Publication

Giurisprudenza | IVASS e sanzioni per ritardi e contrarietà ai principi di correttezza e diligenza

IVASS e sanzioni per ritardi e contrarietà ai principi di correttezza e diligenza: il Consiglio di Stato conferma la linea dura

Author:

Global | Publication | September 3, 2018

Prime Minister Scott Morrison and new Trade Minister Simon Birmingham met with President Joko “Jokowi” Widodo at Bogor Palace in West Java, Indonesia on 31 August and signed two declarations on the Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA) and the Comprehensive Strategic Partnership and the Comprehensive Strategic Partnership formally declaring that negotiations have concluded for IA-CEPA paving the way for greater economic cooperation between the two nations.

Indonesia is Australia’s 13th largest trading partner with total two-way trade worth almost A$16.5 billion in 2017.1 IA-CEPA has been under negotiation since November 2010.2

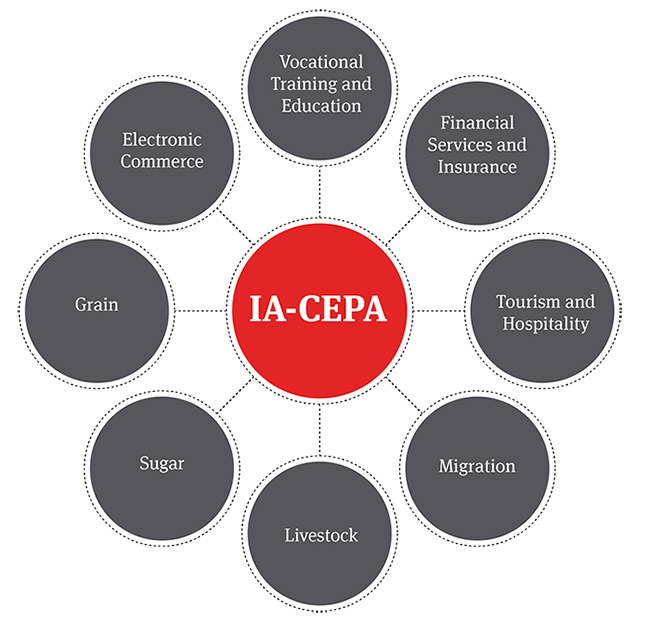

IA-CEPA will open new markets and opportunities in multiple sectors including the Australian education sector – the opening of an Australian university campus in Jakarta is proposed – as well as businesses, primary producers, service providers and investors. IA-CEPA will give Australia preferential tariff treatment on sugar, and cattle and make Indonesian exports to Australia more competitive. In short, IA-CEPA will allow 99% of Australia's goods exports to enter Indonesia duty free or with significantly improved preferential arrangements by 2020 (compared with 85% under the ASEAN-Australia-New Zealand FTA (AANZFTA)). All Indonesia's goods exports will enter Australia duty free. (for more detail, see Department of Foreign Affairs and Trade IA-CEPA dedicated page).

In addition to IA-CEPA, the Comprehensive Strategic Partnership sets out five key principles that Australia and Indonesia will commit to so that they can ensure greater co-operation politically and economically. The full text of the Comprehensive Strategic Partnership can be found here.

Indonesia market snapshot |

Bandan Pusat Statistik (Statistics Indonesia) trade data for Q1 & 2, 2018 |

IA-CEPA builds on the trade liberalisation commitments implemented through AANZFTA, under which Indonesia already extended some “WTO plus” trade concessions to Australia.

IA-CEPA however goes further than AANZFTA, with a focus on industries such as the digital economy and e-commerce, the green economy and skills/labour exchange. Instead of a traditional focus on tariff levels and schedules for reduction, the focus of IA-CEPA is on key areas of cooperation. One such example is red meat, where the countries have mutually beneficial opportunities – Australia wishes to increase its live exports to Indonesia, while Indonesia on the other hand is seeking support to boost its own local beef industry to manage issues in food security. Last year’s negotiations resulted in agreement on Australia’s elimination of its tariff on herbicides and pesticides in exchange for a reduced tariff on Australian sugar exports to Indonesia.

The Indonesian FMCG market is expected to benefit from Australia’s cheaper sugar while Indonesian pesticides will be more competitive in the Australian market. IA-CEPA will further enhance a variety of existing business channels including:

The key outcomes are set out on the DFAT website.

One industry most likely to benefit from IA-CEPA is the Australian financial services industry. As part of the IA-CEPA negotiations, the Australian Centre for Financial Studies (ACFS) and Indonesia’s “OJK Institute” (an initiative of Otoritas Jasa Keuangan (the Indonesian Financial Services Authority)) are working on enhancing the capacity of OJK Institute staff in financial sector research and on developing a network of financial regulators, policymakers, researchers, and practitioners across Australia and Indonesia. This work is likely to see an increase in Australian financial services penetration into Indonesia, especially when you consider that Indonesia has a relatively low insurance market penetration rate, a large population and expanding consumer class.

In addition, Australian services and investment in Indonesia will benefit from the following:

Figure 1 Scope of IA-CEPA

The next steps involve both parties’ legal teams reviewing the agreement and finalising it with a view to translating the text into English and Bahasa Indonesia. Following translation, a formal signing ceremony will take place and the agreement will be made public.

Although IA-CEPA is not far away from being signed, the actual deal will not take effect until both Governments have completed their domestic processes and transposed the agreement into law. As part of this process, enabling domestic legislation will need to be enacted by the Australian Parliament, which will include an inquiry by the Parliamentary Joint Standing Committee on Treaties, as well as changes to various regulations. Similar steps would occur in Indonesia which may take up to a year to finalise.

Please contact Tasdikiah Siregar (Managing Partner), and Diane Jungmann (Senior Foreign Counsel) in Jakarta, Indonesia if you have any questions arising from this publication.

In Indonesia, TNB & Partners works in association with Norton Rose Fulbright Australia, which is strategically positioned in Jakarta, Indonesia’s financial and commercial centre, and has developed strong corporate, commercial, and banking and finance practices.

We have experience in advising on free trade agreements and market access issues, which is especially relevant for business in Indonesia, with its fast-growing emerging economy, attracting a wide range of international investors.

Norton Rose Fulbright is a global law firm, with more than 50 offices across Europe, the USA, Canada, Latin America, Asia Pacific, the Middle East and Central Asia.

Department of Foreign Affairs and Trade (DFAT), Indonesia-Australia Comprehensive Economic Partnership Agreement (2018) Australia Government: Department of Foreign Affairs and Trade – Free trade agreements < https://dfat.gov.au/trade/agreements/not-yet-in-force/iacepa/Pages/indonesia-australia-comprehensive-economic-partnership-agreement.aspx >.

DFAT Australia and Ministry of Trade, Republic of Indonesia, ‘Australia – Indonesia Free Trade Agreement: Joint Feasibility Study’ (Report, DFAT, 2009).

Publication

IVASS e sanzioni per ritardi e contrarietà ai principi di correttezza e diligenza: il Consiglio di Stato conferma la linea dura

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025