CMU overview and timeline

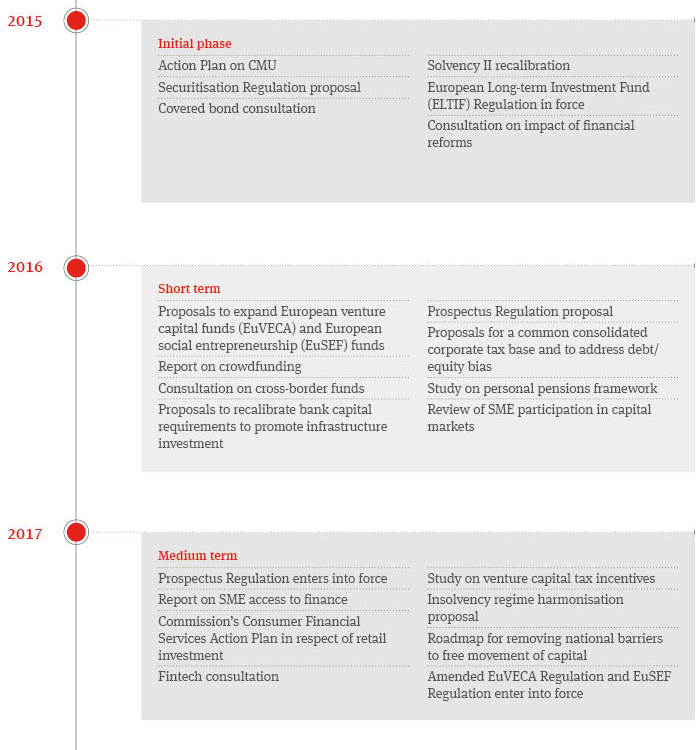

Since publishing its Action Plan for Capital Markets Union (CMU) in September 2015, the European Commission has progressed a package of legislative and other initiatives that will affect credit institutions, investment funds, pension funds, insurance companies and other institutional investors. The reforms are intended to kick-start growth in Europe by revitalizing the capital markets while at the same time maintaining stability.

The CMU project arose primarily to address concerns that corporates in Europe remain overly reliant on bank finance, which made them vulnerable during the financial crisis when banks retrenched and tightened their balance sheets. As a result, a central aim of CMU is to make the financial system more stable by encouraging a wider of range of funding sources (i.e. growth in non-bank finance). CMU is intended to reduce or eliminate obstacles to cross-border investment, and to make the capital markets more accessible to small and medium-sized enterprises (SMEs) as an alternative to bank loans. For investors, CMU aims to encourage access to a wider range of competitive and transparent investment products, and improve returns on long-term savings.

The Action Plan noted that CMU will not be delivered through a single measure; rather, it will result from the cumulative impact of a number of initiatives. As these measures began to take shape, CMU’s remit expanded to include other areas such “Fintech” and the consolidation of regulatory powers by the European Supervisory Authorities.

The Commission intends to have a comprehensive package of CMU initiatives in place and implemented by 2019, which is when the Prospectus Regulation and Securitization Regulation will be in full effect. However, questions remain whether these initiatives will be effective in encouraging broader participation in capital markets, particularly by SMEs.

As you will see in the timeline below and throughout this technical resource, progress has been made in a number of areas. However, it is still too early to tell how effective these measures will be. In the long term, areas such as taxation and insolvency law, which differ across national lines, may only involve incremental changes to break down barriers to cross-border investment. This will take time. In the meantime, we will continue to update this technical resource as the CMU project develops.