Publication

VAT in the UAE: implications for transactions and group structuring

Global | Publication | October 2017

Content

Introduction

VAT is being introduced in the UAE from January 1, 2018 as part of the wider introduction of VAT by members of the Gulf Cooperative Council (GCC). It is expected to raise significant revenues: AED20 billion in the second year (approximately $5.5 billion). The head of the Federal Tax Authority (FTA) has confirmed recently that online registration will open by the end of September1. The basic VAT law Federal Decree Law No. (8) of 2017 on Value Added Tax (the Decree) was published on August 27. The underlying regulations (providing detail on the operation of the new VAT system) are expected in the fourth quarter of this year. Businesses that are required to register must have done so by January 1, 2018 and it is possible that regulations may specify an earlier date to avoid a last-minute rush on registration.

The GCC member states signed a Framework Agreement for the introduction of VAT back in 2016. This set out the basic principles for GCC VAT allowing some scope for implementation to vary between members. The UAE Ministry of Finance (MoF) has released some details of how it will implement the regime. This, taken alongside the Decree, enables us to see, in broad outline, how GCC VAT is expected to operate.

The introduction of VAT presents some obvious systems and compliance challenges in terms of invoicing and accounting for the new tax, but it is also essential for businesses to be aware of and prepare for the effect of VAT on contract documentation, group structuring/ restructuring and mergers and acquisitions (M&A).

Some risk areas are sector specific, others apply to specific transaction types. The basic Framework for GCC VAT does not replicate all the characteristics which have given rise to complexities in the EU VAT system, but the broad concepts are aligned which means that we can draw to a significant extent on experience of the operation of VAT in the EU in order to identify risks and those areas where pre-emptive action can be taken.

The basics of VAT

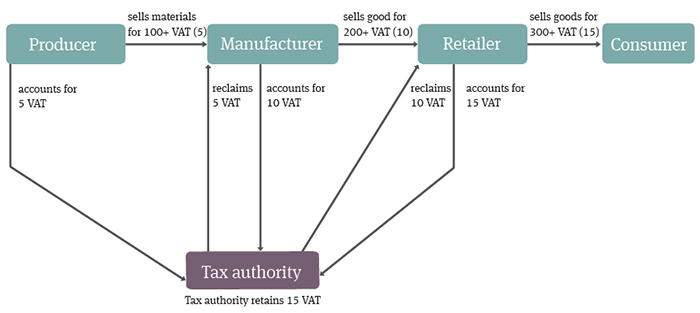

VAT is a tax on consumption of goods and services supplied by “taxable persons” (persons carrying out an economic activity which requires them to be VAT registered). It is an “indirect tax”, meaning that it is, in most cases, collected and accounted for by the supplier on behalf of the tax authority. A key feature is that it is designed to be borne by the ultimate consumer but is charged on each transaction in a supply chain. To achieve this it allows for recovery of VAT incurred on supplies received where those supplies are used to make further taxable supplies.

By way of example, taking the five per cent GCC VAT rate:

For a “taxable business” making fully “taxable supplies” VAT incurred should be fully recoverable and should not represent any real cost to the business. However, the basic concept of a tax borne by the ultimate consumer is deceptively simple and, in the EU, implementing legislation has given rise to a vast amount of litigation. A large amount of this complexity arises from the distinction between “fully taxable”, “zero rated” and “exempt” supplies. The distinction is particularly important due to its effect on the ability of a supplier to recover VAT incurred on supplies made to it. A “zero-rated” supply is a “taxable supply”, but a VAT exempt supply is not and impacts the ability to recover VAT incurred on supplies received. VAT is a real cost for businesses making exempt supplies.

What will UAE VAT look like?

The proposals

- Five per cent standard rate.

- Mandatory registration for businesses with taxable supplies and imports in excess of AED375,000 (this is expected to include zero-rated supplies). Voluntary registration threshold of AED.

- 187,500 (supplies and imports or expenses to enable VAT recovery in start-up phases).

- The Framework allows GCC member states to introduce exemption for supplies in certain sectors including financial services, education, health, real estate and local transport. The Decree provides for the exemption of residential real estate (other than the first sale of residential property within three years of its construction which will be zero rated to enable VAT recovery by real estate developers for construction costs). Supplies of bare land are also exempt. Commercial real estate will be standard rated. Financial services specified in the regulations will also be exempt. The MoF has indicated that this will include the supply of margin- based financial services and life insurance. Fee-based financial services and non-life insurance are expected to be standard rated.

