The South African economy is at a crossroads – that was the message that the Minister of Finance, Tito Mboweni delivered in the Medium Term Budget Policy Statement last October - and the same theme filtered through in the National Budget Speech which was read before Parliament today.

The Minister of Finance delivered a hard-hitting budget for 2019/2020, highlighting the fact that the economy’s performance continues to weigh heavily on tax revenues, while at the same time endeavouring to contain government expenditure and debt to appease the international ratings agencies.

The central challenges currently facing Government are to raise economic growth and to reduce government expenditure. With real GDP growth expected to rise to 1.5% in 2019 and with an unemployment rate of approximately 27%, the National Budget did not address any new initiatives which will meaningfully stimulate economic growth. Under these circumstances, there is a real risk that tax revenue collection in 2019/2020 will once again disappoint on the downside and that Government will be forced to implement more pervasive tax and expenditure policy changes in the short to medium term.

On Wednesday, 20 February 2019, the Minister of Finance presented his maiden National Budget before Parliament. As we have seen in the recent past, the Minister has attempted to balance a range of competing objectives, without raising taxes but controlling government expenditure in order to contain the budget deficit to around 4% of GDP.

Although personal income tax brackets remain unchanged, they will not be adjusted for inflation, meaning individuals with an inflationary increase in their taxable income will face a larger tax burden. This is expected to raise an additional R12.8bn in revenue, and additional budget proposals are anticipated to generate a further R2.2bn in revenue. Government has taken steps to adjust expenditure downwards by a total of R50.3bn over the medium term. Half of the expected reductions are expected to come from adjustments to government’s spending on wages.

In the State of the Nation Address, the President mentioned that the National Health Insurance Bill will be introduced and therefore we expected further funding measures to be mentioned in the National Budget. Instead, R2.8bn which was prioritised for the National Health Insurance Scheme has been reallocated to human resources capacitation to fund critical posts.

As far as Eskom, which supplies almost 95% of the country’s electricity needs and has recently resorted to load-shedding, is concerned the Government will set aside R69bn over the next three years to fund the power utility.

The recent mismanagement at SARS has been widely reported and Government is considering a comprehensive response to the Nugent Commission’s report so as to increase the efficiency in its tax administration. In the interim, the process of recruiting a new SARS Commissioner is underway and SARS will also re-establish a divisions that will focus on large businesses and tax syndicated evasion.

The international credit rating agencies are likely to focus their attention on disappointing revenue collections as well as the increased budget deficit projections and a debt-to-GDP ratio which is set to reach 60.2% by 2023/2024.

In conclusion, the 2019/2020 National Budget was presented in what has been labelled as the most difficult economic circumstances in the post-apartheid era. Sustained revenue under-collection and continued weak economic growth means that Government is faced with difficult choices. In an election year the Government has decided not to increase either the corporate or personal income tax rates but has opted to attempt to curtail government expenditure. In a weak economic environment the determination on the part of the Minister of Finance to maintain fiscal discipline has to be commended but one must question whether the budget proposals have gone far enough to avoid a ratings downgrade in the short-term.

Main tax proposals

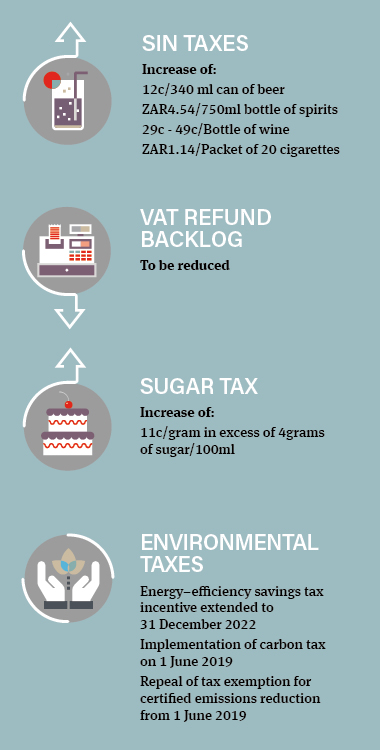

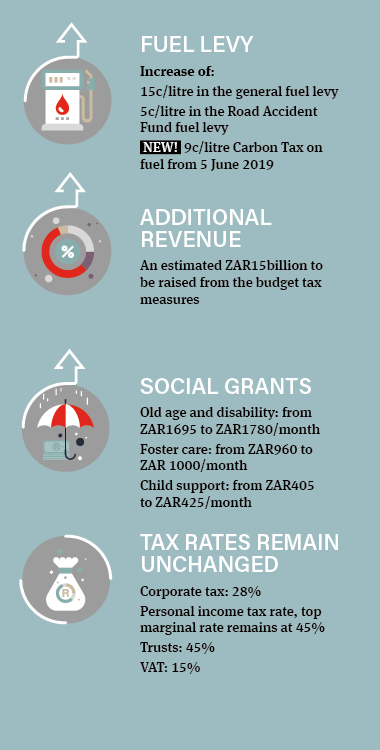

The main budget proposals for the 2019/2020 fiscal year are as follows

- No changes are made to personal income tax brackets, including no adjustments for inflation. The primary, secondary and tertiary rebates will be increased by 1.1%.

- Increasing the tax-free threshold for personal income taxes from R78 150 to R79 000.

- Increasing the fuel levy by 29c/litre for petrol and 30c/litre for diesel, consisting of a 15c/litre increase in the general fuel levy, a 5c/litre increase in the Road Accident Fund (RAF) levy and the introduction of a carbon tax on fuel of 9c/litre.

- Increasing excise duties on alcohol and tobacco products by between 7.4% and 9%.

- Increasing the eligible income bands for the employment tax incentive.

- Carbon tax will be implemented on 1 June 2019.

- Review the scope of fuel levy goods to include other transport fuels.

2019 budget highlights