The Hong Kong Stock Exchange published the Consultation Conclusions and Frequently Asked Questions (FAQs) on Capital Raisings by Listed Issuers on May 4, 2018.

The amendments to the Hong Kong Listing Rules will take effect from July 3, 2018, which relate to the following five areas:

Highly dilutive capital raisings

Given that highly dilutive capital raisings may jeopardize an orderly, fair and informed market for trading of securities, a listed issuer cannot conduct rights issues, open offers or placings of securities which are specifically authorised by the shareholders of the listed issuer in general meeting (specific mandate placings) if (individually or when aggregated with any other rights issues, open offers and/or specific mandate placings announced by the listed issuer within a rolling 12-month period) that would result in a theoretical dilution effect of 25 per cent or more.

Theoretical dilution effect of an issue refers to the discount of the “theoretical diluted price” to the “benchmarked price” of shares.

“Theoretical diluted price” means the sum of:

- the listed issuer’s total market capitalisation (by reference to the “benchmarked price” and the number of issued shares immediately before the issue); and

- the total funds raised and to be raised from the issue, divided by the total number of shares as enlarged by the issue.

The total funds raised and to be raised from the issue is calculated by reference to:

- the total number of new shares issued and to be issued; and

- the weighted average of the price discounts of the issues (each price discount is measured by comparing the issue price against the benchmarked price at the time of that issue).

The “benchmarked price” means the higher of:

- the closing price on the date of the agreement involving the issue; and

- the average closing price in the five trading days immediately before the earlier of:

- the date of the announcement of the issue;

- the date of the agreement involving the issue; and

- the date on which the issue price is fixed.

The theoretical dilution effect of the placing of convertible bonds (or warrants) is calculated on an “as-converted” basis (that is, applying the initial conversion price (or the sum of the initial placing price and the exercise price) and the corresponding number of conversion shares (or subscription shares) for the calculation).

Please refer to Appendix III to the Consultation Paper on Capital Raisings by Listed Issuers for an example on the calculation of cumulative value dilution, which is extracted in the Appendix to this note.

If the proposed rights issue, open offer or specific mandate placing issue may trigger the 25 per cent threshold, the listed issuer must consult the Hong Kong Stock Exchange before it can announce the proposed transaction.

This restriction does not apply if the listed issuer can satisfy the Hong Kong Stock Exchange that there are exceptional circumstances (e.g. the listed issuer is in financial difficulties and the proposed issue forms part of the rescue proposal).

Rights issues and open offers

Minority shareholders’ approvals for open offers

Open offers provide less protection to shareholders compared to rights issues. An open offer is non-renounceable (meaning that shareholders cannot dispose their rights to subscribe). Hence, non-subscribing shareholders will lose the value of the subscription rights.

Unless the open offer shares are to be issued under the authority of an existing general mandate, minority shareholders’ approvals are required for all open offers.

Controlling shareholders and their associates (or where there are no controlling shareholders, directors, other than independent non-executive directors, and chief executive as well as their respective associates) must abstain from voting in favour of the resolution. An independent financial adviser is required to opine on the terms of the open offer.

Underwriting of rights issues and open offers

The existing Listing Rules require that all rights issues and open offers must be fully underwritten. The decision to engage an underwriter is a commercial matter for the directors to decide. The existing mandatory underwriting requirements for all rights issues and open offers will be removed.

If listed issuers choose to engage underwriters to underwrite rights issues or open offers, the underwriters must be persons licensed or registered under the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) for Type 1 regulated activity and their ordinary course of business includes underwriting of securities. In addition, the underwriters must be independent from the listed issuers and their connected persons (subject to the exception mentioned below).

If any of the controlling or substantial shareholders of the listed issuers acts as an underwriter or sub- underwriter, listed issuers must make arrangements for the disposal of unsubscribed offer shares in the market and return any premium to the non-subscribing shareholders (compensatory arrangement). The connected transaction rules apply to underwriting or sub-underwriting of the issue of new securities by the controlling or substantial shareholder. The current connected transaction exemption available to connected persons acting as underwriters or sub-underwriters of the issue of new securities will be removed.

Arrangements for the disposal of unsubscribed shares

With regard to the new shares that are not taken up by shareholders during the subscription period of a pre-emptive offer, the listed issuer must adopt either (a) the excess application arrangement (that is, an arrangement that allows shareholders to apply for the unsubscribed shares in excess of their pro rata entitlement) or (b) the compensatory arrangement (as mentioned in the above section “Underwriting of rights issues and open offers”).

If the excess application arrangement is adopted, the listed issuer must take steps to identify the excess applications made by any of the controlling shareholders and their associates, whether in their own names or through nominees. The listed issuer must disregard the excess applications made by the controlling shareholders and their associates to the extent that the total number of excess shares they have applied for exceeds a maximum number equivalent to the total number of the shares offered minus the number of shares taken up by them under their assured entitlements.

Placing of warrants or convertible securities under general mandate

Placing of warrants, options or similar rights to subscribe for new shares of the listed issuer for cash under a general mandate is disallowed. This means that listed issuer has to seek specific shareholders’ approval for the placing of warrants etc.

The use of general mandate for the placing of convertible securities is permitted if the initial conversion price is not lower than the benchmarked price (as defined in Rule 13.36(5) of the Listing Rules) of the shares at the time of placing. If the initial conversion price is lower than the benchmarked price, the listed issuer has to seek specific shareholders’ approval for the placing of convertible securities.

Disclosure of the use of proceeds

Details of the use of proceeds from all equity fundraisings must be disclosed in both annual and interim reports of the listed issuers.

