Publication

Essential Corporate News – Week ending 11 July 2025

On 1 July 2025, the Quoted Companies Alliance (QCA) published three new board committee guides to accompany the QCA Environmental and Social Guide published in December 2024.

Luxembourg | Publication | January 2020

CSSF Circular 19/732 sheds light on the identification of the ultimate beneficial owners in different structure types. In particular, for trust structures, it clarifies that all parties to a trust which has an ownership interest in a legal entity may qualify as the ultimate beneficial owners of such entity.

The Commission de Surveillance du Secteur Financier (the CSSF) published Circular 19/732 on December 20, 2019 (the Circular) in which it clarified the obligation imposed on those professionals which are subject to the anti-money laundering/counter-terrorist financing (AML/CTF) supervision of the CSSF to identify and verify the identity of the ultimate beneficial owner (the “UBO”) in corporate structures, when applying due diligence measures on their customers.

The UBO is defined in the amended law of November 12, 2004 on the fight against money laundering and terrorist financing (the AML Law) as “any natural person who ultimately owns or controls the customer or any natural person on whose behalf a transaction or activity is being conducted”.

When identifying the UBO of a corporate entity, a threefold “cascading” approach should be applied:

The Circular stresses the importance that steps (i) and (ii) be carried out cumulatively and not alternatively and that step (iii) be used only as a fall-back option.

The Circular also includes a non-exhaustive list of illustrative examples of how a UBO should be identified in certain corporate structures, to assist with the identification of the UBO in the context of a due diligence process. Such examples include the “ownership” approach (e.g. indirect ownership in a legal entity or trust) and the “control by other means” approach (e.g. control of decisions, veto rights and indirect majority control).

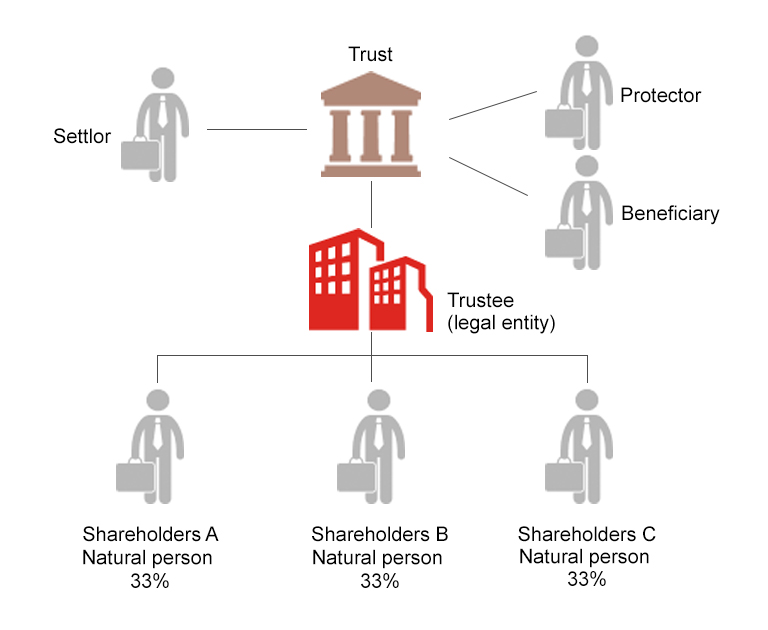

When considering trust structures, the Circular makes it clear that a trust's partial or full ownership interest in a legal entity calls for a concurrent application of the rules on beneficial owner identification of trusts and those applicable to legal entities. Moreover, according to the Circular, professionals need to apply a look-through approach when the trustee is a legal entity (or is itself fully held by a legal entity), thereby identifying the UBO(s) of such legal entity as the UBO(s) of the trust, as shown in the below diagram.

The Circular also clarifies that if the senior managing official is identified as the UBO in accordance with step (iii), the assumption is that such senior managing official) is personally the UBO unless the relevant entity is run by a collegial body such that no individual can be deemed to be the senior managing official.

In addition to the guidelines regarding the UBO identification, the Circular lists a number of indicators to help detect potential concealment of beneficial ownership.

Although the Circular’s scope is limited to professionals which are subject to the AML/CTF supervision of the CSSF, it serves as useful guidance as to the developing market practice regarding the identification of UBO(s) for any entity which is subject to the obligation to file the information regarding their UBO(s) with the Luxembourg Register of Beneficial Owners.

Publication

On 1 July 2025, the Quoted Companies Alliance (QCA) published three new board committee guides to accompany the QCA Environmental and Social Guide published in December 2024.

Publication

In the two years since our last climate litigation update, the prevalence and variety of global climate litigation around the world has continued to increase.

Publication

Selon un rapport conjoint du Bureau du surintendant des institutions financières (BSIF) et de l’Agence de la consommation en matière financière du Canada (ACFC), environ 70 % des institutions financières fédérales prévoient utiliser l’IA d’ici 2026 .

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025