Publication

Essential Corporate News – Week ending 11 July 2025

On 1 July 2025, the Quoted Companies Alliance (QCA) published three new board committee guides to accompany the QCA Environmental and Social Guide published in December 2024.

United States | Publication | February 2020

Authors include K. Eli Akhavan, Evan Bloom, Martin M. Shenkman, Jonathan I. Shenkman, Ben Utecht and Eido M. Walny.

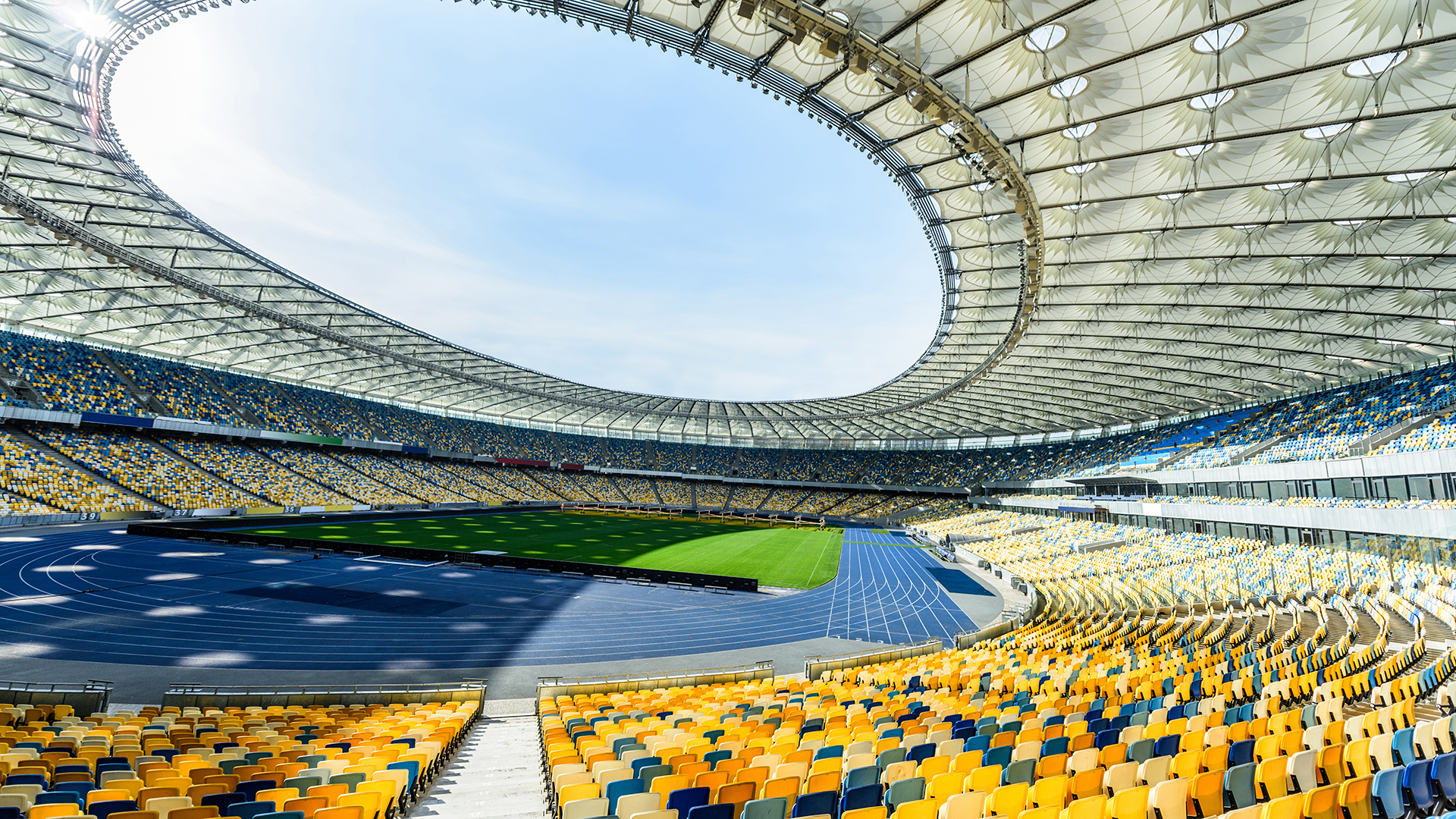

The professional athlete needs the same sound foundation of financial and estate planning that all wealthy clients require. However, the professional athlete typically faces many unique circumstances that must be integrated into the planning process. Movie stars, musicians, entertainers, and others with “star” power encounter some of the challenges common to athletes, so that the applicability of some of the planning ideas discussed here will be broader than merely for athlete clients.

There is potentially an important time pressure to planning for pro athletes that might require quick action. If the political balance of power changes in Washington in 2020, a Democratic administration might enact restrictive estate tax changes similar to that proposed by Senator Bernie Sanders in the Senate and Congressman Jimmy Gomez (CA-34) in the House. These bills reduce the gift tax exemption to US$1 million and the estate tax exemption to US$3.5 million. Discounts, GRATs, grantor trusts and GST planning may all be severely restricted. Thus, for athletes that have already amassed substantial wealth, planning should proceed before those changes might occur.

K. Eli Akhavan is a lawyer in the trusts and estates group at Norton Rose Fulbright in the firm’s New York City office.

Publication

On 1 July 2025, the Quoted Companies Alliance (QCA) published three new board committee guides to accompany the QCA Environmental and Social Guide published in December 2024.

Publication

In the two years since our last climate litigation update, the prevalence and variety of global climate litigation around the world has continued to increase.

Publication

Selon un rapport conjoint du Bureau du surintendant des institutions financières (BSIF) et de l’Agence de la consommation en matière financière du Canada (ACFC), environ 70 % des institutions financières fédérales prévoient utiliser l’IA d’ici 2026 .

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025