- a detailed breakdown and description of the use of proceeds for different purposes during the financial year or period;

- if there is any amount not yet utilized, a detailed breakdown (by different purposes) and description of the intended use of the proceeds and the expected timeline; and

- whether the proceeds are used, or are proposed to be used, according to the intentions previously disclosed by the listed issuers, and the reasons for any material change or delay in the use of proceeds.

Subdivisions or bonus issues of shares

A listed issuer must not undertake a subdivision or bonus issue of shares if the theoretical share price after the adjustment for the subdivision or bonus issue is less than HK$1 based on the lowest daily closing price of the shares during the six-month period before the relevant announcement of the subdivision or bonus issue.

Appendix – Example on the Calculation of Cumulative Value Dilution

The cumulative value dilution is calculated by reference to (i) the aggregate number of shares issued during the 12-month period, compared to the number of issued shares immediately prior to the first offer or placing; and (ii) the weighted average of the price discounts (each price discount is measured against the market price of shares at the time of the offer).

Company A conducted the following capital raisings:

- a 1-for-2 rights issue with offer price at a price discount of 25 per cent;

- a 1-for-1 rights issue with offer price at a price discount of 40 per cent; and

- a specific mandate placing of 50% of existing issued shares at a price discount of 70 per cent.

|

|

Rights issue January 2017 |

Rights issue May 2017 |

Placing September 2017 |

| Theoretical value dilution of each pre-emptive offer/placing |

| Number of issued shares before capital raising |

A |

100 |

150 |

300 |

| Issue size |

B |

50% |

100% |

50% |

| Number of offer/placing shares to be issued (= A * B) |

C |

50 |

150 |

150 |

| Benchmarked price (Note 1) |

X |

HK$1.0 |

HK$0.92 |

HK$0.73 |

| Price discount |

Y |

25% |

40% |

70% |

| Offer/placing price (= X * (1 – Y)) |

Z |

HK$0.75 |

HK$0.55 |

HK$0.22 |

| Shareholding value before rights issue/placing = A * X |

J |

HK$100.00 |

HK$137.50 |

HK$220.00 |

| Subscription amount = C * Z |

K |

HK$37.50 |

HK$0.73 |

HK$33.00 |

| Number of enlarged issued shares = A + C |

L |

150 |

300 |

450 |

| Theoretical ex-price = (J + K)/L |

TEP |

HK$0.92 |

HK$0.73 |

HK$0.56 |

| Theoretical value dilution (TD) = (TEP – X)/X |

TD |

-8.3% |

-20.0% |

-23.3% |

| Cumulative theoretical value dilution |

| Shares in issue immediately before 12-month period |

Sh |

100 |

100 |

100 |

| Benchmarked price immediately before 12-month period |

Pr |

HK$1.00 |

HK$1.00 |

HK$1.00 |

| Number of offer/placing shares to be issued |

C |

50 |

150 |

150 |

| Aggregate number of offer/placing shares (that is, sum of C) |

D |

50 |

200 |

350 |

| Price discount |

Y |

25% |

40% |

70% |

| Average price discount (that is, weighted average of Y by reference to C) |

R |

25% |

36% |

51% |

| Shareholding value before 1st rights issue = Sh x Pr |

M |

HK$100.00 |

HK$128.00 |

HK$171.50 |

| Cumulative subscription amount = D * [Pr * (1 – R)] |

N |

HK$37.50 |

HK$128.00 |

HK$171.50 |

| Number of enlarged issued shares |

L |

150 |

300 |

450 |

| Cumulative theoretical ex-price = (M+ N)/L |

CTEP |

HK$0.92 |

HK$0.76 |

HK$0.60 |

| Cumulative theoretical value dilution = (CTEP – Pr)/Pr |

CTD |

-8.3% |

-24.3% |

-39.7% |

The “benchmarked price” means the higher of:

- the closing price on the date of the agreement involving the issue; and

- the average closing price in the five trading days immediately before the earlier of:

(i) the date of the announcement of the issue; and

(ii) the date of the agreement involving the issue; and

(iii) the date on which the issue price is fixed.

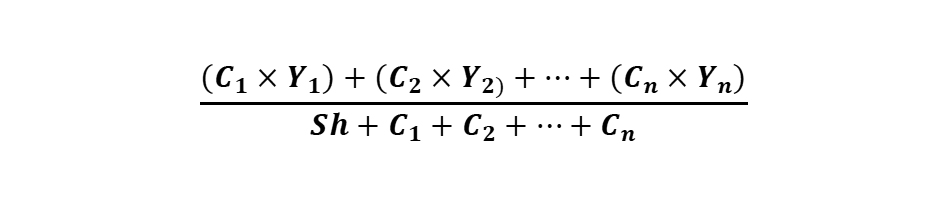

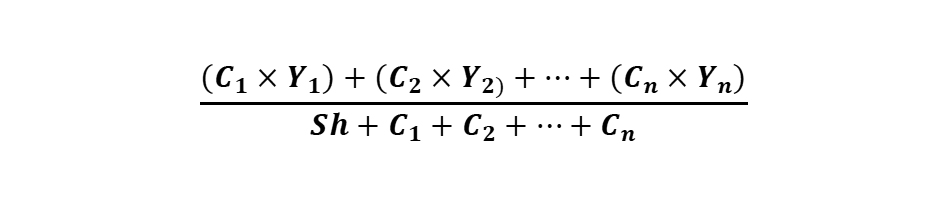

The cumulative value dilution can also be calculated by the following formula:

Sh = Number of issued shares immediately before the 1st offer or placing

C1 = Number of shares to be issued in the 1st offer or placing

C2 = Number of shares to be issued in the 2nd offer or placing

Cn = Number of shares to be issued in the nth offer or placing

Y1 = Price discount of the 1st offer or placing

Y2 = Price discount of the 2nd offer or placing

Yn = Price discount of the nth offer or placing