01 | Why enter into the China Market?

China has become the world’s second largest medical device market with an average growth of 20 per cent year-on-year. However, this rapid growth has not kept up with strong demand driven by an increasingly aging population and a growth in the number of affluent consumers who seek better quality medical services. Currently, there is a lack of resources and underdevelopment in relation to medical devices in rural areas and it is anticipated that the demand for medical devices will also increase from second and third tier cities and villages in the coming five to ten years.

China’s first comprehensive five-year blueprint for the healthcare sector, the National Planning Guideline for the Healthcare Service System (2015–2020), sets out clear targets for 2020 including (i) one clinic and one medical service centre for each community with a population of over 30,000; and (ii) 1.2 hospital beds for every 1,000 residents within the community. Li Beiguang, Deputy Director of the Planning Department of the Ministry of Industry and Information Technology, who was in charge of drafting the national plan ‘Made in China (2025)’ recently stated that at least 70 per cent of the medical devices used by county level hospitals and clinics in China must be domestically manufactured in China by 2025. This signals potential for development of China‘s medical device market which may offer opportunities for multinational corporations as well as for SME manufacturers.

02 | Do I have to move my manufacturing to China?

Yes. There are over 16,000 hospitals in China, 85 per cent of which are publicly owned and which spend more than RMB200 billion every year purchasing low to mid-end medical devices from domestic manufacturers and import mid to high-end products from foreign manufacturers. Procurement is conducted through a centralised tender process.

Public hospitals are not prevented from importing medical devices; however, in practice, public hospitals are encouraged to purchase domestically manufactured and domestically branded products. The National Health and Family Planning Commission (NHFPC) is in the process of establishing an incentive scheme to encourage the use of domestically produced medical devices and it is creating a series of lists of qualified products. In light of this incentive scheme, a number of foreign companies are moving or considering moving their production to China so that their products can meet the qualifications under the incentive scheme in order to remain competitive in the Chinese market.

03 | What is the key legislation and what is the key regulatory body?

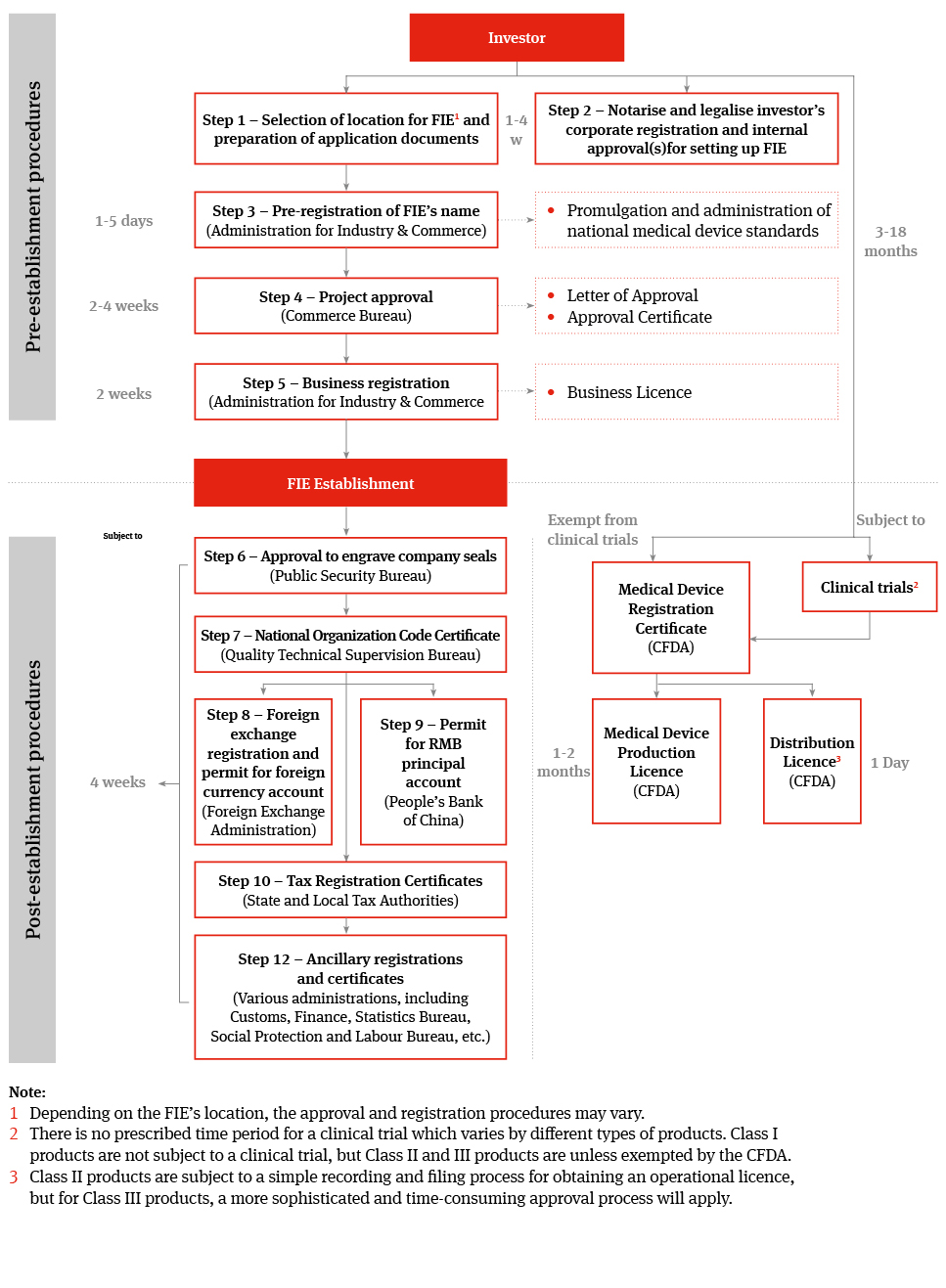

Regulation for the Supervision and Administration of Medical Devices, following which a number of implementation regulations have been issued by the China Food and Drug Administration (CFDA), the key regulator of China’s pharmaceutical and healthcare industry. These include the Provisions for Supervision and Administration of Medical Device Manufacturing, the Provisions for Supervision and Administration on Medical Device Distribution and the Provisions for Administration of Medical Device Registration.