of sufficient capacity guarantees in order to cover their clients’s energy consumption at its highest peak. This base period is used in the assignment of obligation for each mandatory actor.

Peak Period PP2 is the period during which owners commit to an availability of their capacities during a peak period. This base period is used in the methods of certification and of capacity control.

In the decree dated 14 December 2012 the « garantie de capacité » is defined as a movable, intangible, fungible, tradable and assignable asset and for which is assigned a nominative power per unit, emitted by the public energy transportation grid manager and delivered to an owner of capacity, entitled with a capacity certificate and valid for a given year of delivery.

EDF independent subsidiary, in charge of high and very high voltage lines.

Specialized actors in the development of curtailment offers, i.e. the temporary and voluntary suspension of energy consumption for flexible power-consuming equipments during grid tension periods.

Temporary stopping, often seasonal

La France menacée de pénurie d’électricité en 2016-2017, Le Figaro, 10 septembre 2014

Those plants scarcely operate, only few hours a year, when consumption level is high enough. This is why investments must be encouraged to enhance these technologies that only remunerate during peak periods.

Capacity gaps refer to gaps in relation to a supplier’s insufficient guarantees or an owner’s unavailable capacity.

Group of entities of certification, connected to one Responsible of Certification Perimeter.

In accordance with the letter sent by the Direction générale de l’énergie et du climat to RTE dated 30 September 2015. Nevertheless, operators must have initiated the certification procedure before 15 October 2015 for the year of delivery 2017.

Article L. 321-16 of Energy Code states all production plants or curtailment plants connected to the public transportation grid or to the public distribution grid shall be subject to a certification request by its owner to the public transportation grid manager.

The trade register is also called capacity guarantee register or capacity guarantee trade register.

Publication

Our shipping law insights provide legal and market commentary, addressing the key questions and topics of interest to our clients operating in the shipping industry, helping them to effectively manage risk.

Publication

Our 23rd report spotlights landmark legislative reforms such as the UK’s new Arbitration Act 2025 and South Africa’s rise as a regional arbitration hub. We examine procedural innovations, enforcement challenges, and the evolving role of tribunals in promoting settlement.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025