- The general rule will be that the place of supply is the location of the goods at the time of supply or, in the case of services, where the supplier is established. Specific rules will apply for the supply of certain goods (e.g. water, energy) and the cross-border supply of goods and services.

- A “reverse charge” mechanism will apply to supplies to taxable persons from abroad (including other GCC member states) in order to level the playing field for domestic and foreign supplies. This will work by treating supplies from outside the UAE as having been made in the UAE and requires the UAE recipient to account for VAT.

- VAT grouping will allow UAE businesses, operating essentially under common control, to apply to be treated as a single person for VAT purposes so that transactions between them are ignored.

- Where expenses relate to both taxable and non-taxable supplies, a “partial exemption” method apportioning the VAT incurred between the taxable and exempt supplies will apply. Unless an alternative partial exemption method is agreed with the FTA, input VAT recovery will be determined on the basis of the proportion relating to taxable supplies.

- Supplies by government entities will be within the scope of VAT unless the government entity is the sole provider of such supplies or, for some other reason, is not making the supplies in competition with the public sector.

- Special rules will apply to a transfer of a business as a going concern (TOGC) so that it is not treated as a supply for VAT purposes.

- There will be quarterly filing obligations and a requirement to retain records for a period of five years.

Implications for transactions and structuring

VAT impacts most transactions. VAT regimes give rise to difficult and complex issues simply in terms of determining the basic VAT liability. There are then specific structuring and transaction concerns.

- Classification of supplies. Tripartite supplies (made to one party but paid for by another) require detailed analysis as do single “mixed” or “composite” supplies where a supply is composed of separately identifiable taxable and exempt elements. Boundaries will depend on the detail of the legislation enacted and developed over time. The sheer volume of domestic and EU case law in this area reflects the fact that outcomes are highly fact specific, relying on the application of principles identified in earlier cases to the specific fact pattern.

- VAT groups. Establishing a VAT group requires thought in terms of setting the parameter of the group in order to maximise input VAT recovery and there may be particular issues where branches are in the structure. Group companies making exempt supplies can be problematic. Tricky issues can also arise in respect of accountability and entitlement to refunds and these need to be worked through and drafted for on company disposals and acquisitions. Administrative matters such as quarterly returns and the retention of VAT records for five years also need to be addressed.

- Input VAT recovery for transaction costs. Careful thought also needs to be given to the VAT treatment of costs incurred in M&A transactions or pre-initial public offering restructurings. A wealth of EU case law has established principles for VAT recoverability by holding companies.

- Basic allocation. A key point to remember is that basic contractual allocation is important: the supplier is responsible for accounting for the correct amount of VAT within relevant time limits. This responsibility is not dependent on the supplier’s ability to recover the VAT from the recipient of the supply.

- Contractual provisions need to allocate VAT risk and in doing so need to take into account VAT recoverability by parties. In complex situations or areas of uncertainty, such as TOGCs or in situations where full recovery may not be available, detailed representations and provisions in respect of conduct of discussions with the tax authorities may be appropriate. Break fees give rise to further concerns. It may also be appropriate to revisit long-term contracts to prevent any adverse VAT impacts after January 1, 2018 and to future-proof those provisions to ensure they cater for subsequent changes to the regime.

- Exemption for supplies, e.g. of some financial services or categories of land, means a real VAT cost for the supplier as it is effectively treated as the final consumer. Particular care must be taken on negotiation of risk allocation in these areas.

- Outsourcing. Difficult issues can arise where a financial institution is either making crossborder supplies or outsourcing all or some of its activities, including back office functions.

- Discretion allowed in implementation, particularly in terms of the scope of exemptions, means that the same supply may not always attract the same treatment in different member states leading to structuring opportunities (and risks).

Businesses making or receiving cross-border supplies or making supplies of financial services or land will want to pay particular attention to the detail of the draft legislation released by each GCC member state. There will also be important sector-specific developments to follow in other areas including aviation, oil and gas and construction.

As a general matter, where a contact is silent on VAT, the price will be deemed to be VAT inclusive. The MoF has indicated that a transitional regime will apply, however, to existing contracts; this will mean that a supplier can make an additional charge for VAT where part of a supply under an existing contract is made on or after January 1, 2018, provided that the customer is able to recover it. Detail is expected in the regulations. Contracts which will continue in effect after January 1, 2018 should be reviewed and, if necessary, renegotiated to ensure that they work appropriately for VAT.

Footnotes

Online registration opened on September 17.

Recent publications

Subscribe and stay up to date with the latest legal news, information and events . . .