Following the issuance of Law 4 of 2023 on the Development and Strengthening of the Financial Sector (Law 4/2023) in January 2023, the Financial Services Authority (Otoritas Jasa Keuangan or OJK) issued an implementing regulation to further regulate carbon trading in Indonesia through a “carbon exchange”. OJK Regulation No. 14 of 2023 on Carbon Trading through Carbon Exchange came into effect as of 2 August 2023 (OJK Carbon Exchange Regulation).

At the time of this update, the Indonesian Stock Exchange (IDX) has been appointed as one of the exchange administrator. Reports indicate that there were at least thirteen transactions recorded, totalling in 459,914 tCO2 equivalent coming from energy sector, on its IDX carbon stock exchange debut launch on 26 September 2023.

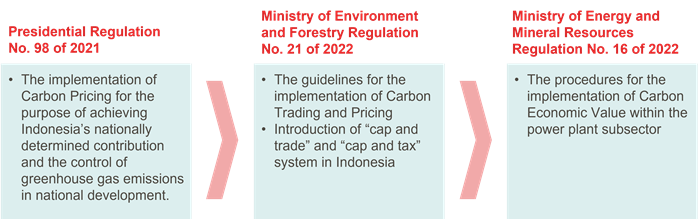

As background, Indonesia has enacted a number of legislation regarding carbon trading in Indonesia. Prior to the OJK Carbon Exchange Regulation, the following regulations set out matters regarding carbon units and trade in Indonesia:

The following are some key highlights of the OJK Carbon Exchange Regulation:

- Carbon units as securities

Under the OJK Carbon Exchange Regulation, carbon units1 are classified as securities2 which should be traded through the carbon exchange. In this regard, each carbon units must be first registered at the national registry system for climate change (Carbon Unit Registry) and a local carbon exchange administrator (as further discussed in item 3 below.

- International voluntary carbon trading

Not only for domestic carbon units, the OJK Carbon Exchange Regulation provides opportunity for international carbon units certified in other countries to enter into the carbon exchange.

Although the international carbon unit is not required to register with the Carbon Unit Registry, when not registered within the Carbon Unit Registry, at the minimum, it must comply with the following requirements:

i. registered, validated and verified by the competent authority whom received accreditation from the international registry system provider;

ii. complied with the requirement to be traded in foreign carbon exchange; and

iii. other requirements provided by the OJK.

Point (iii) requirement is subject to coordination between OJK and the Ministry of Environment and Forestry (MOEF). Understanding the loosely regulated provision in point (iii) of the OJK Carbon Exchange Regulation, OJK and the MOEF may loosen or stricken the requirement as needed. Under the given circumstances, registering with the Carbon Unit Registry might be the preferable course for businesses.

However, we anticipate that further implementing regulations would be issued to address the possibility to conduct international trading of carbon units which are generated from Indonesia.

- Carbon exchange administrator

The OJK Carbon Exchange Regulation provides that a local carbon exchange administrator should be an Indonesian limited liability company licensed by the OJK to administer and implement the carbon market by providing the relevant systems/platforms or facilities to enable carbon trading. The administrator shall have a paid-up capital of at least IDR100 billion (around USD6.5 million) which must be in equity (not sourced from loans) and issue relevant administrator regulations for the conduct of the carbon trading.

Pursuant to the OJK Carbon Exchange Regulation, there is a possibility for more than one administrator for carbon trading.

- Further implementing regulations

We would expect for further implementing regulations to be issued. These include, among other, OJK regulations on the procedure of obtaining relevant OJK licenses for carbon trading, MOEF regulations on the procedure for international voluntary carbon trading as well as other sectoral regulations on applicable carbon pricing for relevant sectors.

Please do not hesitate to contact us for further details on our legal update.