Reputational Risk Australia - 2017 Survey Report

Australia | Publication | September 2017

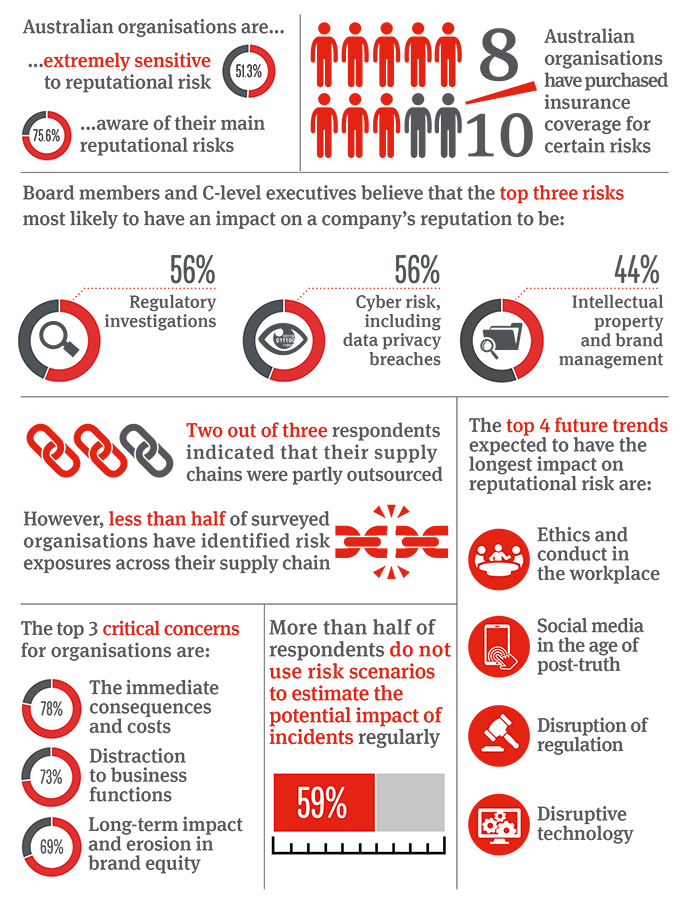

Reputational capital is the new black. Faced with changing consumer preferences, growing public mistrust and social media powered news, business leaders are highly sensitive to the pivotal role reputation plays in the success of each company.

In 2017, Norton Rose Fulbright surveyed business leaders across Australia with regard to reputational risk, and what it means for their respective organisations. The results outline the high awareness and good knowledge of different exposures that could results in reputational damage, but also point to certain areas for improvement.

Several strategies can help businesses manage reputational risk more effectively, and strengthen compliance across their corporate cultures:

- Maintain an open dialogue between board members, the executive team, general counsel and risk managers in order to have a more accurate, multi-faceted view of potential reputational threats, and a fit-for-purpose mitigation plan.

- Stress-test policies and processes against real-world risk scenarios regularly, and embed the learnings for continuous improvement. Constant monitoring is a critical part of ensuring compliance.

- Organise regular training for exposures that can result in reputational damage, ranging from cyber risk to ethical conduct and diversity. This can help further embed organisational values in your culture, and foster a culture of compliance.

To find out more about what reputational risk means to Australian organisations and benchmark your business against your peers, read our full report.

For more information, contact one of our risk advisory experts below.

Associated resources

List of pages

Recent publications

Publication

COP30 Outcomes

Beyond the standard two weeks of intense negotiations, attendees at COP30 experienced extreme heat, torrential downpours and the venue briefly catching fire on the penultimate day.

Publication

Pensions Regulator updates 2026 scheme return questions for DB and hybrid schemes

The Regulator has updated the questions included in scheme returns for DB and hybrid pension schemes. Most schemes are obliged to submit annual returns to the Regulator.

Publication

ICO consultation on data protection enforcement procedural guidance

The Information Commissioner’s Office (ICO) has published a consultation paper on new guidance about the process it follows when carrying out investigations and taking enforcement action using its powers under the UK General Data Protection Regulation and the Data Protection Act 2018.

Subscribe and stay up to date with the latest legal news, information and events . . .