Publication

Australia’s new mandatory merger control regime

Mergers or acquisitions that meet certain turnover thresholds will shortly be required to be notified to the ACCC.

Australia | Publication | June 2025

As a leading global energy and environmental practice, we are one of the few firms who have acted for clients in offshore wind (OSW) auctions and we bring sector-specific project finance experience.

Clients value our innovative and commercially sound advice, backed by extensive offshore wind experience, acquired over advising on 45 offshore wind projects worldwide.

We provide partner-led solutions with a dedicated team of specialists – our work in the energy transition helps clients navigate government frameworks and enter new markets.

This inaugural update comments on:

This month, we also share two feature updates, including:

The registration of interest process for Victoria’s revenue support auction for offshore wind feasibility licence holders closed in May 2025. The Government intends for the request for proposal phase to launch in Q3 2025, with contract award targeted for Q3 2026. The auction design and support package is due to be finalised soon, though the Government has already indicated that a contract for difference (CfD) and availability payment is their preferred offering.

It remains to be seen what commitment the Commonwealth and other states will make to revenue support for offshore wind. Offshore Wind Energy Victoria, in their fourth Implementation Statement, have said that Commonwealth commitment is required. With the Federal Labor Government re-elected with a strong majority, Commonwealth support may well now be forthcoming. We understand that an expert panel is developing a market mechanism to replace the Capacity Investment Scheme when it expires in 2027 and that the Victorian Government is agitating for it to account for higher cost technologies, such as offshore wind.

A government-backed revenue support contract will be vital, to ensure the bankability of these projects. However, revenue support auctions will be competitive with as many as 13 projects bidding in Victoria for 2GW of capacity. As such, we anticipate that some projects will be bifurcated into phases and bid for phased capacity. We have seen this strategy successfully deployed in other markets; although its success will partially turn on the certainty of future auctions to support the future phased capacity of those projects.

We understand that the assessment of bids will consider quantitative economic factors and qualitative project delivery factors. From a price perspective, a CfD-based arrangement is consistent with international best practice for offshore wind and this offering is enhanced by the potential for availability support; although we are aware of some concerns regarding the proposed calculation of such availability support. Close attention will also need to be paid to the imposition of any price caps or similar restrictions, which have proved problematic for offshore wind developers in other markets. Regarding the non-price related criteria, the ability to deliver to government timelines will likely prove critical. Localisation related criteria will also need to be carefully monitored as we have seen non-price criteria stifle offshore wind development in certain markets where it has been used as a blunt instrument.

A series of management plans submitted by feasibility licence holders in the Gippsland declared area have been approved by the Offshore Infrastructure Regulator.

Some proponents have made referrals under the Environment Protection and Biodiversity Conservation Act 1999 (Cth) for just the feasibility phase of their projects, whilst others have made referrals covering the entire lifecycle of the project.

Depending on the nature of the feasibility activities, an approved management plan may or may not be required to undertake feasibility activities. Whilst some proponents have sought approval, others have sought to undertake feasibility activities within the scope of the general law.

Again, the nature of the proposed feasibility activities and the project timeline will dictate what referral should be made and when.

Offshore wind proponents can now apply for transmission and infrastructure licences under the Offshore Electricity Infrastructure Act 2021 (Cth) (OEI Act). VicGrid is assessing a range of feasible options for transmission infrastructure to service and coordinate offshore wind connections in Victoria.

Gippsland feasibility licence holders can now apply for Victorian feasibility access licences whilst a suite of legislation has been amended to allow offshore wind developers to access and occupy public land (including the seabed) in the Victorian jurisdiction. It remains to be seen how offshore transmission in New South Wales, Tasmanian and Western Australian waters will be managed.

In addition to registering as a National Electricity Market (NEM) participant, in Victoria, offshore wind generators will be required to obtain a licence from the Essential Services Commission. The Australian Energy Market Commission is also considering how the National Electricity Rules need to be amended to facilitate connection of offshore wind to the NEM.

While similar to the feasibility licence application process under the OEI Act, the transmission and infrastructure licence process is unique and will require due consideration by proponents once their connection pathways are better known.

The Victorian offshore wind access regime is new and largely untested. Careful consideration of the authorisations and proposed activities will need to be had.

The NEM is a highly complex and regulated energy system, though offshore wind connection brings an added level of complexity, particularly if multiple proponents’ transmission infrastructure are to meet at one designated point. Further complexities arise if this connection point is offshore.

Some Gippsland feasibility licence holders have entered into agreements with the Gunaikurnai Land and Waters Aboriginal Corporation, who themselves have published a renewable energy strategy.

Offshore wind proponents across the country, even those without feasibility licences, have engaged firms to conduct offshore studies for their projects. As projects progress, these engagements will become more sophisticated, particularly once construction and operation and maintenance procurement begins.

Given the number of offshore wind projects and proponents in Australia plus the upfront capex required to develop offshore wind farms, we expect to continue see a consolidation of proponents in the Australian market.

Appropriate and timely engagement with Traditional Owners is critical to the success of offshore wind in Australia. Compliance with environmental, planning and heritage laws (particularly underwater cultural heritage processes) will be required for each project, as will Native Title and cultural heritage due diligence.

Split contracting is expected to be one of, if not the largest, bankability risks for financiers. To this end, ensuring appropriate risk allocation across contractors will be critical.

The change in control regime under the OEI Act is prescriptive and has several procedural nuances. Potential JV partners will need to work closely with each other and their legal advisors in preparing their change in control applications and addressing any concerns of the regulator.

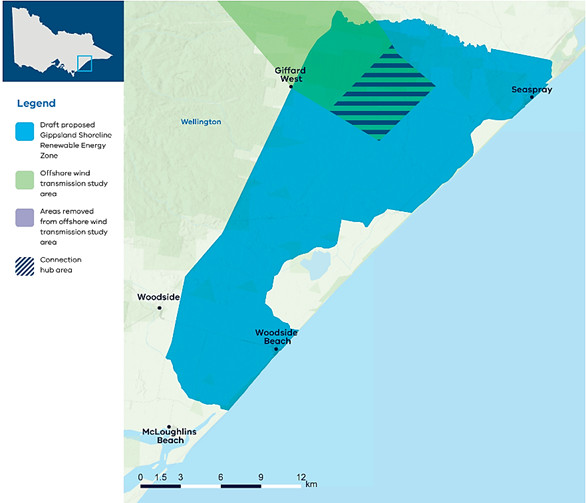

The recently released Draft 2025 Victorian Transmission Plan (Draft VTP) proposes a shoreline renewable energy zone (REZ) to enable the development of offshore wind in Gippsland. The draft proposed Gippsland Shoreline REZ, as described in the Draft VTP, designates a broad area for offshore wind developers to locate their onshore connection infrastructure for connection to the transmission connection hub (see map extracted). Once finalised, the Gippsland Shoreline REZ will more precisely identify where offshore wind export cables can cross the shore which in turn will allow developers to determine their route to the transmission connection hub. The identification of suitable crossing locations is currently being undertaken by VicGrid.

The Draft VTP also proposes upgrades to transmission lines in the Portland area to be carried out in the 2030s to accommodate offshore wind in the Southern Ocean.

While there is more than 25GW of offshore wind planned by feasibility licence holders in Gippsland alone, the transmission planning set out in the Draft VTP clearly aligns with offshore wind targets previously set down by the Victorian Government (2GW before 2032, 4 GW in 2035 and 9GW in 2040). To this end, the offshore wind transmission planning is clearly segregated into three phases.

Since 2023, the Victorian Government has been planning the first 2 GW of new transmission infrastructure needed to connect offshore wind in Gippsland. To date, they have conducted a strategic options assessment, refined the transmission study area, progressed environmental assessments and are now tendering for a delivery partner to work alongside VicGrid.

The Gippsland offshore wind transmission stage 2 program includes a new transmission loop to support offshore wind. This new program will connect additional offshore wind generation in the Gippsland offshore wind area to meet Victoria’s 2035 and 2040 offshore wind targets and is expected to be delivered between 2033 and 2038.

The third phase, due to be delivered by 2038 is the uprating of existing lines from Heywood to Portland to connect offshore generation from the Southern Ocean offshore wind area to Portland.

In Western Australia, the Minister for Climate Change and Energy has made a preliminary decision to offer a feasibility licence to Bunbury Offshore Wind Farm Pty Ltd for its project in the northern part of the Bunbury declared area. The Minister has also shortlisted two projects: one from Westward Wind Pty Ltd and an additional project from Bunbury Offshore Wind Pty Ltd for a preliminary feasibility licence in the southern part of the declared area. However, these two projects overlap, meaning the applicants will now follow the overlap procedures set out in the OEI Act.

Separately, the Department of Climate Change, Energy, the Environment and Water have suggested that the Minister’s final decision on the feasibility licence applications depends on the outcome of consultation on the proposed projects with First Nations groups under the Native Title Act 1993 (Cth).

In New South Wales, in the Hunter declared area, Novocastrian Wind Pty Ltd has been granted an additional 90 days to finalise its commercial arrangements. Novacastrian Wind Pty Ltd, a joint venture between Oceanex and Equinor, has been offered a feasibility licence for a 2GW project but are yet to accept.

The Minister has also made a final decision not to offer a feasibility licence to Seadragon in the Gippsland declared area.

The overlap process which the two WA applicants must now follow was recently amended. Following the Federal Court’s decision in Seadragon Offshore Wind Pty Ltd v Minister for Climate Change and Energy [2024] FCA 1290, which ordered the Minister for Climate Change and Energy to remake his decision on Seadragon’s Gippsland feasibility licence application in accordance with law, the Commonwealth passed a retrospective law which validated the Minister’s original reasoning and settled the interpretation of the overlap procedures set out in the OEI Act.

Whilst the Minister is yet to make a decision on feasibility licences in Tasmania’s Bass Strait declared area, the Tasmanian government has unveiled plans for Bell Bay to host a renewable energy terminal and serve as a key hub for offshore wind development.

With thanks to Jack Brown for his contribution.

Publication

Mergers or acquisitions that meet certain turnover thresholds will shortly be required to be notified to the ACCC.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2026